Forex rollover rate is something traders come across if they have ever held an open position overnight. These are additional costs that you pay when trading forex (besides spread and/or commissions).

The rollover rates can go by different names. Some traders refer to forex rollover as overnight interest rate, or swap rates.

No matter what name you call it, forex rollovers cannot be avoided if you are a swing trader. It does not matter what currency pair you are trading either!

In many cases, the rollover rates should not be much of a concern anyways. Of course, these overnight fees tend to add up if you keep your position open over a span of weeks.

This article about the rollover rate in forex trading gives you complete insights into what is a rollover rate. You will learn why there is a rollover rate in the first place in the forex market and how it is calculated.

Be warned though, that calculating the exact swap rate is not possible. There is also a markup applied to the overnight swap rate. Hence, you will never get the correct swap rate fee even if you painstakingly calculate it by yourself.

You will also learn some important points to bear in mind when trading the currency markets.

What is forex rollover?

A forex rollover is the overnight interest rate that is debited or credited to your trading account when your position is held overnight.

The swap rollover is based on the interest rate differential. This is applicable because when you trade in the currency markets, you are simultaneously buying one currency and selling the other.

When you buy one currency, you are essentially borrowing it from your broker.

Hence, there is an interest to pay on borrowing this currency. Similarly, when you buy another currency, you will also earn interest on this other currency. The swap rates tend to balance the difference in interest rates.

Generally, interest rates are represented as an annual percentage. But when it comes to the rollover fees, this annualized interest rate is broken down to the exact number of days for which your trading position is kept open.

Depending on the calculation, your trading account may get debited with extra interest, or it may get credited with the extra interest.

Traders refer to the forex markets as a positive rollover or a negative rollover. A rollover in forex is defined as the net difference between the interest rates of the two currencies.

Breaking down the overnight swap long/short points

For example, if you are buying the EURUSD, you are buying the EUR and selling the USD. Hence, for the EURUSD, the interest rates or the long rate (EUR) and the short rate (USD) apply.

Many websites misleadingly mention that the forex rollover rates are the difference between the central bank interest rates. This is not true!

You can simply take a look at the overnight swap fees charged by your broker and in many cases, you will find negative swap rates. If one goes by the logic of swap rates being the interest rate differential, then there are many currency pairs such as AUDNZD, NZDJPY and many more which should attract positive swap rates on open positions. But this is not the case!

The difference in interest rate is based on different factors such as the prevailing rates for the respective currencies.

What time is a rollover in forex applied?

Since the forex markets operate 24 hours a day, the term overnight can vary from one geographical location to another. Broadly speaking, a rollover in forex happens at 5 PM EST (Eastern Standard Time).

The 5 PM EST is the same as 21:00 GMT. You can now deduce at what time the rollover fees kick in.

To be more precise, as long as your close out your position by 4:59 PM, you won't be charged the rollover. But if you keep your position open at 5 PM EST, then that currency position will attract the rollover rate.

Every forex broker follows a standard time zone such as CET, GMT, CET+2 and so on.

You will typically find a forex broker using a GMT time zone or a GMT+2 (during European summer time) and GMT +3 (when daylight savings are on). Hence, it does not matter where a forex trader is located.

What matters is what time zone your forex broker is using. Based on this, at 5 PM EST, the forex broker will automatically roll over your currency position into the next day.

What is a triple rollover day?

The triple rollover day is a Wednesday. On Wednesdays, the rollover points are tripled to account for the weekends. Some forex brokers apply the rollover on a Friday (to account for the weekends). So this can vary from one broker to another.

Usually, you can see this mentioned in the instrument specifications. It is referred to as the 3-day swap. If there is any holiday, then you are also charged a rollover fee for this holiday. It is prevalent during key holidays such as Christmas, New Year's day and so on.

It may sound counterintuitive to the fact that the forex markets are open round the clock, but there are some holidays for certain currencies. Consequently, the overnight swap rates are charged accordingly. There is no way to get out of avoiding rollover fees unless you have a verified sharia account or just a day trade.

Triple rollover comes into effect if you keep any of your trades open through to 5 p.m. EST on a Wednesday. It does not matter whether you opened the position on a Monday or at 4:50 p.m. EST. Both trades will attract triple rollover fees.

How does forex rollover work?

To understand where a rollover rate is applied in forex trading, we need to look at how the currency markets work.

In the real spot markets, banks and other financial institutions exchange one currency for another. This spot transaction is based on the current prevailing exchange rate. But when it comes to currencies changing hands, the delivery is on T+2 or two business days after the spot date.

This is also known as the value date. Similar to the spot transaction, there are other conventions such as Spot Next, Tomorrow Next or Tom-next or T/N.

The forex rollover calculations are not straight forward as using just interest rates. There is also another component to this.

What is Tomorrow next in forex and why it matters for overnight swap points?

Tomorrow next or T/N is a short-term transaction in the currency markets. It allows traders to buy and sell currencies over two separate business days.

This is obvious from the name, Tomorrow and the Next day. This is where Tom-next differs quite a bit from the spot markets. In the spot markets, we already learned that traders take delivery of the underlying currency two business days later.

