As someone who may be exploring options trading, there is no doubt that traders are intimidated by the different trading terminologies. Unlike forex trading, options trading is an entirely different beast. Even seasoned options traders tend to struggle at times, be it with strategy or with the terminology.

To make things easier, this options trading terminology glossary gives the reader a simple yet robust explanation of options trading. You will learn about the different types of trading terminologies that one can come across with options trading. Let's start with the basics.

What is an option contract?

The option contract is a derivatives contract that gives the buyer the right, but not the obligation to exercise the contract upon expiration. This makes it fundamentally different from other derivative contracts such as futures where the seller of the contract if holding the contract to maturity will have to deliver the underlying commodity.

The options contract has the inbuilt optionality, from which it derives the name. One can buy an option or also write an option, meaning the seller of the option. The seller of the option receives a premium from the buyer. The seller of the option is obliged to deliver the underlying instrument if the option buyer exercises their right.

The options contract has two main components, the expiration date, and the strike price. The strike price is the price at which the option can be exercised if the underlying instrument is trading above or below the strike price.

What is the strike price for an option?

The strike price is the price that is set in an option contract, at which it can be bought or sold. For a CALL option, the strike price is the price at which you can buy, while for a PUT option, the strike price is the price at which you can exercise the right to sell.

The strike price is also referred to as the exercise price because this is the price at which the option buyer can exercise the price. Upon the option expiry, the strike price or exercise price is essentially the price at which you would have bought or sold the underlying stock or instrument.

What is an option’s expiration date?

The expiration date is the last date at which the option can be exercised. Depending on the option you buy, one can choose from different expiration dates. The expiration date is usually selected based on the cost (premium) of the option and the length of the contract.

There are no predefined option expirations as one would expect in the futures contract. In the futures market, the contracts, depending on the commodity in question can be monthly or quarterly contracts. In the options world, there is no such standard. Therefore, one can buy an option contract with same-day expiration or longer-term, to as far as two years contracts.

The longer-term contracts are known as LEAPS, short for Long term Equity Anticipation Securities. LEAPS contracts are usually available for stock options.

What is a CALL option?

The CALL option allows the buyer to purchase an option that has a bullish view of the market. The CALL option enables the buyer a cheaper way, relative to owning the stocks. The only risk undertaken by the option buyer is the premium that they pay.

In a CALL option, the duration of the expiration and the strike price are two main components. If the underlying price is below the strike price for a CALL option, it expires out-of-the-money. The only loss here is the premium they paid for purchasing the CALL option.

What is a PUT option?

The PUT option allows the buyer to purchase an option that has a bearish view of the market. The PUT option enables the buyer to hedge against the long position they have in the underlying market. The only risk they pay here is the option premium. If the PUT option expires out-of-the-money, the PUT option buyer does not have to exercise the option at all.

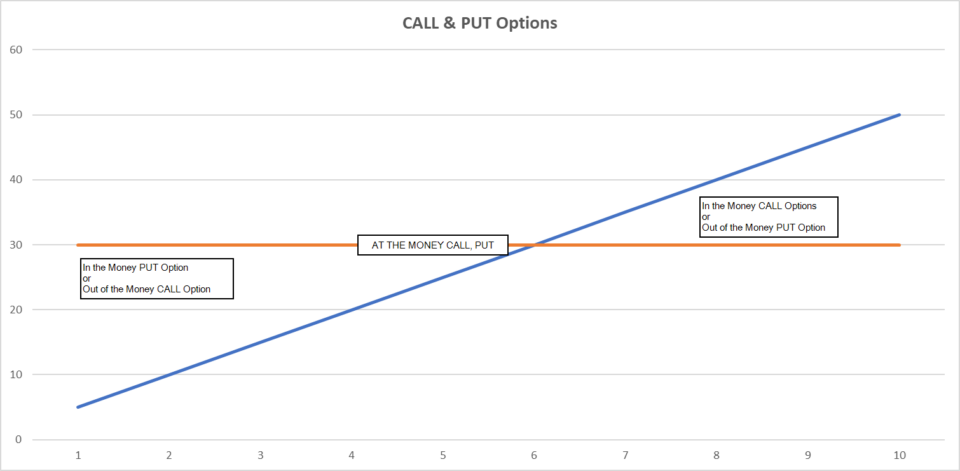

What is an In-the-money option?

