Trailing stops is a functional feature of the stop loss order in trading.

As the name suggests, trailing stops allows the trader to dynamically move their stop losses. This is a feature that is available on the Metatrader 4 trading platform.

A trailing stop loss however has its own benefits as well as disadvantages. Despite using trailing stops, you may not make money in forex trading. This is because using trailing stops requires a good understanding.

Traders often find their trades to be prematurely closed because of using trailing stops. This is something to consider if you want to make use of trailing stops functionality.

Furthermore, not all trading strategies can accommodate the use of trailing stops. Hence, traders who are thinking of using trailing stops should have a good understanding of how this feature works.

Many beginners make the mistake of using the MT4 trailing stop loss without fully understanding how it works.

Although trailing stops can reduce the risk of a trade, it can also be very limiting. Think of trailing stop as a very good risk management technique. But, because it is so risk averse, trailing stop loss can greatly reduce the profit potential.

Anyone who has any trading experience will know that when you take higher risks, the profits are equally big. But of course, there needs to be a balance.

When using trailing stops, you effectively limit this risk-taking behavior.

This article is intended to provide a complete guide to using trailing stops in forex. By the end of this article, traders will have a very good understanding of how trailing stops works. You will also be able to use the trailing stops feature in the MT4 trading platform.

What is a trailing stop?

A trailing stop is a type of stop loss order which trails the market movement. When a trade is entered, traders typically use the entry price, stop-loss price, and the take-profit price.

The entry price is the price at which you enter the trade. This can be a market order, or a pending limit or stop order.

The take profit price is the price at which you will be booking your profits. And the stop loss order triggers when the price moves in the opposite direction.

In the above general example of a trade, the stop loss, as you may notice is fixed to a price point.

When using trailing stops, this fixed price becomes dynamic. Traders on the MT4 trading platform have the option to set a certain number of pips as the trailing stop.

Thus, when the price moves this specified number of pips, the stop loss is also moved.

As you can see with this definition of the trailing stop, it helps traders to move their stop losses dynamically.

An alternate way is for the trader to monitor their trades and move their stop losses depending on how well the trade is working out.

Whether you are using manual trade monitoring to move your stop loss or using trailing stops, the goal is the same.

The goal with using stop losses is to reduce the risk you have on your trade

The trailing stop loss feature allows traders this feature to easily reduce this risk.

However, there are distinct advantages when using the trailing stop loss feature, which we will discuss in the latter part of this guide to using trailing stop losses.

Before we go into this discussion, let’s look at how you can use trailing stops on the MT4 platform.

How to use trailing stops in MT4 platform?

Trailing stop is a feature that is found on the Metatrader 4 and even the Metatrader 5 trading platforms. Not all trading platforms support this feature.

A trailing stop feature allows traders to dynamically reduce the risk on the trades.

To enable the trailing stops on MT4, traders need to have open orders in their trading terminal. Hence, it is important to note that trailing stops on MT4 does not work on pending orders.

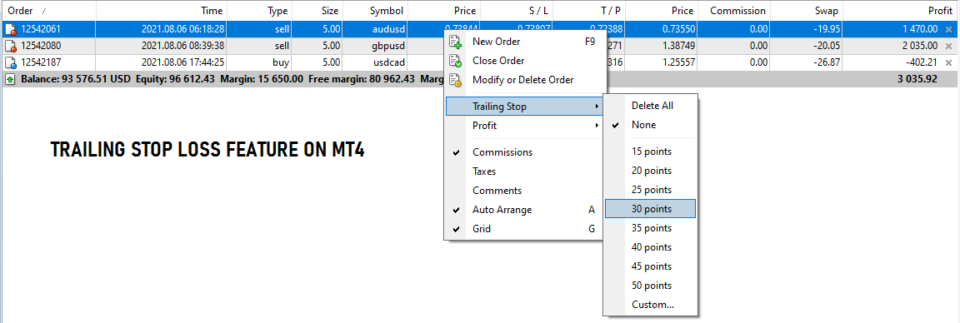

To enable the trailing stop loss feature on MT4, right-click any open order you have and click on the trailing stop command.

