Forex trend analysis is all about predicting or ascertaining trends in forex. It is perhaps one of the most fundamental things a trader could do.

Without understanding how the forex markets trend, trading forex is more of a gamble rather than making an informed choice. Without knowing which direction that the markets are moving in, a trader is prone to make mistakes.

A trader might dismiss the importance of spotting forex trends, citing that they use a different strategy. But no matter what forex trading strategy you use, trends cannot be ignored. After all, it is only when you know the forex chart trends, that are you able to understand what the market is doing.

This article about forex trend analysis gives you a detailed approach to understanding the trends in forex. It will also show you how you can use the forex chart trends to determine which way the market is moving.

In the end, there is nothing complicated about spotting forex trends. You may have seen this at some point in your life. Be it a new clothing brand or real estate. Trends are everywhere and spotting forex trends is key to your success.

From a trading perspective, forex trends can be important in analysing the markets. This will allow you to create on the right side of the market if you are able to analyse trends correctly. There can be different ways of analysing forex trends. In this article, we will look at the price action Bay of analysing the trends in the currency markets.

Before we go any further, let’s talk about trends in general.

What is a trend?

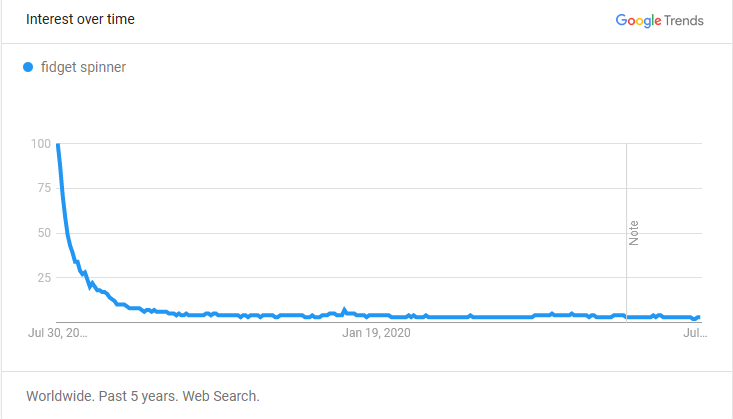

A trend is nothing but a steady increase in interest in something. This can be a clothing brand, a certain type of car, or anything else. Think of fidget spinners or even cryptocurrencies. Trends appear when the interest in something surges.

Similarly, as the interest in the product or asset falls, the trend beings a downward trajectory. This is what we would refer to in the currency markets as an uptrend or downtrend. The reason behind the rise and fall of the trends is basically a product of the consumers' interest.

As an illustration, take a look at the below trend chart from Google about fidget spinners. You can see how the trend showed a sharp rise between the years 2017 – 2018.

Following this, interest in fidget spinners wore off over time.

Trends in forex or the financial markets in general work similarly. There is a rising and a steady surge of interest in an instrument (a currency) or a financial asset (stock, or an ETF, etc).

When there is such a rising interest, the price of the asset starts to rise gradually. We can also take this example and talk about it in terms of supply and demand. In other words, an uptrend is likely to form when there is a huge demand for the currency pair. Likewise, a downtrend forms when there is less demand for the currency pair.

Trends in general, tend to rise and fall over a period of time. This purely reflects the increase and decrease in interest in the product.

Now that we understand a trend, let’s talk about the trends in the forex markets.

Types of trends in forex markets

There are two types of trends in forex markets. The uptrend and the downtrend. Both of these are equally important. An important aspect of trends is that these are also responsible for forming support and resistance levels.

As one may know, at the support level price usually hits the bottom and then bounces off. Similarly, at the resistance level price hits a ceiling and then falls below it. The support and resistance levels are merely a product of the uptrend and downtrend.

An important point to note here is that many rookie traders do not pay too much attention to the trends or the resulting support and resistance levels. Therefore, many beginners in forex end up selling near the support or buying near the resistance.

A classic example of this can be seen during the Bitcoin boom. When prices were rising steadily, more and more investors began to pile on to the trade. However, the uptrend in Bitcoin prices had basically searched and hit up top. On their own, as Bitcoin prices started to fall traders who had purchased at the top saw the sharpest losses.

The types of trends in the forex markets will tell you what the general or the broader interest is, for that asset. When there is an interest in a currency pair, you will witness an uptrend. Similarly, when this interest starts to wear off, you will see a downtrend in forex markets.

What is an uptrend in forex?