An in-the-money option is where the strike price is higher than the underlying instrument price in the case of a CALL option. Likewise, the option is said to be in-the-money if the strike price is lower than the underlying price.

An in-the-money option can be exercised as it allows the buyer of the CALL or the PUT option to purchase the underlying instrument at a cheaper price than the market price. It is also referred to as ITM in the options trading terminology.

What is an Out-of-the-money option?

An out-of-the-money option is where the strike price is lower than the underlying instrument price in the case of a CALL option. Likewise, a PUT option is said to be out-of-the-money when the underlying price is above or higher than the strike price.

The out-of-the-money option is the inverse of the in-the-money option. It is also referred to as OTM in options trading terminology.

What is an At-the-money option?

A CALL or a PUT option whose strike price equals the underlying price is said to be at-the-money or ATM. An ATM option has no intrinsic value since one can also purchase the same underlying instrument at the prevailing market price. Thus option traders generally do not exercise ATM options.

What is the implied volatility for an option contract?

Implied volatility is something you will come across in the options trading universe. The implied volatility tells you what is the market’s expected volatility of a stock over the lifetime of an option contract.

Volatility in general is a metric that measures the likelihood of change in a security’s price. Implied volatility is an important metric because it translates to the option premium. An option with higher implied volatility attracts higher premiums against those with lower volatility.

Implied volatility is denoted by the Greek letter σ (sigma) and is seen as a market measure of risk. IV rises during bearish markets while falling during bullish markets. A good visual example of implied volatility can be seen from the VIX (SPX Volatility Index). You will often see bearish markets with the VIX rises, and bullish markets when the VIX falls.

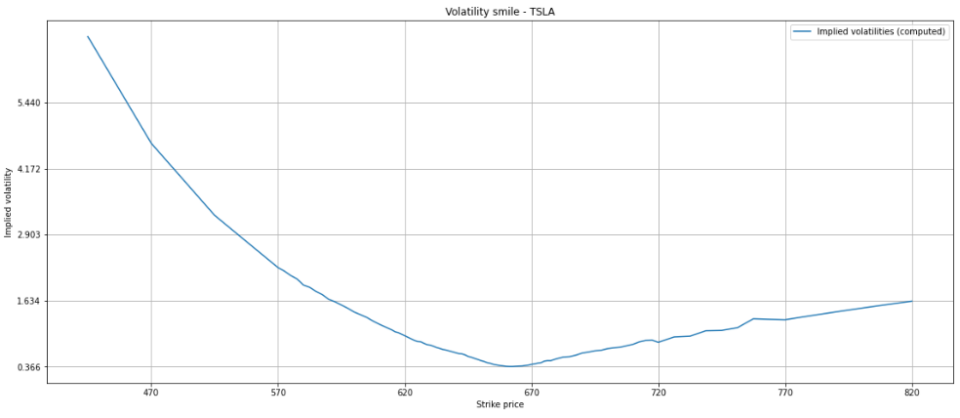

What is the Volatility smile?

A volatility smile, as the name suggests is a graph that resembles a “smile.” The graph is made up of the x-axis and the y-axis. On the y-axis, the implied volatility is plotted, while the x-axis plots the strike price. Thus, the volatile smile captures the implied volatility across various strike prices. The implied volatility is higher for in the money calls or out of the money puts on the left and the in the money puts and out of money calls on the right.

