The EURUSD is perhaps the most liquid currency pair you can find for trading forex. It is a currency pair made up of the world's reserve currency and the shared currency (the euro).

Consequently, there are some clear benefits of trading this forex instrument. In recent times, the strong uptrend in the US dollar is another reason for renewed interest in the EURUSD. You can take advantage of the tight spreads, and good volatility to trade this currency pair.

In this article, we talk about how you can take advantage of this strongly trending forex currency pair. We also cover the various aspects of your trading account (such as leverage, and margin requirements) as well as open up the discussion into some trading strategies you can use.

Last but not least, you will also learn in this beginner's guide to trading the EURUSD the unique methods of analysis that can be beneficial for your trading. Although the below-mentioned points help you to better your skills at trading, bear in mind that the EURUSD trade carries the same risk as any other leveraged speculative trading.

Therefore, traders should not view this article as the blueprint to make money trading EURUSD, but rather have a better understanding of how this currency pair works.

What influences the EURUSD price?

To start off with the very basics, it is essential to understand the fundamental factors behind the price movement in the EURUSD forex instrument. Obviously (and as with most currencies), it has to do with the interest rates.

However, it is not that simple. The markets move on expectations rather than what has already been done. Therefore, it all comes down to the economic data and how the respective central banks react to it. It is almost, always a question of how the two respective economies are faring and in which direction, interest rates are expected to go.

In recent times (especially since Covid 2019), the Federal Reserve has been very hawkish. This has put the ECB on the back foot, which has been lagging. At the time of writing this article, the Fed is expected to continue pushing rates higher.

Meanwhile, for the Eurozone, higher interest rates come with a grave risk of pushing the fragile shared economy into a recession.

Consequently, one can see this in the price charts where the EURUSD is in a steady and prolonged downtrend. Investors cue into aspects such as the central bank’s projected interest rate path to determine which currency to buy or sell.

The war in Ukraine, which most Eurozone countries have caught up with, also adds to the shared economy’s woes. With a lot of funding going into Ukraine, the sharing economy is also bearing the brunt of the war.

If the ECB hikes rates too soon, it could raise the borrowing costs in the region. Complicating matters is the fact that since the Eurozone has countries with different economic levels, higher interest rates have a huge risk of defragmentation, which could potentially lead to a sovereign crisis as we saw in Greece, Portugal, etc.

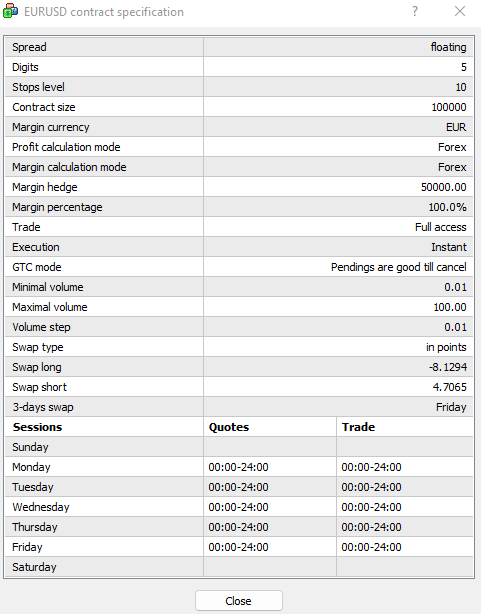

A deeper look into EURUSD margin and trading conditions

Before you trade any currency pair, it is important to understand the trading conditions. Thus, traders should spend a significant amount of time looking at the margin requirements.

Other aspects such as overnight swaps, trade commissions, spread and hedging should be considered. Let’s start with the most obvious. The first step is to open your MT4 and right-click on the EURUSD currency pair symbol and select specifications.

Traders should pay attention to the margin percentage.

To open a position for a 1-lot contract size (100,000 units), at a price of 0.99934, you would require $99,934 worth of trading capital in the margin. Based on the margin requirement of 100% (and leverage of 1:100), this means you need to put up an initial margin of $999.34.

