Having access to the best forex trading tools is essential for a forex trader. As the currency markets are dynamic, forex traders need to keep abreast of the latest developments.

Gone were the days when forex trading was all about using just technical analysis. These days, forex trading requires a lot more than relying on technical analysis alone.

But in search of finding the best forex trading tools, the question about cost can come up.

Should forex traders pay more in order to gain access to forex tools? Do these additional trading tools give you an edge in the markets?

Last but not the least, is the question on whether forex trading tools help you boost your performance as a trader.

It is easy for traders to lose themselves in the world of forex trading tools. You can end up buying subscriptions to just about anything. From custom trading software to trading platforms and forex signals services.

At the end of the day, a trader should consider what forex trading tools they need and whether or not it will help them to improve their trading performance.

This article on the 10 best forex trading tools walks you through the most essential tools required for trading in the forex market. All of these forex trading tools are free and hence, it won't cost you anything extra.

We will also outline the reasons why you may want to use these top 10 forex trading tools.

#1. Use a good charting platform

Having access to a good charting platform is important especially if you use technical analysis for most of your trading.

Thankfully, there are a number of charting platforms that are available, both free and paid.

For beginners, the Metatrader 4 charting platform is more than enough. The charting module of the MT4 trading platform allows forex traders to use technical analysis on the charts directly.

Metatrader 4 has a short learning curve

The advantage of using the Metatrader 4 charting module is that you can also trade directly from the charts. Therefore, despite the forex markets moving dynamically round the clock, this functionality can help you as a forex trader.

Whether you are using standard indicators available with Metatrader 4 or whether you need custom indicators, the MT4 platform makes it possible.

As one of the most popular and free forex charting platforms, traders can get hold of just about any technical analysis tool that they need.

Furthermore, the mobile and web versions of MetaTrader 4 allow you to stay on top of the markets and your positions at any time. This makes it easy for you to use a single charting platform with relative ease.

#2. Staying on top of the Forex news

The forex markets are driven by the day-to-day news releases. Currency pairs track the economic indicators of their respective economies, forex traders need to stay on top of the news events.

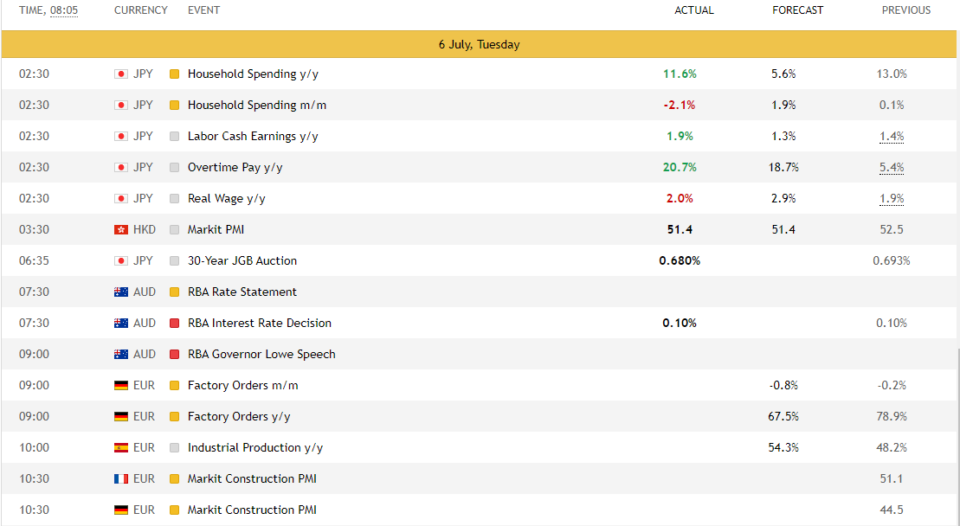

On any given day, there are at least a handful of news events in the forex markets. The best forex traders rely on a good economic calendar to stay abreast. This is especially true if you are an intraday forex trader.

Using the economic calendar to track the forex market

Knowing what the economic calendar schedule is, for the week ahead forex traders can plan their trades accordingly.

There are many economic calendar resources that forex traders can use to keep track of the forex market.

The most obvious economic calendar is of course the ForexFactory calendar. But besides this, Metatrader also has its own free version of the financial calendar. You can also download this as an app on your smartphones.

Using the app, you are able to track the markets in real-time. This in turn can help to plan your trading accordingly.