This will open different options that you can choose from.

The above picture shows an example of how to use trailing stops in MT4.

You right-click on any open order and then select trailing stops. This opens the different options for you to choose from. You can also click on custom which allows you to set a custom setting.

In MT4, the trailing stop loss is measured in points. As you can see, the default options start from 15 points through 50 points. If you want to set a custom amount in points, you can choose the custom option.

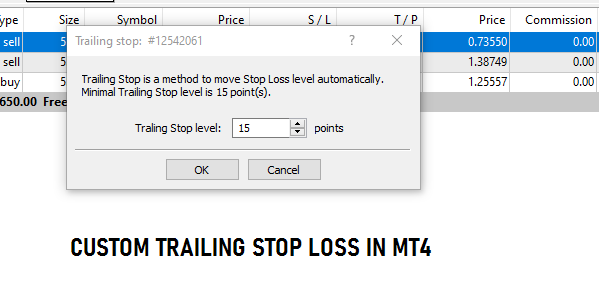

The above window pops up from which you can input a custom amount of your choice. Once the trailing stop value is set, the MT4 trading platform does the rest of the work.

It is important to note that trailing stops function on the client-side, or on your MT4 trading terminal. Whereas a stop loss order sits on the server side. This is important because trailing stops do not work if you close your MT4 trading terminal.

How does trailing stops in MT4 works?

As mentioned in the previous section, trailing stops works only on open orders in your trading terminal.

Furthermore, in order for the MT4 trailing stops feature to work you need to keep your MT4 trading terminal open. When you close the terminal, the trailing stop feature does not work.

This is one of the shortcomings of using trailing stops in MT4.

Besides the above, there are also other factors that can make trailing stops somewhat inconvenient to use. The biggest grip among traders is the fact that trailing stops tend to prematurely stop out one’s trade.

This happens more often than not. The reason is because price seldom moves in one direction. There are a lot of retracements that take place. When this happens, an otherwise normal trade with a good profit potential can be closed out.

This is where a lot of trades can be lost out. As we mentioned earlier, trailing stops can limit your profit potential because it is very risk averse. Take a look at the next section which gives a visual guide on how trailing stops work.

Visual guide to trailing stops

The best way to illustrate trailing stop is by means of an example as outlined below.

In the first chart above, we have a short trade on AUDUSD. This is your typical trade set up. The stop loss is set to 9.4 pips above entry.

In this general set up, the trade’s stop loss remains 9.4 pips from entry even when the price moves significantly in the short direction. Even a few pips towards the take profit level, the stop loss remains fixed until you change it.

Let’s now look at the same example by using trailing stops.

In the above chart, you can see that we use a trailing of 94 points or 9.4 pips, every time the price moves by 9.4 pips, the trailing stop also moves.

This way, it allows traders to lock in the profits. In the first instance, we can see that the trade’s stop loss moves to break even.

By the time price moves a further 9.4 pips, the trailing stop also moves lower, locking in a profit of 9.4 pips.

The above example is a best case scenario when working with trailing stops. As you can see, trailing stops work best when price moves rapidly in just one direction. But this is not the case all the time. If the price made any kind of retracement and moved back up by 9.4 pips, your trade would be closed out.

This would leave you out of the markets, as the price continues to reverse the retracement and move in the original direction.

Example of a trailing stop closing a trade prematurely

In the previous two examples, we outlined a normal trade followed by the same trade and how it works when using trailing stops.

Let’s now take a look at what happens when price moves the way it does (i.e: with retracements).

In the above chart, we have a long position set up. Here, the stop loss is 6.8 pips from the entry price, and we also make use of trailing stops of 6.8 pips.

So every time price moves 6.8 pips to the upside, the trailing stop is moved along as well.

In the first part of the trade, we see a strong straight movement in price. But following this, the price makes a pivot high and retraces the previous gains. As a result, because trailing stops are now moved higher, the trade is closed out.

In this example, we only have a profit of 6.8 pips. But if we did not use trailing stops, the profit would be much higher.

This begs the question as to whether traders should use trailing stops in the first place. The answer to this is of course subjective.

What are points in MT4 trailing stop?

