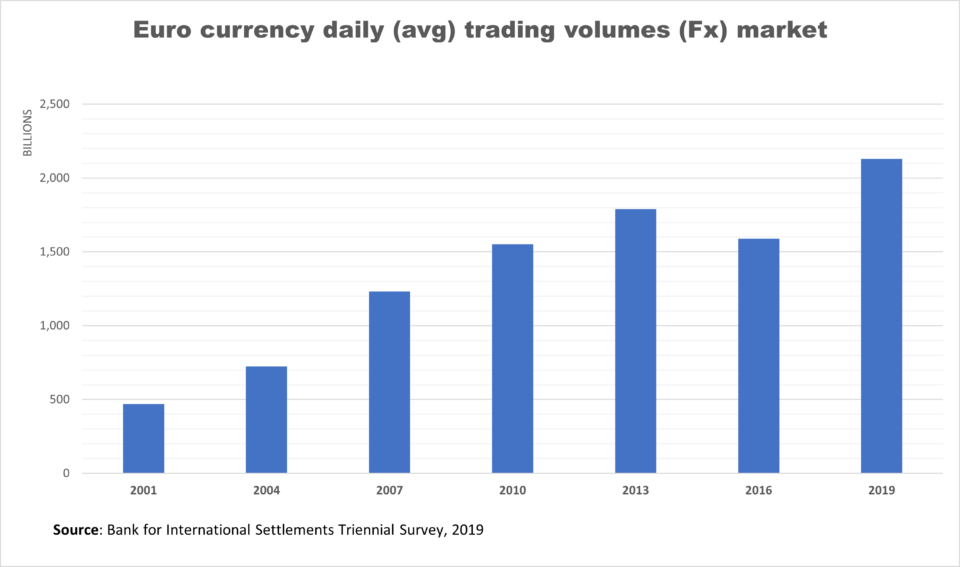

As a forex trader, one is aware that the most liquid currency pair of all is the EURUSD. Data from the Bank for International Settlements (BIS) 2019 triennial survey shows the Euro currency at number two. Only second to the world's reserve currency, the US dollar.

This is a remarkable journey given that the currency can trace its birth to the year 1999*. Having said that, the euro's number spot is only expected. This common currency is shared by 19 countries in the European Union.

The largest among them are Germany, France, Italy, Netherlands. On a broader scale, the EU economy, which includes 27 member states, ranks #3, globally after China and the United States.

The chart below, from Eurostat, shows that the 27 member state EU has a combined GDP, contributing to about 16%, as of 2017.

On a more micro level and from a trading perspective, it is beyond a doubt that the euro or the EURUSD currency pair is the most popular. Many beginners in forex trading, often start off with the EURUSD pair.

Even brokers that offer forex end to advertise their spreads, comparing the EURUSD spreads.

Given its importance, traders should understand certain aspects of the euro currency. It will help to gain a better insight into this shared currency, both from a historical perspective and also learn about some of its unique characters.

Whether you are just starting out, or a seasoned professional forex trader, these five fascinating facts about the euro currency will leave you with awe!

Unlike other articles that merely talk about some interesting things about the euro currency, here, we take a deep dive. There are some interesting concepts worth knowing about the EUR.

*Although the euro was officially born in 1999, it was only adopted as a physical currency in 2002.

Origins of the European Union

There is no euro without the European Union. So a bit of history lesson is on the cards. After the end of the second world war in 1945, the Council of Europe was formed by ten countries in the continent.

The next step came in 1951 with the birth of the European Coal and Steel Community.

The organization’s goal was to regulate the coal and steel industries, with the idea to secure lasting peace in the region. The six countries to join the ECSC* were Germany, France, Netherlands, Italy, Belgium and Luxembourg.

Six years later, the Treaty of Rome saw the birth of the European Economic Community (EEC). A year later in 1958, the European Parliament was born, with the first meeting held in Strasbourg. French foreign minister, Robert Schuman was the first elected president.

By the 60’s trade became a central theme, giving rise to the European Free Trade Association. More countries joined into the EFTA (but not the EEC) such as Austria, Denmark, Norway, Portugal, Sweden, Switzerland and the UK.

In 1968, the six main EEC countries abolished custom duties, allowing for free cross-border trade for the first time. It made the concept of the Union more attractive to other neighbouring nations.

After Denmark, Ireland and the UK joined the European communities, Greece became the 10th country to join the EU in 1981, followed by Spain and Portugal in 1986.

In 1992, the Maastricht Treaty saw a formal direction being set toward achieving a single currency objective.