- Myfxbook economic calendar: https://www.myfxbook.com/forex-economic-calendar

- Forexfactory economic calendar: https://www.forexfactory.com/calendar

- Metatrader economic calendar: https://www.mql5.com/en/economic-calendar

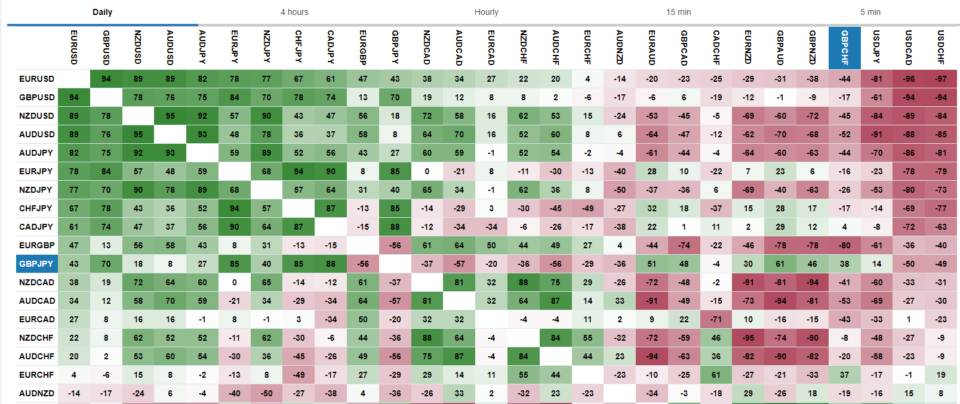

#3. Trading with correlation matrix

Although we have different currency pairs in the forex market, most of them behave similarly. For example, currency pairs with USD move in similar trends comparing to other currency pairs.

Using a correlation matrix can help you find trading opportunities that you did not think of before.

Why should you use a correlation matrix?

A correlation matrix is one of the forex tools that you can use to understand how currency pairs are correlated to one another.

For example, when the USD is strong, you will find that all currencies having USD as the base currency (USDCHF, USDCAD, USDJPY) tend to move in the same direction.

A correlation matrix allows you to find correlated currency pairs. Using this, you can apply your trading strategies on these newly discovered forex pairs as well.

Since trends in a currency are the same, this will help you to use technical analysis tools in a different light.

A correlation matrix can be found on free websites such as MyFXBook.

Or you can also make use of a custom Metatrader 4 indicator and apply it directly on your charts. This enables you to stay within the trading platform and have ready access to the correlation matrix data.

- Mataf.net Correlation Matrix: https://www.mataf.net/en/forex/tools/correlation

- Investing.com Correlation Matrix: https://www.investing.com/tools/correlation-calculator

- Myfxbook correlation matrix: https://www.myfxbook.com/forex-market/correlation

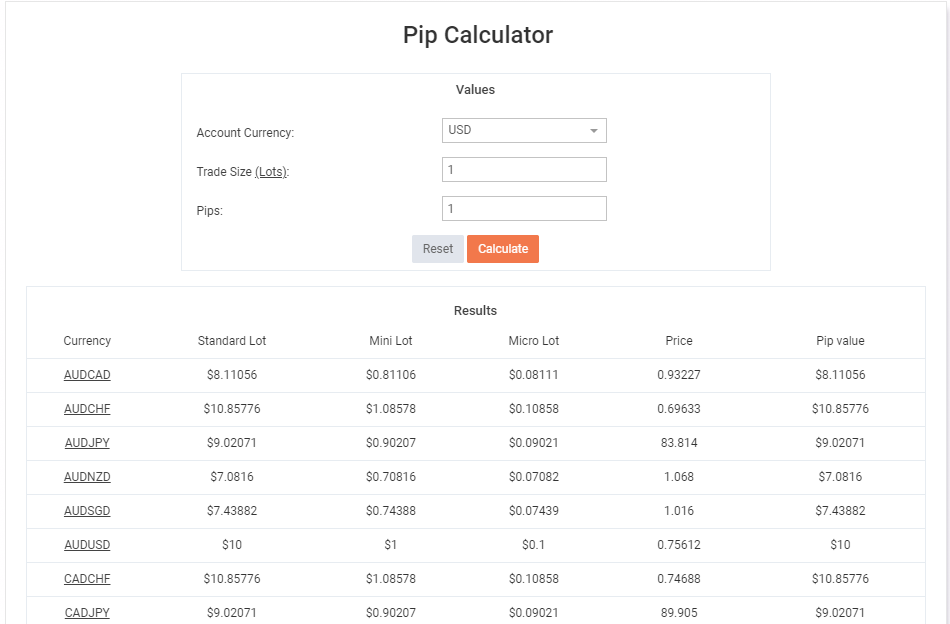

#4. Pip calculator for risk management

A forex pip calculator, as the name suggests is designed to give you more details on the pip value. As forex traders may know, depending on the lot size you trade, the pip value can change.

A pip in forex is the fourth decimal. Therefore, depending on the lot size you trade (standard lot or micro lot), the pip value can change from one cent to as much as ten dollars.

Having access to a pip calculator is important in forex trading as it can reveal how much money you are risking. Because small mistakes can make you lose money quite easily, a pip calculator helps you to understand how many lots or contracts you should trade.

The pip calculate allows traders to work closely with their trading systems. Typically, for currencies that have a high historical volatility, you should use smaller contracts for your trade. This ensures that you are not risking too much on your trading strategy.

