NFTs or non-fungible tokens have quickly become the next big discovery in the world of cryptocurrency and blockchain.

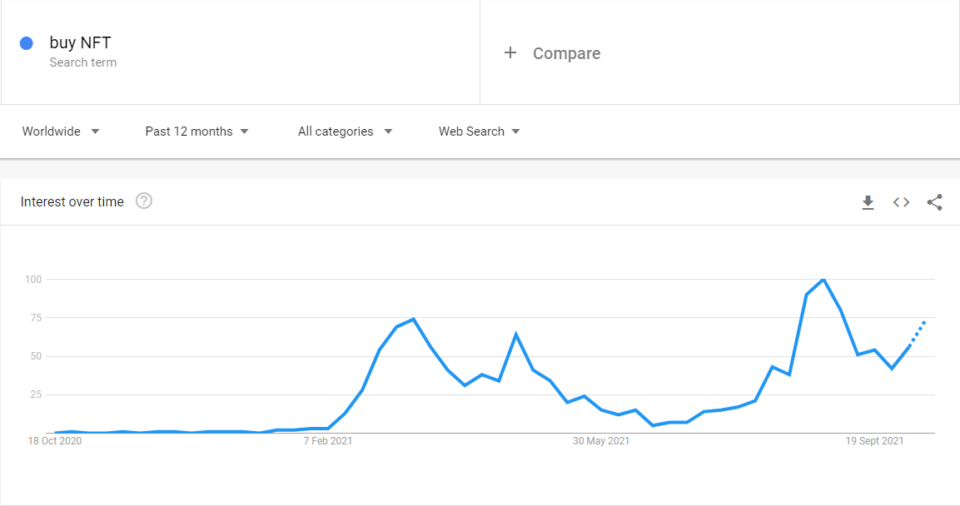

Data from Google trends shows that interest in NFT kicked off around March 2021. Interest in NFTs is only rising since then.

NFTs garner interest, especially from the art world due to its innovation.

NFTs allow artists to monetize their work in a digital sphere. Unlike selling a piece of art at an auction house, NFTs allow these same artists to also sell their work digitally.

Despite NFT's being a recent phenomenon, they have been around for quite a while. In the current day, people use NFT's as the next speculative asset.

In tandem with trading or investing in cryptocurrencies, NFT trading is also picking up pace.

You can now buy NFT either to own something or to buy it for the purpose of selling it after appreciation.

No matter what your reasons may be, navigating the world of NFTs can be confusing at best.

So what are NFTs or non-fungible tokens and how do they work? How can you make money trading NFTs and how do you buy one in the first place?

If you are looking for answers about non-fungible tokens, this article provides you with complete information.

From learning about the history of NFTs to the highest-grossing NFT and the pitfalls one should avoid.

Brief history of Non fungible tokens

NFTs started around the 2012 period, right when cryptocurrencies started gaining traction.

According to various sources, the concept of NFTs started with the term coloured coin. While cryptocurrencies are fungible, there was an idea to track the origin of any bitcoin.

Such coins would be 'coloured' to distinguish them from the rest. This is due to the fact that they now have a special property, setting them apart.

By tracking the origin of a cryptocurrency, they could be used for other purposes such as property, issuing shares and many more.

This guide published by Meni Rosenfeld in 2012 outlines the initial overview of these 'coloured coins'.

The paper goes on to describe how a regular cryptocurrency can be enriched with metadata, giving them special properties.

When coloured coins started in 2012, it garnered interested as the revolutionary next step in blockchain technology. However, the limitations of Bitcoin meant that the metadata one could add was limited.

But the limitations did not stop the crypto community from experimenting.

The next step was that various crypto enabled platforms started issuing the 'coloured coins' based on their own assets. Counterparty, a P2P financial platform issued cards and meme trading in 2014.

As the community started to experiment, by 2017, Cryptopunks opened the first marketplace for 'rare digital art.'

This was launched on the Ethereum blockchain and it showcased some 10,000 digital characters.

Anyone with an Ethereum wallet was able to claim these pieces of art for free. As interest grew and all the 10,000 characters were quickly claimed, it gave rise to a secondary market.

The collectors were able to sell them and as demand grew, the price for owning these digital characters rose as well.

The start of the NFT era

Cryptopunks was an experiment by Matt Hall and John Watkinson, but their pixel generated NFTs sold in the secondary market for about $7.5 million.

These NFTs were issued on the ERC20 token, or the Ethereum blockchain. Following the success of Cryptopunks, the next big project was Cryptokitties. It was launched in 2017 and raised close to $12 million in investments.

Cryptokitties were also unique because, besides the regular metadata, they also had distinct genome characteristics.

This means that every Cryptokitty was its own unique breed. This could then be passed onto its digital offspring.

The success of the Cryptokitty sale saw a new corner of the cryptocurrency world open up. Soon enough, many more digital NFTs came about.

This in turn gave rise to NFT specific marketplaces as well as NFT mining platforms.

NFT or non-fungible tokens represent ownership of unique assets. As mentioned earlier, these can range from simple artforms to complex physical world assets.

How do NFTs work?

NFTs have just one owner at any point in time, which is also the reason why they can be so expensive. The term fungible simply means that you cannot interchange a fungible item for another.