A year later, the “single market” was launched, enabling free movement of people, goods, services and money. By 1994, the EEA or the European Economic Area was created. Australia, Finland and Sweden joined in 1995, taking the total to 15.

*The European Coal and Steel Community changed its name to the European parliament in 1962.

Birth of the euro currency (1999 – 2002)

The euro currency as you know by now is a very young currency, relative to its peers. The common currency came into existence only in 1999, making it just over two decades old.

The euro currency was not born overnight at the wave of a wand by some government authorities. Rather, it took almost a decade of preparation to get to the birth of the euro in 1999.

In the first three years since its inception, the euro was not a physical currency, but used only for accounting and electronic payment processing! Meaning that, in the years between 1999 and 2002, there were no euro coins or physical money in existence.

The goal of the euro currency was to unite the different countries in Europe. It was created to foster unity in the continent, which witnessed two World Wars. But it wasn’t just the wars that led to the idea of creating a common economic union. The financial markets also played a role.

Little known to many is that the concept of using a shared currency came against the backdrop of the financial markets. The financial crisis in the 1960’s in the United States plunged the economy into a recession for close to 10 months.

In 1967, the sterling devaluation caused another crisis. The UK government, under the leadership of Harold Wilson, devalued the pound sterling peg from $2.80 to $2.40. It was a Black swan event as the government previously tried its best to avoid the devaluation.

In the run up to the 1967 devaluation of the pound, the GBP was pegged to the US dollar.

This was just a year before the first Hague Summit in December of 1969 was held. The agenda was to establish a full economic and monetary union, also known as the EMU.

How does a country adopt the euro?

Probably the most fascinating of all is how a country makes the shift to adopt the euro. At the outset, the decision on whether a country can adopt the euro lies with the Council of the European Union.

Needless to say, the country should already be an EU member state in the first place.

All member states have to approve, the following proposals from the European Commission and after consultations with the European parliament.

To adopt the euro, the nation needs to “primarily converge” its economy with that of the EU’s. These include constant monitoring of the convergence by the ECB and other institutions. Without going into too many technicalities, there are various treaties and provisions in place that one must adhere to.

Some of the criteria include the following:

- Maintaining price stability or inflation

- Fiscal balances and public debt

- Exchange rate stability (to the euro)

- Long term interest rates

Adopting the euro usually takes years during which progress is constantly monitored. The nation wishing to adopt the common currency also needs to gain support from its citizens. This includes drawing up new legislation and laws to enable this adoption into the common currency.

The convergence reports guide the nation wishing to adopt the euro towards closer economic integration. Following the 2008 global financial crisis, this has taken precedence.

Not all countries share the same economic characteristics. Thus close economic integration is required. Adopting the common currency also means that giving up on monetary policy sovereignty.

A case in point is the most recent speech given by the ECB Executive board member Isabel Schnabel at the Pantheon-Sorbonne University.

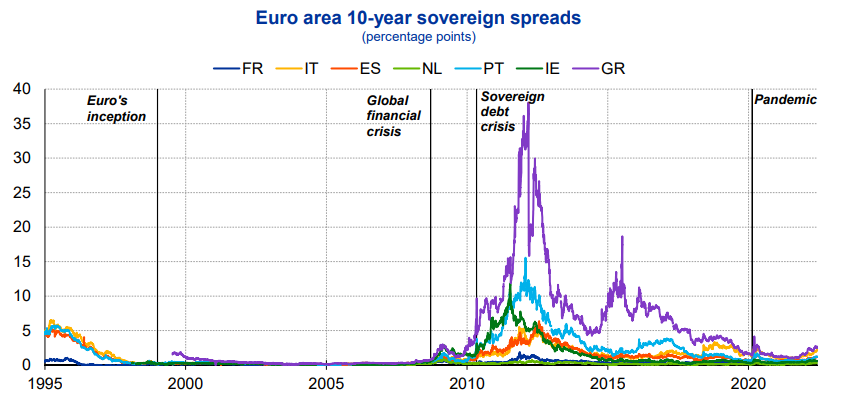

The above chart shows the bond yield spread differences. As can be seen, during periods of economic shocks, the spreads tend to disperse, causing a disparity within the member states.

Each of the EU-19 countries has its own bond yields

Closely related to the previous fact is, that despite the economic integration, every member state has its own unique yields in the bond markets.

A bond yield is a yield or return from investing in a bond. Unlike the United States for example, where the US Treasury issues the bonds, it is a different story in the EU. Depending on whether that country in Germany or Malta, the debt issued has different yields.