There are many places to calculate the pip size. One of the best resources for traders is the MyFXBook pip calculator https://www.myfxbook.com/forex-calculators/pip-calculator.

Using the pip calculator, you can find the pip value for just about every currency pair that you want to trade.

#5. Financial news websites

Online forex trading requires you to keep track of what is happening around the world.

It is not just the forex calendar but also the financial news covering geo-political issues that matter to the market. Hence, a couple of financial news websites make for some of the tools for traders that is beneficial.

We recommend using financial news websites such as CNBC.com, Bloomberg.com or even a mainstream news website's business section.

Keeping track of developments in the world markets can help you to understand how it can influence the foreign exchange markets on the whole. Currencies after all react to factors that are most relevant to them.

Spending a few minutes scanning through the headlines can reveal any important information that a forex calendar will not.

Alternately, you can also click on the News tab on your MT4. Depending on the resources available, you can find a mix of technical analysis and general financial news right from your trading platform.

- CNBC.com: https://www.cnbc.com

- Bloomberg.com: https://www.bloomberg.com

- Forexfactory news aggregator: https://www.forexfactory.com/news

- Investing.com news: https://www.investing.com/news/

#6. Maintaining a forex trading journal

A trading journal is perhaps one of the most important trading tools in forex trading. Many beginners to forex trading should develop the habit of maintaining a trading journal. It one of the analysis tools that will help you trade with a plan.

A trading journal can be created in an excel sheet or in a word document. A forex trading journal should comprise of:

- Technical indicators you are using

- A brief description of the trading strategies you are using

- Screenshots of the charts with your technical indicators

- Reasons why you are going long or short

- Your entry, stop loss and take profit levels along with the lot size

After the trade is closed, whether in profit or in loss, you should also write a summary about what happened.

It is here that you will find some interesting factors about the currency pair or even the technical indicators you are using.

#7. Backtesting software

Trading forex is all about backtesting your trading strategies. Many forex trading platforms allow you the option to backtest your trading strategy. You can find the backtesting software going by different names.

On the MT4 trading platform, it is called the Strategy tester. This allows you to test both your expert advisor as well as indicator based trading strategy.

Online forex trading is dynamic and hence, you should get good practice to become familiar with the indicators used. The strategy tester allows traders to spot trading opportunities and test them in hindsight.

Bear in mind that backtesting is just as important as forward testing. It will help you to fine tune the trading signals from the technical strategy you are using.

#8. Advanced technical indicators

Although this is not recommended for new traders, using advanced indicators in forex trading can help you to find new trading opportunities.

To use advanced technical indicators, new traders need to spend a lot of time and gain experience in currency trading.

If you are using the Metatrader 4 trading platform, there are many free technical indicators that are available for you. You can also make use of an MT4 developer to have a custom indicator developed for you.

One of the commonly used advanced technical indicators are those which use a dashboard. Dashboard indicators give a snapshot of the various currency pairs on your trading platform. It is also lightweight and does not take up too many resources.

Dashboard indicators can help you as a one-stop analysis tools for trading. From here, you can easily drill down into the currency pair of interest.

MQL5.com codebase: https://www.mql5.com/en/code

Free access to custom indicators, as well as paid indicators, EA’s for Metatrader 4 and Metatrader 5.

#9. Forex trading forums and communities

Forex trading can get lonely. Hence, joining a trading forum or community can help you to make friends and also learn about trading forex. You can pick up some tips and tricks as well as learn new things such as discovering new trading platforms or a new trading software.

Forex forums and communities also feature many traders showing off their trading strategies and trades. So be careful not to fall prey to such threads. You may end up abandoning your current trading strategy for something else.

Many trading forums also allow you to manage a trade journal as well. This functionality may differ but if you are short of ideas, you can create a trade journal (and make it private) if required.

Most popular forex trading forums

#10. Using a demo trading account

A forex demo account is the best and free forex tools you could ask for. Any trading software available today gives you the option to create a demo or a paper trading account.

Even professional traders make use of a demo trading account. It helps them to practice not just their strategy but also get more comfortable with tie trading software. In fact, the forex demo account is the basic forex tool you should have in your kitty.

The Metatrader 4 trading software allows you to download the platform for free and use the demo account. Ideally, you should choose the capital to be more realistic. Hence instead of a demo capital of $100,000, choose $5,000 or $1.000 with leverage that you will use on your real account.

This will help you with opening/closing the correct lots on the currency pair that you plan to trade with.

Experience is the best trading tools in forex!

In conclusion, trading forex can be improved depending on the trading tools that you use.

But most importantly, experience is one of the best tools that traders can ask for. The foreign exchange market is risky, and you can lose money quite easily.

Hence, for beginners, it is highly recommended to start slow and steady. If you start chasing money right off the bat, you only end up losing money in the currency markets.

Therefore, take your time and develop the skills needed to be more confident in currency trading.

The top 10 best forex trading tools are mostly free and hence do not come at an additional cost to you as a trader. You can of course look for paid forex tools as well. But this is up to your discretion.