Cryptocurrencies are the latest fad these days!

At one point, Bitcoin was the only cryptocurrency that was available. But that changed as Ethereum jumped in. Sooner than later, the number of cryptocurrencies and different blockchain technologies has risen rapidly.

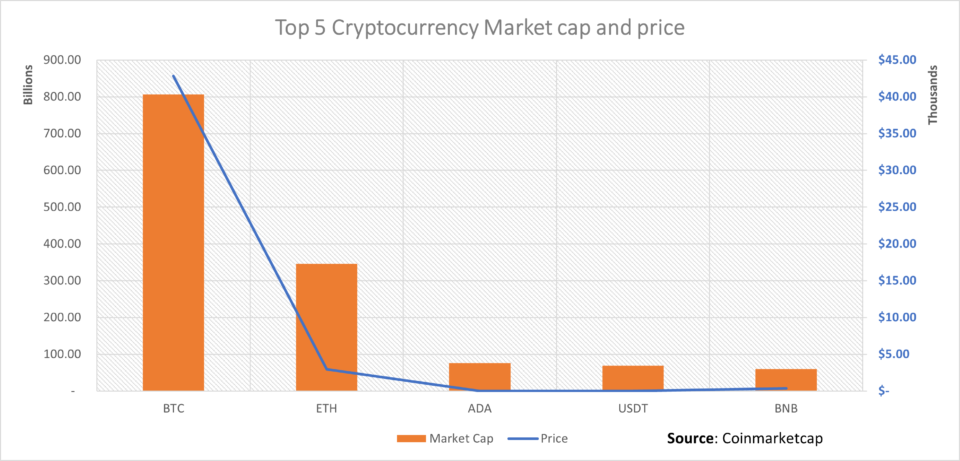

At the time of writing, Bitcoin continues to remain in the #1 spot, with Ethereum at a close second.

According to data from Coinmarketcap, cryptocurrencies have a total market cap of 1.90 trillion US dollars.

Among these, Bitcoin boasts of close to 800 billion, while Ethereum boasts of a market cap of close to 350 billion.

Although Bitcoin remains the undisputed king of cryptocurrencies, Ethereum has its own following. This is largely due to the differences in how Ethereum functions as a blockchain.

In recent times, Ethereum has gained in popularity, rivaling that of Bitcoin.

The world of cryptocurrency trading is akin to diving into a rabbit hole. There are quite some technical terms and jargon that one needs to understand. Therefore, traders who do not have an understanding of Ethereum and blockchain, in general, can find it difficult to navigate.

Even when it comes to owning or speculating on Ethereum, there are different ways to go about it. You can purchase the ETH tokens outright or you can speculate using different derivative contracts.

Among these, Ethereum CFDs offer the simplest solution of all. In this article, we take a look at how traders can start trading Ethereum CFDs. You will also learn a bit about what Ethereum is all about and the risks of trading Ethereum CFDs.

What is Ethereum?

Ethereum, is a blockchain technology that powers the token ETH. Just as with all cryptocurrencies, Ethereum is open source and community-powered.

Ethereum blockchain technology has surpassed its larger sibling Bitcoin as well. If you have heard of terms like decentralized apps, smart contracts, and so on, these are powered by the Ethereum blockchain.

The main benefit of Ethereum is the fact that it goes beyond the use of digital money and payments. It has also found its way beyond the financial sector. A study by CBInsights outlines the potential number of industries that are prime for disruption.

These include traditional forms of investing, managing contracts, wills, legal documents, insurance, and lending, including mainstream industries such as travel and manufacturing as well.

The use of Ethereum can be perfectly summed up by this comment from Bank of America:

“Bitcoin is the most talked-about cryptocurrency but Ethereum has more features, including being more flexible”

Indeed, these days, no matter where you look, decentralized finance or DeFi is the buzzword. And this was made possible only by Ethereum’s blockchain technology.

For a blockchain that is at the forefront of innovation, ETH or Ether is of course gaining attention.

ETH or Ether is the token (also known as gas) that fuels blockchain technology. Miners or computers that are involved in processing the transactions are rewarded with tokens. These tokens or Ether as they are called can then be used to purchase items, both physical and digital goods.