Using Tom-Next, traders can prevent taking delivery of the currencies. But the Tom-Next allows them to keep the forex positions open overnight.

The provider simply swaps the overnight positions for a similar contract on the next day. But since the markets keep moving, there is a difference between the two contracts.

This difference becomes the overnight swap rate adjustment.

Hence, if on the first day, you purchased EURUSD at 1.1810. But you need to sell this in order to buy it the next day. Let's assume that you sold the EURUSD position at 1.1812. But the next day, the EURUSD is at 1.1815. It is about 3 points higher.

Hence, for a 1-lot size trading position, one pip is equal to $10. Thus, at 3 points, the overnight swap rate is 0.3 x $10, which is $3.

Financing costs also matter

Besides the Tom-next swap rates, there is an additional layer, which is the financing costs.

Since you are essentially borrowing one currency to buy or sell the other currency, there is an interest you need to pay or receive. This interest rate comes from the underlying LIBOR rates (not to be confused with the short-term interest rates set by central banks).

These LIBOR rates dictate the actual lending rates in the interbank markets.

Hence, a forex position left open overnight attracts both the swap points which are derived from the interest rate for borrowing and lending.

How to avoid rollover forex?

Day trading will help traders to avoid rollover fees. Day trading is when the trades are open and closed within the day. Since there are no overnight positions, there are no fees to pay or receive.

However, this should not be the primary reason for not keeping your currency pair open overnight. In many cases, the trading platforms automatically add or deduct the fees from your trading account.

As long as you close the positions by the end of the trading day, or 5 PM EST, you can safely trade, knowing that there will not be any extra fees to bother about.

How to calculate the rollover interest overnight?

To calculate the overnight swap rates on open positions held overnight, we use the following formula:

Long Currency interest rate/Short Currency interest rate * Number of lots = Swap points in the quote currency.

If you are long on AUD/NZD, and if your account balance is also in AUD, then the above calculation is straightforward.

The long rate and the short rate are the financing rates, represented annually.

In another example that is more typical, your account balance may be in USD. In this case, you convert the resulting swap points into USD at the prevailing exchange rate. Finally, you then need to convert the annual interest rate to a daily interest rate, in order to get the true overnight swap rate.

But as we mentioned, the rollover fees are at the discretion of the forex broker. Hence, for example, broker A offers positive rollover fees on EURUSD long, while a forex broker B offers negative rollover on the same EURUSD long trade.

How to find out the rollover interest rates charged by your forex broker?

A forex broker generally publishes the rollover rates and you can find this information from the forex broker's website under the trading terms sections.

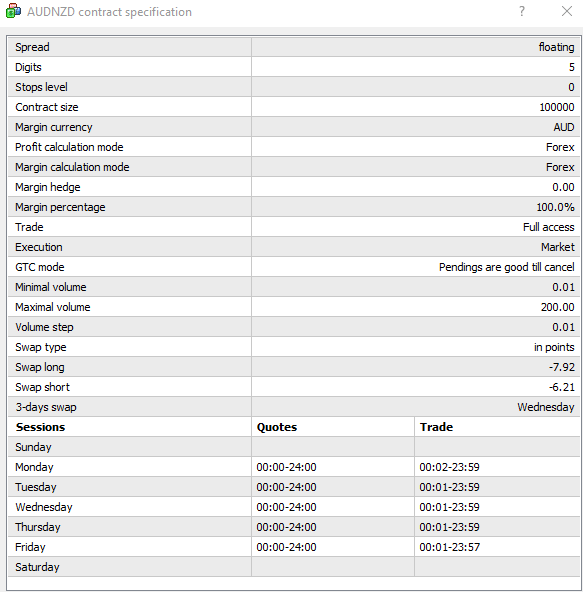

In the picture below, you can see that for AUDNZD, a long position incurs -a $7.92 overnight rollover fee, while for a short AUDNZD, for a 1 lot position, you are charged -$6.21. As you can see, depending on the currency pair, sometimes you will find opposing fees on both long and short positions.

In the above example, the swap points are in AUD currency. So if your trading account was in USD, then the AUDUSD prevailing spot rate is charged to convert the fees into the same currency as your trading account.

Forex brokers tend to publish their swap points on the websites, but it can be difficult to find them. Hence, the best way is to use the MT4. You can use a demo account which in most cases reflects the same swap fees as on a live account.

You can access the Market watch window in MT4 and right-click on the currency pair. Then click on specifications which opens the specification window in your trading terminal. You will then notice the swap long and swap short points here. Also, pay attention to the triple rollover day.

A swap long means that the swap rate applies to a long position. Likewise, swap short applies to the short positions held overnight.

Forex rollover - Summary

Not many brokers fully explain how the rollover rates work. Therefore in many cases, traders will have to write to the broker’s support channel to understand how the swap long and swap short points are calculated.

In summary, the forex rollover fees are applicable if you are swing trading the currency markets. The longer your position is kept open overnight, the more the fee eats into your position. Depending on positive or negative fees, this can be an advantage or a disadvantage.

However, once you know the full costs of the overnight rollovers in forex, you are then able to take a better decision on whether you want to swing trade a particular currency pair or not.