Is your broker truly regulated?

Not all FX brokers or CFD providers who claim to be regulated in New Zealand are truly regulated. There are some brokers who say they are regulated because they are registered on the Financial Services Providers Register (“FSPR”). This is not true. All New Zealand financial companies must be listed on the FSPR; however, this does not mean they are licenced and regulated. For a broker to be truly regulated a broker must have a “Derivative Issuers Licence” issued by the Financial Markets Authority (“FMA”). By dealing with a licenced broker you can have certainty that is dealing with a trustworthy broker.

How we got here

The Global Financial Crises in 2008 brought the world’s financial markets to its knees. Governments around the world scrambled to ensure that the “Great Recession” did not become a repeat of the 1930’s “Great Depression”. Governments infamously bailed out large financial institutions such as Goldman Sachs and also created new laws to regulate the behaviour of financial institutions. While New Zealand was not as badly affected by the GFC as some countries, New Zealand overhauled its financial regulation to create a world-leading environment. However, there is one unique feature that has caused a lot of confusion and unnecessarily damaged New Zealand’s reputation: the Financial Services Providers Register (“FSPR”).

Financial Services Providers Register

The FSPR is a register that all financial service providers must register on if they have a place of business in New Zealand. This register is open to the public to see and provides some details about the entity. This should be seen like the “Yellow Pages” or a business directory. Being merely registered does not mean that the broker is licenced in New Zealand.

Since the FSPR covers all financial services, such as banks, advisers, as well as derivative issuers, it includes services that are not required to have a licence at all such as mortgage brokers. Therefore, some people have been using the FSPR to gain legitimacy and use the reputation of New Zealand as a selling point.

The FMA does not “regulate” the behaviour of a broker merely because they are registered on the FSPR. You do not have the assurance that broker is keeping funds separate or that the broker is not acting recklessly with your funds. Only a broker that is licenced can you have confidence that the FMA is overseeing, and truly regulating, the behaviour of the broker.

Derivatives Issuer Licence

The Derivatives Issuer Licence (“DIL”) is one of the hardest licences to get in New Zealand. In fact, most brokers that apply for the licence are turned down by the FMA. The FMA sets strict requirements for all DIL holders to ensure that only reputable brokers get the licence and are able to maintain the minimum standards.

The FMA sets the “minimum standards” that each broker must follow. These standards are in fact very high and require a lot of time and effort to maintain. These standards include:

- Capable senior management;

- Financial resources to maintain the business; and

- Consumer protections.

Senior Management

Senior management of a licenced broker needs to have the skills and experience to properly run the company. This means a licenced broker will have people who are experienced in the industry and understand the markets. A poorly run company could lead to the company failing and resulting in losses for customers. A company that is only on the FSPR has no obligation to have competent and experienced managers so who knows what experience they have?

Financial Resources

A licenced broker must also have the financial resources to operate. This includes a capital buffer which is also known as “Net Tangible Assets” (NTA). The NTA means that the broker has a large capital buffer so that if the markets move there are enough resources to cover that. A broker who is merely registered on the FSPR does not need to have any capital reserves so if the company gets into trouble, they could use your money to fund their costs such as salaries. This means when it comes the time you to withdraw your funds there might be no money for you.

Consumer Protections

The first major consumer protection that a trader has with a licenced broker is what is known as “segregated client funds” or “funds safety”. When a trader makes a deposit with a licenced broker those funds are held separately in a client trust account. This means these funds cannot be used to fund the daily operations of a broker. In addition, the licenced broker must ensure that the client trust account must cover the traders’ positions. If the trader makes money, the client trust account must be “topped up” to match it. Therefore, when a trader comes to make a withdraw there is enough money to honour the withdraw. Who knows what an unlicensed broker does with client money?

When dealing with a licenced broker there is another feature that will protect you and that is the compliances process. Every licenced broker must belong to a dispute resolution service. One such dispute resolution service is Financial Services Complaints Ltd (“FSCL”). This organisation provides an independent, fair, and free service if you have a complaint about a broker. FSCL will ensure that if you have a complaint then the broker will treat you fairly. All brokers are bound by the decision of FSCL and can direct the broker to remedy the complaint and provide compensation.