One commonality for plotting the volatility smile is that the options should be for the same underlying asset and same expiration date but varying degrees of different strike prices. The chart below shows the volatility smile for TSLA.

What is the volatility surface?

The volatility surface is the three-dimension plot of an option's implied volatility. The three dimensions are expiry, tenor, and implied volatility. The volatility surface is actually constructed out of the volatility smile. However, as mentioned above, the volatility smile has a constant which is the same expiration date. Different volatility smiles for different tenors and expirations are used to interpolate the points using the smile interpolation. Following this, the three-dimensional graph is plotted.

Covered and uncovered options

When it comes to options, there are mainly two types. Covered options and uncovered options. Covered options are typically when the option underwriter already owns the underlying asset. This way, if the option were to be exercised, the option seller is covered. An uncovered option or a naked option is when the option underwriter has no position in the underlying asset. This is a lot riskier as the underwriter will have to purchase options at the current market price for delivery should the option buyer exercise their rights.

What are option Greeks and what are the different types of Greeks?

There are five main types of Option Greeks. The option Greeks measure the sensitivity of an option price to its underlying asset's parameters including volatility and price. Option Greeks can help measure the sensitivity of options contracts in a portfolio. The different options Greeks are:

Delta: Delta measures the sensitivity of an option price change, relative to the underlying asset's price. Thus, if the underlying asset price changes by $1, then the option price will change by the delta amount. Delta is calculated as a decimal ranging from -1 to 1 representing deep in the money, with CALL options having a delta of 0 to 1 and PUT options having a delta of -1 to 0.

Gamma: Gamma measures the delta's change relative to the change in the price of the underlying asset. In other words, if the price of the underlying asset increases by $1, then the option's delta will change by the Gamma amount. Gamma basically assesses the option's delta and it decreases when the option is in the money.

Vega: Vega measures how sensitive the option price is, in relation to the volatility of the underlying asset. Thus, if the underlying asset increases by 1%, then the option price will change by the Vega amount. An important distinction with Vega is that it is expressed as a monetary amount rather than a decimal amount.

Theta: Theta measures the option's price relative to its time to maturity. If the option's time to maturity decreases by one day, the option's price will change by the theta amount. Theta has another name, time decay.

Rho: Rho measures the option price relative to interest rates. In other words, if the interest rate rises by 1%, then the option price will change by the rho amount. Rho, as an option Greek is the least important of all as options are usually less sensitive to interest rate changes. However, Rho can gain importance when dealing with Fx options.

What are the intrinsic value and time value of an option?

Intrinsic value

Intrinsic value and the time value of an option are two important numbers that help to determine the option’s premium. The option’s premium is the price you pay to purchase an option. Intrinsic value is a simple calculation of subtracting the in-the-money option’s strike price from the underlying asset’s market price.

For a CALL option,

| Intrinsic Value | = | Price of underlying asset | - | Strike Price |

For a PUT option,

| intrinsic value | = | Strike price | – | Price of underlying asset |

The intrinsic value of the out-of-the-money or at-the-money option is zero.

Time value

The time value of an option is further derived from the intrinsic value and the premium you pay.

The formula is:

| Time value | = | Option Premium | – | Intrinsic Value |

Thus, we can change the above formula to also get the option premium, which is Time value + Intrinsic Value. The time value of an option becomes zero when it expires.

The time value of the option is the amount an investor pays over and above the option’s intrinsic value. The time value can rise even further as the option moves closer to its expiration.

What is the moneyness of an option?

The moneyness of an option is a term used to describe if an option would make any money if it were to be exercised immediately. Thus, it determines the intrinsic value of an option in its current state during the contract period. A loss would signal that the option is out of the money, while a gain suggests that the option is in the money. The break-even rate is when the option is at the money.

Therefore, the moneyness of an option is a measure of the intrinsic value of an option. A 100% option is at-the-money, while a 90% option is in-the-money for a PUT option and a 110% option will be an in-the-money option for a CALL option.