Market index in finance measures the performance of a portfolio of companies or assets in its holdings. They are also known as the benchmark index. Depending on the type of financial asset a market index tracks, it can be classified into categories.

The major market indexes are managed by companies such as Dow Jones, Standard&Poors’, MSCI, FTSE Russell and many more. Investing in a market index allows investors to choose between any financial sector and asset class.

The world of market index started with the Dow Jones Transportation index in July 1884.

It was created by the famous Charles Dow. Since then, the financial markets have seen a rise in market indexes.

Different types of a market index

Investors can gain access to any market index for trading. Below are the most popular market indexes depending on the type of asset you want to track.

Equity Indices

Equity indices track the performance of selected stocks in a stock exchange. The benchmark equity market index is a proxy for the economy’s equity markets. It is a measure of how bullish or bearish investors are in the equity sector.

The equity market index is categorized based on stocks with the most significant market capitalization.

The most famous are the Dow Jones Industrial Average or DJIA30 and the S&P500 index in the United States.

Depending on the composition and structure, the number of holdings in the equity indices can vary. For example, the DJIA tracks the 30 largest publicly traded companies. On the other hand, the S&P500 tracks 500 large-cap companies in the U.S.

Commodity Indices

The commodity market index tracks the performance of a select group of commodities or companies related to the commodity markets.

These can be further classified into the type of commodities and includes the portfolio of company holdings under it.

For example, the Philadelphia Gold & Silver Index (PHLX) tracks the top thirty gold and silver mining companies in its holdings. Depending on the type of commodity market index you choose, investors can gauge the performance of the commodity sector based on the holdings in the index.

Other types of commodity indices include natural gas, energy market index, oil market index and so on. You can gain exposure either on the mining/manufacturing side or track the performance in the holdings of the various commodities in the respective indexes.

A unique aspect of commodity indices is the fact that given the different sub-categorizations, you can find many different types of commodity indices. Some of the most common categories include the precious metals index, base metals index, grains index etc.

Currency index

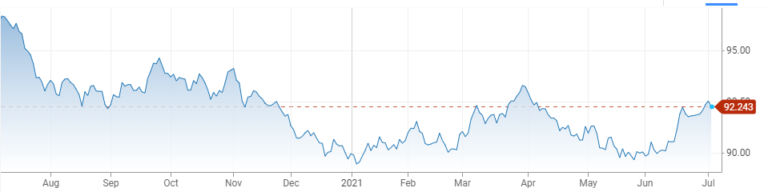

Currency indices track the performance of a currency against a basket of currencies in its holdings. The most popular of all currency indexes is the US Dollar Index or the DXY.

The DXY tracks the performance of the US dollar against a basket of six currencies. There are some customized currency indexes as well. These can be easily constructed and can depend on the method that you use stop therefore, you can create a EUR currency index a Japanese yen index and so on.

Currency indexes help investors understand the overall strength of the currency that is tracked. These types of indices can be derived based on the underlying futures contracts of the various currencies in the index holdings.

Besides the Dollar Index, other popular currency indices include the Bloomberg British Pound Index, Euro Index and many more which can be both standard and non-standard. Within the dollar index world, there is the DXY maintained by ICE (Intercontinental Exchange), and the Bloomberg Dollar index, to name a few.

Fixed Income indices

Fixed income market indices track the performance of fixed income assets. These assets range from sovereign or corporate bonds, to inflation-linked notes and other variations.

The popular fixed income indices are the FTSE Russell World Government Bond Index (WGBI) and the FTSE Eurobond Indices.

The Fixed income indices work in the same way as equity indices. The difference is that fixed income indices track the performance in the debt markets. Based on such indices, financial institutions usually tend to create additional derivative products.

For example, there is many fixed income index-based FS that can be used for trading. In doing so, investors are able to trade the index directly rather than having to have active positions in the underlying fixed income instruments.

Why should you choose a market index?

In the financial world, investors used indices as a benchmark for comparing their portfolio returns.

When a hedge fund or an investment firm beats the market, it means that their returns outperform the benchmark index.

Investors can buy stocks of a company directly. But this involves actively managing your positions in the individual stocks. Investing in an index is better because it automatically tracks a basket of stocks. This is known as “Passive investing.”

But there are many funds such as ETFs and Mutual funds that allow you to do so, indirectly. These funds re-create the index portfolio, comprising the same companies under the index holdings. Index funds are managed by a portfolio manager.

Trading index CFDs is another way to invest in indexes in the short term. Index CFD trading comes with the advantage that you can use leveraged funds. Index CFD is a derivative product that tracks the performance of the underlying index. CFDs are speculative instruments and they are used to hedge positions in the underlying market.