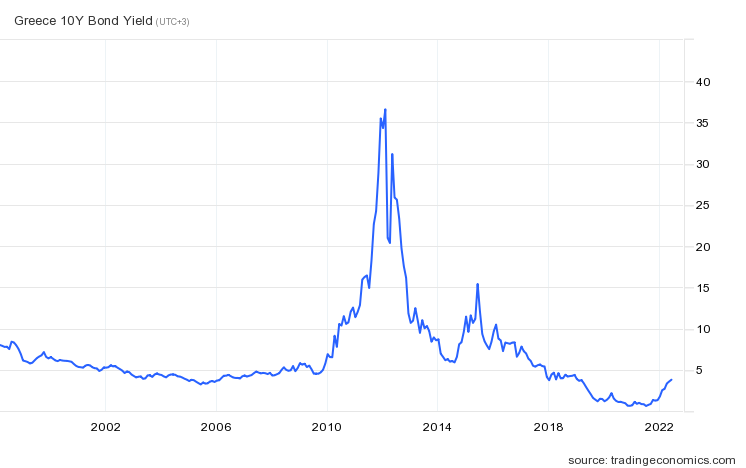

The yields are set by the market expectations. Although the nation issuing debt can fix the yield, the yield to maturity can change depending on the bond price movements. This was very evident during the Sovereign debt crisis in Europe.

Yields on bonds issued by Greece for example surged to 35% at the height of the sovereign debt crisis.

This was despite Greece being one of the early countries to adopt the euro. As a general rule, investors use the German bond market as a benchmark. The comparative analysis of another EU country’s bond yields to that of the benchmark is what constitutes the European bond yield spreads. Among the different European bond yield spreads one can construct, the spread between the 10-year German and 10-year Italian bond spread is the most watched. The German/Italian 10-year bond spread is a gauge of the financial stability in the European Union.

The chart below shows a historical plot between the 10Y German/Italian bond spreads and the euro currency.

As evident, there is a correlation between rising bond spreads and a weakening euro exchange rate. It is therefore imperative for forex traders to pay attention to the news reports especially concerning the bond spreads.

The movement between the spreads and the exchange rate is almost simultaneous. But, understanding the spread related to the exchange rate helps to explain market movements.

The ECB is the sole monetary policy decision-making body of the EU

Those who trade forex will already know that the ECB or the European Central Bank is the central bank for the euro.

This is the decision-making body governing interest rates for the 19- EU member states. The ECB is made up of:

- Governing council

- Executive Board

The governing council members are representatives of the 19-nation central bank governors, also known as the NCB. The governing council’s job among other things is to adopt the guidelines from the executive board’s decisions.

The Executive Board is made up of the president, vice-president and four other members from the executive board. The main role of the ECB’s executive board is for implementing monetary policy.

The ECB replaced the European Monetary Institute and was established in May 1998. It is headquartered in Frankfurt, Germany. The central bank’s governing council meets twice a month and holds two types of meetings: monetary and non-monetary.

The monetary policy meetings are held once every six weeks. The central bank sets decisions on a wide range of interest rates. These include:

- Minimum bid rate or main refinancing rate – The rate that the NCB’s charge for loans up to one-week.

- Overnight deposit rate: This is the rate for overnight deposits made with the NCB’s. A higher deposit rate means that commercial banks having deposits at the NCB can earn a higher rate of return.

- Marginal lending rate – This is the lending rate the NCB’s charge commercial banks for any overnight loans they give. Typically, the marginal lending rate is used by commercial banks to meet their reserve requirements.

The marginal lending rate is always higher than the minimum bid rate. It is deliberately done so as to penalize (and discourage) banks from borrowing emergency funds for their reserve requirements.

The Euro – Conclusion

The common currency is no doubt one of the most liquid currencies in the world. Despite its age, the euro has grown to take the second spot globally. Due to the number of economies in the European Union, there is always an interest for other states to integrate into the EU.

The common currency has often been questioned, with some going as far as predicting the demise of the euro. Some of the notable events in recent history included Brexit – when the UK dropped out of the economic union.

During the Greece financial crisis, there was talk about Grexit. However, back then it showed how difficult it would be for a country to go back to its own currency. Over the decades, as a result of the various economic crises, the European Union has continued to strengthen.

It is quite unlikely to expect the demise of the euro. The facts and notes presented in this article should give the reader better insights. When trading the forex markets, the information from this article will help you to understand the euro currency.

The euro is after all the second most liquid currency in the world!