Thus, if you have a trading capital of $10,000 the initial margin will take up almost 10% of your equity, leaving you with a trading balance of ($10,000 - $999.34) and $9000.66. You should also pay attention to the minimal volume, which in most cases, starts at 0.01 lots (or 1000 units).

The next step is to look at the rollover fees which are the swap long, and swap short specifications. These are quoted as points and mentioned per standard lot. So, if you have a long position and held it overnight, the amount of $8.1294 is deducted every night.

This triples on a Friday due to the weekend. Based on this, you can now already conclude your trading conditions. Firstly, given the 1:100 leverage, you are able to put up just 10% of the initial margin requirement for a standard lot.

Depending on whether you are long or short, the swap amounts are added or subtracted for positions kept open overnight. This is useful when it comes to long-term or swing trading.

Availability of hedging

It is crucial that you know beforehand if your broker allows hedging. Hedging, in forex trading terms, relates to the ability to place both long and short orders on the same instrument. This will allow you to capture both short-term retracements while maintaining a long-term trend position.

You should also check whether the margin requirements reduce when you do so. In other words, check if your broker doubles the margin or not. In most cases, brokers who allow hedging will apply margin only on the latest position that you have taken.

Essentially, you can now trade one position without any margin. This frees up your capital which can be used for the floating margin.

Assessing the EURUSD direction

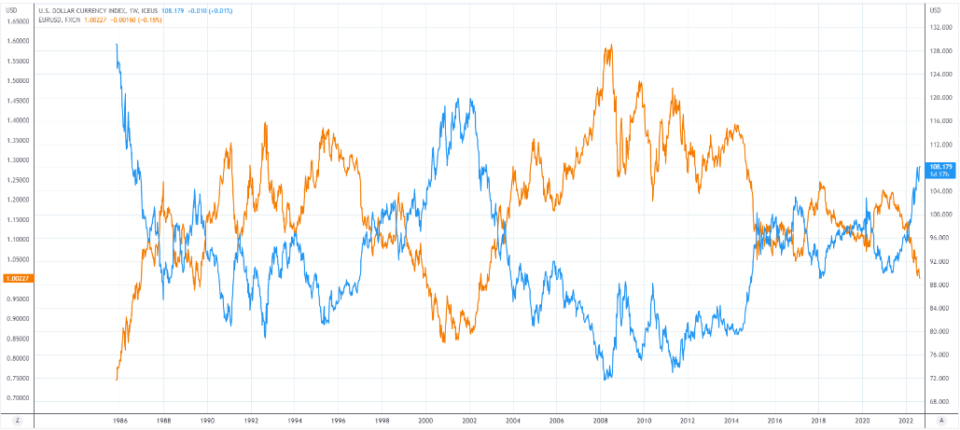

The euro currency plays an integral role in the US dollar index. You can read more about what is the US dollar index here. Since the euro has the largest weightage, the movements in the US dollar index are directly opposite to the euro.

The above chart shows the dollar index in the blue line and the EURUSD in the orange line. You can notice how starkly opposite they move to each other. This allows you to basically analyse the dollar index as a way to enhance your EURUSD analysis.

Since the focus is now only on the EURUSD currency pair, the ability to look at the market movements in the US dollar index can help to determine if you are on the right track.

The commitment of Traders Report

The CoT report is another great way to assess the speculative position of the euro currency. The coT is short for the commitment of traders' reports. It covers the futures markets and the large participant’s positioning in these markets.

There are euro futures and US dollar futures that are of interest to us. The CoT report serves the purpose of analysing how traders’ bets are positioned. Are they extremely long or extremely short? You can analyse this based on the relative positioning in the markets.

When there is an extremely long or short concentration, you can expect prices to snap. It does not matter that the CoT report is not real-time. But still, it helps to get an understanding of the wider market positioning.