These tokens are stored in a wallet (online or physical) and can be connected to a service that allows ETH-based financial transactions.

Brief history of Ethereum

Ether was the second cryptocurrency to be launched after Bitcoin.

The brain behind Ethereum is attributed to Vitalik Buterin who started development on the Ethereum blockchain in 2013. Of course, this wasn’t just a one-man show. Other early co-founders included names like Gavin Woods, Charles Hoskinson among others.

Buterin also co-founded the Bitcoin Magazine. In January 2014, Buterin unveiled Ethereum at the Bitcoin conference in Miami, Florida. You can watch the full 30-minute presentation by Buterin here.

However, back then, it still remained as a proof of concept. In the months between 2014 and 2015, various prototypes were produced by the Ethereum foundation.

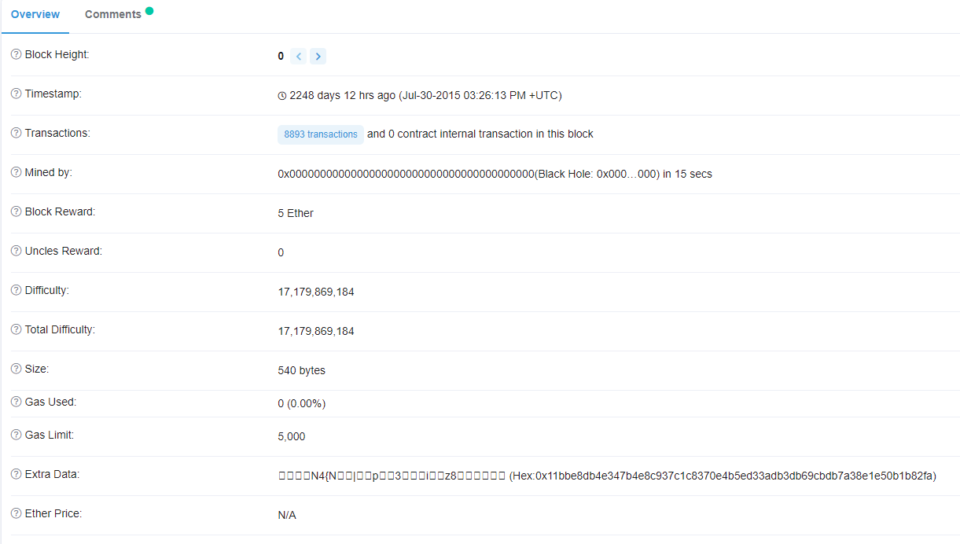

On July 30, 2015, Ethereum’s genesis block was created.

Since then, Ethereum began a gradual but steady cryptocurrency that slowly gained popularity. The main differentiating factor between Ethereum and its main rival Bitcoin was the Proof of Work vs. Proof of Stake concept.

These are two terms that effectively refer to how one can mine cryptocurrencies. You can read more about the PoW and PoS here.

When Ethereum created its genesis block, the ETH price was less than $5 during the initial few months. By the spring of 2017, ETH popped above $100 for the first time. The cryptocurrency briefly surged past $1000 in late 2017 before settling back lower.

And by early 2021, ETH surpassed the $3000 milestone.

Needless to say, the rise in Ethereum prices also caught the attention of the mainstream media. This in turn saw new investors and speculators coming in to own a piece of the pie.

What is ETH?

ETH or Ether is the native cryptocurrency on the Ethereum blockchain. It is also referred to as the token.

Miners who contribute to the blockchain are rewarded with the ETH tokens.

In the blockchain, a term that you will often come across is Gas.

Gas, as the name suggests, is fuel. For a simple transaction of sending ETH from one wallet to another, you have to pay a network fee. This fee is known as Gas. Gas is denoted in gwei, which is a sub-unit of ETH.

1 Gwei = 0.000000001ETH

You can learn more about Ethereum Gas by watching this video.

Unlike Bitcoin, which has a supply cap of 21 million BTC, Ethereum on the other hand has an unlimited supply. However, there is an annual cap of 18 million ETH. In other words, Ethereum has somewhat similar characteristics as that of fiat money.

This means that ETH is inflationary, which in some ways has its own benefits. This is one of the key differences between ETH and Bitcoin.