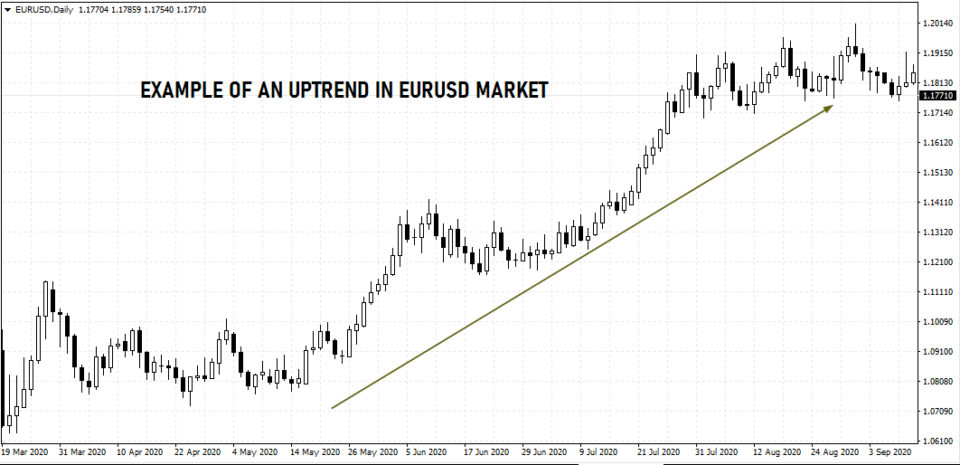

The uptrend is defined by a gradual increase in the prices of a currency. This is when the price of the currency pair or the exchange rate starts to rise rapidly or in a gradual manner.

There is a lot of interest in the markets to buy that particular asset.

During an uptrend, you will see prices rising gradually from the bottom left side of your chart to the top right side of the chart.

An uptrend in the forex markets usually indicates a continued interest in the currency. In the above example, we can conclude that investors had more interest in buying the euro. Needless to say, in an uptrend, it makes sense to place long orders or to buy.

The interim dips that you see in the above chart are nothing but corrections to this uptrend. Long-term trend traders usually wait for these short-term dips in order to enter into the uptrend. This is known as trend trading. And opposite way or a counterintuitive way is to sell when the price reaches a peak and then exit the short trade when it hits a bottom.

This is called countertrend trading.

What is a downtrend in forex?

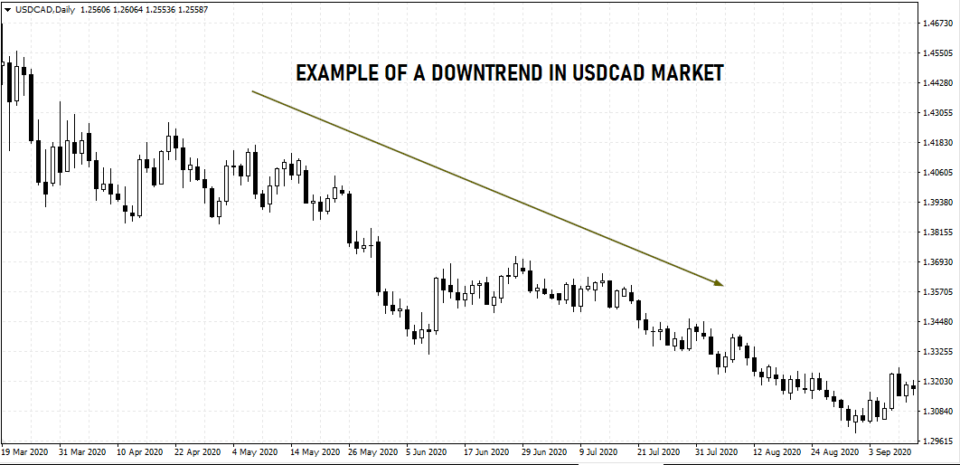

The downtrend in forex is the exact opposite.

In a downtrend, you will find prices gradually or rapidly falling. This is because of dying interest in the asset. The reason for the decline in prices in a downtrend is that investors (people) want to liquidate their inventory.

The idea behind a downtrend is to sell into the decline. On the forex, chart trends are visible by prices falling from the top left corner of the chart to the bottom right corner.

In the above chart, we can see that the US dollar has been in a downtrend relative to the Canadian dollar. An interesting aspect to note especially among the major currency pairs is that if the US dollar is in demand then all currencies which have the USD as the quote currency tend to depreciate.

At the same time, currencies that have the USD as the base currency tend to appreciate. Therefore, when the US dollar has established a strong trend be it on the upside or to the downside, you can see currency pairs such as EURUSD, GBPUSD, AUDUSD, and NZDUSD, all moving in the same direction.

Currencies such as USDJPY, USDCHF, and USDCAD tend to move in the opposite direction. Similar to trading the uptrend, traders prefer to wait for the price to make a short rebound or a rally and then they sell these rallies.

The counterintuitive way to trade this would be to buy after prices hit a bottom in a downtrend and trade all the way up to the end of the correction.