There are many numerous websites that publish and interpret the CoT results. This will enable you to understand what is going on in the markets. It is ideal to use this approach especially if you are swing trading.

You can also use google search to look for the CoT reports and see how the euro futures and the US dollar futures are positioned. But as mentioned, do not look at the data for the week. Rather try to understand if the net long or net short is at some extreme level.

Combining fundamentals with technical – EURUSD trading

A most overlooked aspect is in tying up the fundamentals and the technical analysis together. Timing is of utmost importance. Hence, if you expect to see the EURUSD to reverse at a support or resistance level, see if it coincides with any potential fundamental news.

Here’s an example.

Firstly, the EURUSD chart has the 20-period and 50-period moving averages. We see that prices are in a steady downtrend. What’s worth noting is that in this example, we have a short position placed already.

This will be the long-term downtrend that we are interested in. Following the highs from the 10th of August 2022 to the lows of August 24, we can see that the 38.2% retracement level is around 1.0085. Therefore, based on further technical analysis, we expect a retracement to take place.

Thus, a long position is now taken (with a focus on moving the trade to break even as soon as possible). But here comes the fundamental part. Looking at the economic calendar, the Fed’s Jackson Hole symposium is due on Friday, 26th of August.

The markets are still mixed with consensus divided. If the Fed speak from the symposium turns out to be less hawkish, we can expect this retracement rally to continue. But a reversal is in store if the markets view the speech as very hawkish.

Trading the EURUSD – An example

Given that prices are likely to retrace initially to 1.0085 and probably towards 1.01455, the view for trading EURUSD goes like this:

Ideal scenario:

- Markets view Fed speak at Jackson Hole as less hawkish and rally into the week’s close

- The following week, fresh economic data from the US is due, with the payrolls report. Hence, a strong payrolls report could derail this retracement and cement expectations of a 75 bps rate hike

- In the following weeks, we then also have the inflation report which will be the final report before the September Fed meeting

Alternately,

- a hawkish fed speak could see the EURUSD reverse around 1.0085

- it could likely gain momentum on a strong payrolls report for August on September 2nd OR

- we could see a weaker report that will see a short-term bounce, but still, keep the Fed on track for a 50 bps rate hike

Thus, tying the above to technical analysis, we can expect a strong close to the EURUSD during the week ending August 26th followed by a likely continuation or a decline back to the trend the week after.

Since we are swing trading, we already know of the margin requirements, and swap long and swap short costs to the trade as well. Last but not the least, the moving averages continue to serve the purpose of showing us which direction the markets are trending in.

It is therefore essential that traders focus not just on technical analysis but also on the fundamental analysis aspect as well. This brings a more holistic view to the positions. You are able to get a better understanding and gain confidence if prices move against you.

This takes practice but allows for a good way to remove subjectivity from the trading equation.

How to trade EURUSD – A beginner’s guide to trade EURUSD summary

To summarize, the EURUSD currency pair is one of the most liquid forex instruments available to trade. Thus, traders can enjoy tight spreads, which can help reduce costs. It is better to stick to one instrument rather than focus on too many.

This way, you can get to know the instruments you are trading on a deeper level. Understanding the leverage, margin and swap requirements helps you to understand the costs involved in trading. You can already use this information to cover for such fees when setting your stop loss and take profit levels.

Analysing the fundamentals, and correlating them to instruments such as the US dollar index can be helpful for traders to further cement their views on the currency pair in question. By using the information from other tools such as the Commitment of Traders report, you can further understand what large speculators are doing.

This will enable you to anticipate any potential changes and thus manage your risks while trading the EURUSD on a better level.

Last but not the least, the EURUSD currency pair is risky just as trading any other leveraged instrument. Hence, one should pay attention to the risks when trading the EURUSD. It will not be easy to get it right from the start. But the more time you spend, the more you are able to enhance your EURUSD trading skills.