Furthermore, since you are trading Index CFD it allows you to go both long and short on the index. This is not possible if you were investing in an index ETF or a mutual fund.

For many, investing in a market index offers a hassle-free approach to tracking the market performance of as basket of stocks. If commodities are of interest, an investor can choose to invest in a commodity index. This allows for easier portfolio management compared to managing each of the individual stock holdings in a portfolio.

When you are investing in an index, you are merely replicating the performance of the broader market. You cannot beat the market if you are investing in an index.

Benefits of trading indexes

Trading indexes as CFDs allows you to diversify your strategies. Traders focus on just one market such as currencies or precious metals or commodities.

There is no diversification with this approach. Depending on the market, you will see similar trends no matter what instrument you trade.

Advantages of trading using a market index are:

Geographical diversity: As there are many regional market indexes, investors have the choice of diversification. You can choose to trade a TSX30 (Toronto Stock index) and the S&P500/ASX index in Australia. This helps you to isolate the risks from one economy to another.

24Hr access: Market index trading allows you to access a 24-hour market. When the European markets close, you have the option to trade in the Asian markets. Likewise, when the US market hours are closed, you can access equity indexes in Asia.

Thematic distribution: By choosing between a currency or an equity index, investors can choose a thematic strategy. This allows for better risk management. For example, a higher US dollar index will not have an impact on a foreign equity index tracking the performance of technology companies.

Clear trends: Trends in the market indexes are more observable and sustained. Hence, investors and speculators can use trend trading strategies to pick bottoms within the trend. You can also use the medium to short-term trend trading strategies.

One index – many securities: another benefit of trading indices is that it allows you to trade just one instrument while it tracks many underlying instruments that make up the index. For example, the S&P 500 index tracks the 500 top blue chip companies in the US by market cap.

Therefore if you want to gain exposure to all the 500 underlying securities, it is more convenient to trade the index rather than having to monitor the individual securities.

What is the idea behind using a market index?

The idea of indices is to create a benchmark to track the performance of a sector of the economy.

This benchmark allows portfolio managers, economists and financial analysts to gauge the health of the general economy. When the stock market indices outperform fixed income indices, it signifies that an investor is more prone to taking higher risks.

Stock market indices are historically a good proxy for gauging the economic health of a nation. Even central bank policymakers keep track of the indices when it comes to making key policy decisions such as hiking or cutting interest rates.

Other examples include the currency index. Investors use the performance of a currency index to assess the trends in the currency markets. This also helps policymakers understand whether the exchange rate is too high or too low.

You may have heard for example about various financial outlets talking about the US dollar index. When they do so, they are basically referring to the strength of the US dollar. It is assumed that when one says that the US dollar index rose by 10%, it means that the dollar has strengthened across the board. Therefore, whether you're looking at the EURUSD or NZDUSD, you can expect both these markets to fall.

Why are indices important?

Indices or indexes are important because they can tell you how a sector of the financial market is performing. Tracking indexes allows market participants to learn more about any bubbles that may be brewing.

Because there are many different types of indexes, it gives a snapshot of the economy. For example, you could compare the stock market index performance against a fixed income index. This allows investors a glimpse into how well interest rates is working, as well as point to inflation expectations in an economy.

Indices are also important for the fact that they are used for monitoring the performance of various funds ranging from ETFs to mutual funds and hedge funds. This is commonly referred to as benchmarking in the fund industry. Without benchmarking, it can get difficult to analyse the performance of the fund in question.

Depending on what sector indexes you choose, such as the different commodity indices, investors can diversify their portfolios. Diversification enables investors to distribute their risks across different sectors or themes.

One can also gauge the sentiment in the market as well by tracking indexes. For example, rising commodity indexes can signal a weaker US dollar and hint at rising inflation. Even some central banks around the world have their own in-house index. This is commonly referred to as the currency trade-weighted index.

In this context, such an index can be used by central bank policymakers to understand the strength of the currency when measured against a basket of currencies it usually trades with.

Trading indices on MT4

If your forex broker allows it, you can also find many different equity indices on your MT4 trading platform. While most of these indices are usually confined to the three major U.S. stock indices or those from Europe, many forex brokers also have stock indices from different parts of the world as well.

The indices that you trade on MT4 are nothing but CFD instruments. Therefore, it allows you to take both long and short positions and you can also use leverage. The flip side of this benefit is the fact that there will be overnight financing costs.

Traders should also note that since stock indices or equity indices are also subject to dividends, depending on whether you are long or short these dividends are added or subtracted from your positions. Therefore there are additional costs that one needs to consider especially if you want to swing trade equity indices.

To conclude, this article should now give you a clear idea of what indices are and their importance in the financial industry. From being used as performance measurement and benchmarking to being able to actually trade come-up indices offer a lot of benefits for traders.