When you are buying Ethereum, you are in essence purchasing ETH. At the time of writing, 1 ETH = $2934.

Of course, as with any cryptocurrencies, volatility is much higher and prices can change within a few minutes, or during the course of the day.

Those investing in cryptocurrencies, tend to purchase these ETH tokens, which can then be stored in a physical or an online wallet. Some of these names include: MyEtherWallet, MathWallet, which are online wallets.

You can also purchase offline or physical wallets such as Ledger, which is one of the most widely popular means of storing your ETH offline.

How Ethereum CFD’s works?

Ethereum CFDs work in the same way as forex CFDs, or commodity CFDs work.

Ethereum CFDs are contracts for differences. Ethereum CFDs derive their value from the underlying asset, which is the ETH token itself. Price in the Ethereum CFD mirrors that of ETH prices. The main difference of course is that you do not actually own any ETH when trading Ethereum CFDs.

This makes Ethereum CFDs purely a speculative instrument. You can bet on the direction of ETH prices and profit from the difference. But beyond this, you do not have much to do.

Since volatility is one of the key factors of cryptocurrencies, Ethereum CFDs, alongside other cryptocurrency CFDs have grown in popularity.

Traditional forex traders find Ethereum CFDs a great way to trade a (financial) instrument that offers great intraday volatility. This in turn means that traders are able to day trade and profit by trading Ethereum CFD contracts.

Since CFDs are derivative instruments, the broker offering CFD trading on cryptocurrencies will charge a mark upon the spread. In other words, if the actual ETH is trading at $2940, then you may see Ethereum CFD price at $2950 (as an example).

When trading Ethereum CFDs it is also important to note that the price of ETH may vary from one exchange to another. But this price difference is not that big and can vary by few dollars.

You can make use of the general technical analysis study that you would use when trading forex, or equities, or stock CFDs. Since there is now close to six years of price history for Ethereum, most of the technical indicators work.

Ethereum CFD contract specifications

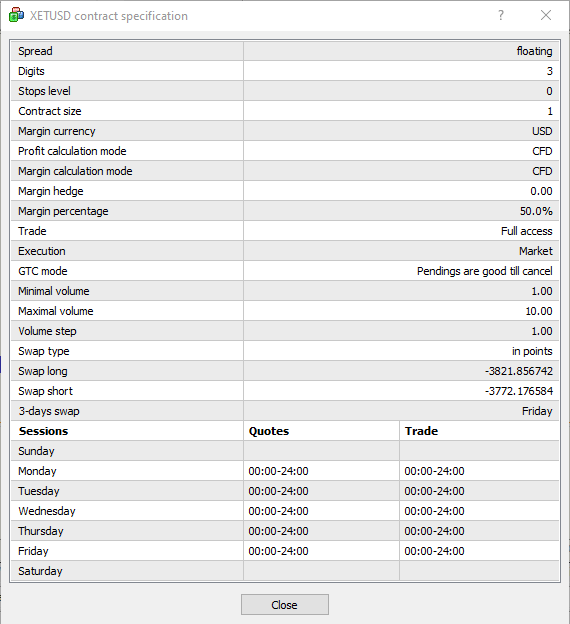

Since cryptocurrencies are decentralized, they trade round the clock.

However, depending on your broker who offers CFDs you may not be able to trade Ethereum CFDs over the weekends. This is for the obvious reason that the broker may be closed for business on the weekends.

Therefore, if you are interested in trading Ethereum CFDs, then you should focus on a broker that offers 24/7 access to trading Ethereum CFD contracts.

Ethereum CFD’s instrument symbol can also change from one broker to other. Examples of Ethereum CFD contract tickers include XETUSD, ETHUSD. If in doubt, you can check your broker’s terms and conditions and instruments available for trading to learn more.

The number of decimals in Ethereum CFDs can also differ. But they mostly range between two and up to four decimal places. It is important for traders to keep this in mind as it will eventually influence the tick value for Ethereum CFDs.

For example, a tick value of 0.10 for an Ethereum CFD with 2 decimals means that a move from $2900 to $2901 is equal to $10 when trading with a standard lot size of 1.

Since your forex trading account is leverage, there will also be financing costs involved if you keep your positions open overnight.