A closer look at forex chart trends

While we have defined what an uptrend and a downtrend is, prices can also move sideways. This is when the interest in the asset is not that much. During this period, called consolidation, the forex markets move within certain price levels.

More importantly, unlike the forex trends, here you will find prices trading flat, moving sideways and not doing much.

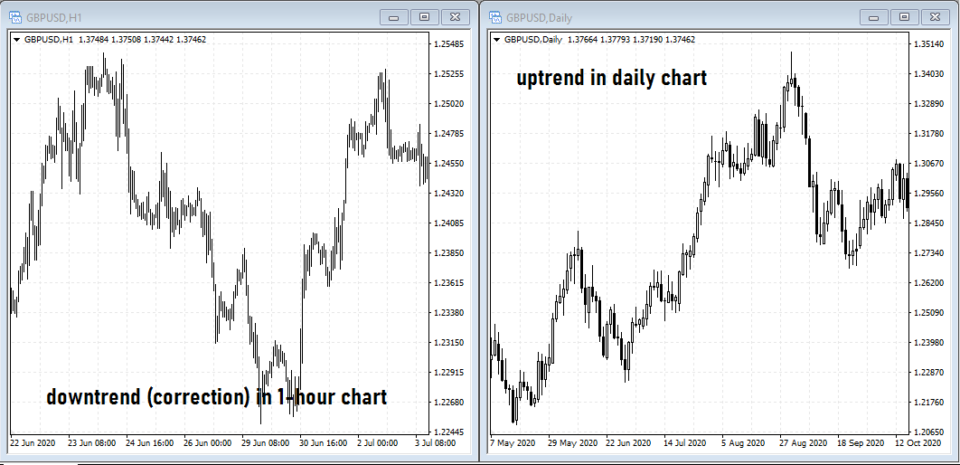

When observing trend analysis in forex, one should focus on the timeframe relative to the trend.

For example, you may find that there is an uptrend on the daily chart timeframe. On the other hand, you may find that there is a downtrend in the 30-minute chart timeframe.

Does this mean that the trend is changing? Or does this mean that the market is fickle? Well, not really. As we mentioned, trends are relative to the time frame that we are looking at.

On the daily chart, you may see that the trend is rising steadily. But on the short-term charts, you may find this to be the opposite trend. This is perfectly normal because it is not all the time that trends across different time periods will line up.

The general rule of thumb in forex currency trends analysis is that the larger trend dominates the smaller trends. This means, that unless there is evidence that the trend on the daily chart is shifting, the prevailing uptrend takes precedence.

How to determine forex trend direction

To determine forex trend direction, traders need to look at the relative trends and not in isolation.

Many traders make the mistake of just looking at the daily or the weekly charts to identify the trend. But this is incorrect as it can be misleading. Spotting forex trends requires multiple time frames down to the time frame from which you will be trading.

As we mentioned, trends seldom move in a straight line. The chart below shows a comparison between the daily trend and the short-term trend.

While we see a steady rise in the trend on the daily chart, on the short-term chart, you have various spikes and troughs in the making. Since we notice a downtrend taking shape on the smaller one-hour chart time frame, does it mean that traders should go short?

Obviously not! As you can see, this was merely a correction to the larger trend. Following this brief dip, the price soon emerges back into an uptrend.

Therefore, when trading trends in forex, a trader should bear in mind what the major trend is. Only then will they be able to draw some context. This trend analysis in forex allows traders to place their trades in the direction of the trend movement.

No matter what anyone tells you, trends cannot be predicted. Rather a trend is identified only after it has been formed for a significant amount of time. There trying to predict trends can be a futile attempt and it only makes you lose your money.

However, as you can see in the above chart you can analyse trends from different timeframes in order to understand which way prices might continue to move.

Why is a trend important in trading?

No matter what trading system you use, trends are important when trading forex or any other markets. Trends tell you which way the market is moving. If you find intimidated when it comes to understanding what trends are, you can make use of indicators such as the moving average or the Bollinger bands which will visually guide you to the prevailing trend.

You certainly do not want to trade in a direction that is opposite to the trend. This is the reason why analysing forex currency trends across the time frame is important. Without a clue of the market's direction, this can prove to be disastrous.

There are trading strategies that work contrary to the main trend. But these trading strategies are difficult to implement and require quite a bit of knowledge for traders. You should be adept at understanding which way the market is moving.

There can be different ways traders can trade when using trend trading in the markets. One can use indicators or simply just price action in order to understand these trends. As we mentioned earlier, support and resistance levels are two key factors that go hand in hand with trend trading.

Therefore, understanding trend trading and the resulting support and resistance levels are essential if you want to be a successful trader.