While brokers that are registered on the FSPR must also belong to the dispute resolution service it does not mean that your complaint will be handled fairly or at all. Many of the merely registered brokers do not have a physical presence in New Zealand. Often, they use a “serviced office” with nothing more than a name-plate to signify that they are in New Zealand. If FSCL finds in your favour there might not be anyone in New Zealand to follow through. If you deal with a broker merely registered, then who knows how your complaints will be dealt with?

Culture and Conduct

It is now generally accepted that one of the leading causes of the GFC was that the culture and conduct at some financial institutions was poor. Some of these financial institutions the focus was not on the client or customer or even the shareholder but rather the big bonuses that the staff got. Some of the staff put their own interests first before that of the client or customer. This too happened in some of the brokers. However, in recent years there has been a massive emphasis from regulators around the world to improve the culture and conduct of financial institutions.

Licenced brokers, such as Rockfort Markets, are required to have a culture that puts the interests of the client in the centre. This is lead by the “tone at the top”. That is why the FMA puts a large emphasis on the senior management of a broker. If the senior management of a broker does not set a good “tone” then this will filter down to all levels of staff. For brokers that are only on the FSPR no regulator checks the culture and conduct, a police check is done in New Zealand but if the directors and managers are overseas there is no oversight. Who knows the interests of an unlicensed broker?

Misleading and confusing

A large number of margin trading companies based outside New Zealand have registered in New Zealand since the launch of the FSPR in 2010, but not all are what they seem. They often do this to make themselves look they are regulated. There has been a criticism of the FSPR law in New Zealand and there have been a few minor adjustments over the years, but these have not stopped companies using the FSPR to mislead clients on them being regulated. You may see companies say they have an FSPR license or are licensed in New Zealand under the FSPR. They may show a registered address in New Zealand and even have a .co.nz domain name and New Zealand phone number. They may even claim they are licensed by FSCL or that they are AML/CFT reporting entity under the FMA. FSCL is just an external mediation organisation and does not vet or monitor its members. All financial companies need to comply with the separate New Zealand anti-money laundering laws but this does not provide you with any protection.

As discussed earlier unless the broker has a Derivative Issuer License, sometimes known casually as an FMA license, they are not licensed at all and may not even be based in New Zealand. These brokers will not provide the level of security you might expect and if there is an issue you will find that FSCL and the FMA will not provide any help.

Due diligence

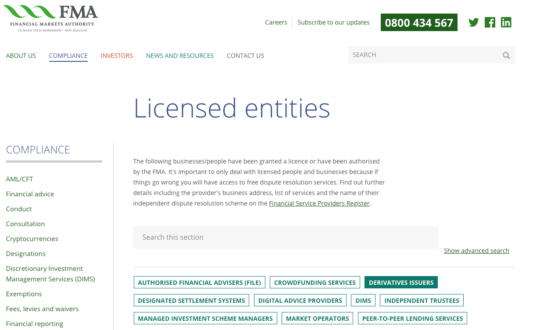

Do your own due diligence, check the FMA derivative issuer license holder list or check the FSPR to make sure that the company holds a derivative issuer license.

To check go the FSP register

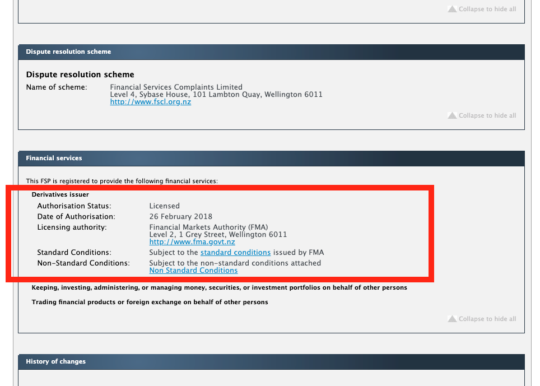

Search the broker and scroll down to the Financial services section, you will see Licensed entities

Conclusion

There is a huge difference between a broker with a Derivatives Issuer Licence and being registered on the Financial Services Provider Register or having a “FSPR Licence”. Brokers that imply that being on the FSPR means you are protected or they are regulated are simply lying. If they are lying about this what else are they lying about?

Adrian O’Flynn

Head of Operations & Compliance

Rockfort Markets