These overnight swap long/swap short values (represented in points) will vary depending on the broker you trade with.

What are the risks of trading Ethereum?

As with any speculative form of trading, risks are an inherent aspect of it. In this aspect, cryptocurrencies, including Ethereum are not immune to the risks. Clearly, there is a larger risk of losing more money trading cryptocurrencies than forex.

This is due to the fact that the daily volatility of cryptocurrencies is much higher comparing to that of the forex markets. Of course, comparison forex to cryptocurrencies is akin to comparing apples with oranges.

Cryptocurrencies have their own unique characteristics and hence you cannot use any relative comparison with forex.

But due to the fact that many brokers offering cryptocurrency CFD trading as well, it is easy for traders to compare cryptos to forex and vice versa.

Below are some of the key risks unique to trading Ethereum CFDs that you should keep in mind.

Spreads

The spreads on the Ethereum CFDs can vary from one broker to another. In most cases, when talking about variable spreads, these can widen. The change in the spread can be attributed to periods of low and high liquidity in the market. Since the tick value will determine your dollar amount, traders should pay attention to the spreads when trading Ethereum CFDs.

Volatility

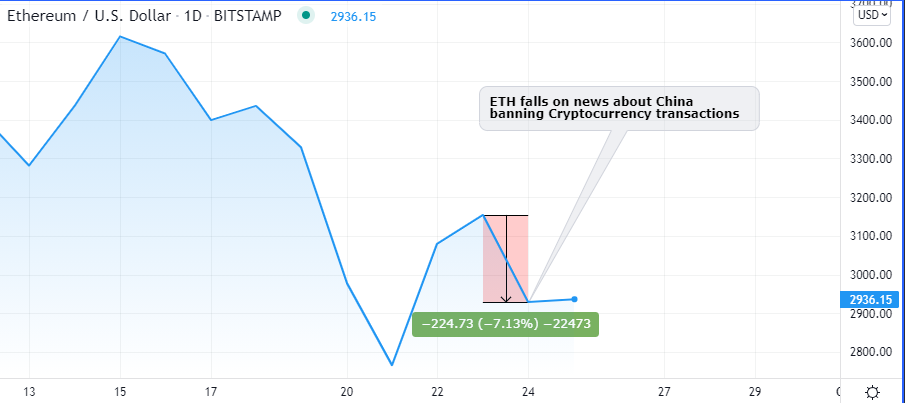

Unlike traditional financial markets, volatility in cryptocurrencies can be offset by just about anything. A most recent example is that of China banning cryptocurrency transactions.

The volatility is of course driven by the market news and information. This is something that traders should keep in mind, and as covered in the next point.

Market news

It is not just blockchain and cryptocurrency-related information that can move prices in cryptocurrencies such as Ethereum CFDs. Another example was that of Elon Musk’s tweet, flipflopping on cryptocurrencies.

While initially, prices of all cryptos rose on positive tweets, they fell soon after Musk tweeted something negative about cryptos. It is not just the big names, but almost all the names that matter in the crypto world, which can potentially move the markets.

Therefore, when trading Ethereum CFDs there is a lot that traders should keep in mind, lest they get caught out on the wrong side of the market.

Ethereum blockchain developments

Ethereum CFD traders should also pay attention to the news about the blockchain itself. This is even more important in today’s time and age. Amid the surge of various blockchain technologies, there is a rush to create the ultimate blockchain.

This includes taking into account factors such as climate change, the impact of mining on the environment, security, privacy concerns, and last but not least transaction fees.

Therefore, to be a successful cryptocurrency trader, one should gain an in-depth understanding of how Ethereum works. Relying solely on technical analysis may net you profits, but it won’t go further down the road.

Sooner or later, some piece of information may catch you off guard which can prove to be very costly.

To conclude, Ethereum CFDs can be a great way to speculate on ETH prices. Ethereum CFDs are derivative contracts and you do not need to be concerned with storing your ETH in a wallet.

At the same time, trading in Ethereum CFDs does not grant you any ownership of the token itself. If you are looking for a market that is ripe with volatility, then Ethereum CFDs are the place to be. Of course, with higher volatility comes higher risk as well.

Therefore, try to learn more about Ethereum and blockchain in general before you start trading Ethereum CFDs.