When using trailing stops in MT4 you may notice that the terminology used is points. Points are nothing but the number of pips.

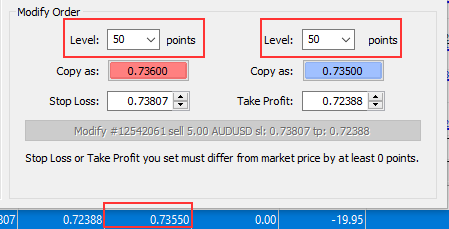

An easy way to understand this is by looking at the next image.

In the above picture we have a snapshot from the MT4 trading terminal.

Make note of the current price, which his at 0.73550.

Using the order modification window, we bring up the modify order where we set the level at 50 points in either direction. This gives us the price of 0.736 and 0.735.

Hence, the value of 50 points translates to 5 pips (removing the fifth decimal, or fractional pricing).

Therefore, when using the MT4 trailing stop feature, the points merely reflect the number of pips. But as mentioned, note that you need to mentally remove the last digit on the right to get the actual number of pips.

Hence, 50 points equal 5 pips, and likewise 100 points means a 10 pip difference.

Now that we know how the points work and what they mean, you can set your trailing stops in MT4 accordingly.

There are a few things to note when using trailing stops in MT4.

Firstly, the trailing stop is only triggered only after the profit (calculated in points) is equal to or greater than the trailing stop loss.

When this happens, the trailing stops will move the stop loss to the specified distance from the current price.

A trailing stop will only move after your trade is in the profit. However, if price reverses direction and moves back, the trailing stop will not change.

Example of trailing stop in MT4

So far, we understand how trailing stops work. We also explained how to read the points in the MT4 trailing stop functionality.

The below steps are what you would take in order to set up trailing stops in MT4.

- Open a trade (it can be a market order, or a pending limit or stop order)

- Once the trade is triggered, click on the Trade tab and right click on the open order

- Now select Trailing Stop and choose the appropriate trailing stop in points.

- If you do not find the trailing stop in points, you can use the custom option and set a custom value that you want.

In order for trailing stops to work, you need to keep your MT4 trading terminal open. The moment you close the terminal, the trailing stops do not work. Only the take profit and stop loss levels remain.

To delete any trailing stop functionality, right-click on the trade, choose Trailing Stop, and select Delete All.

Any trade that has trailing stops will have the S/L column highlighted in yellow so it is easy to see which trades have trailing stops activated.

Advantages vs. disadvantages in using trailing stops

By now you have a good understanding of what trailing stops are and how they work. You also have an understanding of how to enable and disable the trailing stops in the Metatrader 4 platform.

You may now be asking the question of whether trailing stops are a good feature to use.

By reading at the examples outlined, you can see the pros and cons of using trailing stops outright. Below is a summary comparison on the pros and cons of trailing stops.

| Advantages of using Trailing Stops | Disadvantages of using Trailing Stops |

| An efficient way to monitor your trades without having to watch the trades constantly | Prices seldom move in one direction. The retracements can cause your stops to be triggered prematurely |

| When traders choose the trailing stop points smartly, it can indeed help one to lock in profits along the trade | Choosing the right trailing stop value can change depending on the market, time frame and the volatility |

| Best used for breakout trades where there is a strong move in the market, quite often in one direction | Not suitable for any other trading strategies such as trend following methods due to retracements that take place |

| There is no need to watch your trades all the time and move stops manually | Works only when your MT4 trading terminal is open. |

Conclusion – Should you be using trailing stops?

As you can see in the previous section, there are both advantages and disadvantages of using trailing stops.

If you are asking yourself the question of whether you should use trailing stops, you need to look at your trading strategy. This will most likely give you an answer.

Typically speaking, trailing stops work best on short term trading strategies. And within this, the breakout based trading systems are the best. You can also use trailing stops during high-impact news events such as interest rate decisions or GDP releases.

For trading strategies where retracements occur (mostly found in trend following or momentum-based methods), trailing stops are counter-intuitive. They will prematurely close your trade and limit the true profit potential.

As a result, the answer to whether a trader should use a trailing stop will differ based on one’s preferences.