Currency is one such example. It is fungible, meaning that one dollar can be exchanged for another one dollar. Hence, when the term non-fungible comes into play, it automatically infers that the item is unique.

This is what makes NFTs interesting and highly sought after. The benefit of NFTs is that it allows artists to break past the barriers they face today.

For example, if a music artists published a song, it is usually done through a medium such as iTunes or Spotify. These mediums collect royalty in return for providing an immediate marketplace for the music.

NFTs on the other hand are decentralized and global. Hence, there is no middle man involved. Hence, the actual owner and publisher of the song retains the rights, making it non-fungible.

NFTs are not the same as tokens

One of the main things to bear in mind with NFTs is that they are not to be confused with cryptocurrency tokens.

For example, DAI is a token similar to the ERC20. Whereas an NFT issued on the Ethereum blockchain is not the same as the ERC-20 token. This difference makes NFTs unique.

An Ethereum token can be fungible or broken down into smaller units. But an NFT cannot, giving its unique character of non-fungibility.

NFTs, due to the metadata enrichment allows one to track proof of ownership. Therefore, if you purchase an NFT, the blockchain knows that you are the owner of the NFT.

More importantly, since an NFT is non-fungible, the NFT you own, is truly unique. If you look beyond the current craze behind owning NFT’s, they actually serve a very big purpose.

One could call it the next big disruption when it comes to serving digital media.

What makes NFTs popular, and why are they important?

Given the fact that we are moving into a digital world, the current concern lies with the ability to fake something. A great example of this can be research papers or content such as the one you are reading.

If John Doe is the original author of Essay A, in today’s world, one can easily copy/paste this content and pass it off as original.

With NFTs, a digitally proof of authorship or ownership can go a long way. While there can be multiple copies, there is just one owner.

Applying this to the real world, NFTs can be useful to carry information such as property sale deeds, ownership of stock and so on.

Take for example a company that wants to issue stocks in the digital world. They can issue the NFTs which are then bought at a price.

The purchase of these NFTs is now the actual owner of the stock. Thus, when it comes to paying out dividends or for shareholding rights, the NFT can be tracked back.

And of course, similar to the real world, the person who bought the NFT (stock) can sell it and transfer ownership to another person. This now gives the new person, the full ownership of the NFT. And at the same time, the authenticity of this NFT can be tracked.

From the company that issued the NFT, to the first person who bought it and the next person to who it was sold (transferred) to.

How to buy NFTs?

First and foremost, you need to have a cryptocurrency wallet before you can even think of buying NFTs. Following this, you need to sign up to one of the many NFT marketplaces.

The most famous NFT marketplaces are:

- OpenSea

- OKEX

- Rarible

- SuperRare

- WazirX

- Coinbase (more recently) and many more

Since NFTs continue to rise in popularity, the above list of marketplaces can grow.

But you are not done just yet. When you sign up for any of the above NFT marketplaces, you also need to create a wallet within the marketplace. This is called a Web3 wallet. Metamask is one of the widely used Web3 wallets.

You can download and install it via a browser extension such as Chrome, Firefox, Brave and Edge. There is also an Android and iOS app as well.

Following this, you can now transfer your cryptos from your personal wallet to the one held by the marketplace.

As obvious by its name, the NFT marketplace is where you can bid on digital items. At the moment, the highest popularity is toward digital art, memes and some more.

You can browse through to OpenSea.io to get an idea of the various items sold as NFTs.

Once you find an item you are interested in, you can click on it to find more details.

Example of NFT sale of domain names

Let’s take a look at something many could relate to, which is sale of domains.

In the traditional world, domain names can be bought via a domain registrar. After the purchase of the .com or any other tld extension, you can then list it in a marketplace.

If your domain name is interesting, it will garner a few bids. The highest bidder of course gets the domain.

In the OpenSea marketplace, domain names with .eth extension are sold. Here, you can find interesting domains such as tribute.eth, scripter.eth and many more.

To buy such a domain, you can bid and if you win, the amount from your Metamask wallet is debited to the seller. In turn, you own the newly purchased .eth domain.

The transfer of the .eth domain is now registered on the blockchain ledger, thus proving ownership. Of course, if your wallet is stolen, there is nothing you can do about it.

When purchasing NFTs bear in mind that besides the asking price, you also have to pay the Gas fee. The Gas fee is the same that you would pay if you were to transfer some Bitcoins or ETHs to anyone.

The Gas fee can be high depending on the network activity and can dramatically raise the cost of buying NFTs.

Mining for NFTs! Is that possible?

Besides purchasing NFTs, did you know that you can also mine for NFTs?

There are specific NFTs that can only be mined. These are called POWNFTs or short for Proof of work NFTs.

NFT mining is relatively new at the time of this article going to print. However, it offers users another entry point into the world of cryptocurrencies and NFTs. But take this as face value as there are concerns that this could be a ponzi scheme as per this Reddit thread.

How to create your own NFT?

Besides buying and selling NFTs you can also create you own NFTs. Doing this is very simple.

You only need to use your account at an NFT marketplace like OpenSea. This is one of the few NFT marketplaces that allows users to create and sell their own NFTs.

There is not much of technical knowledge required to create your NFT. You can read here for a more detailed description on creating your own NFT.

While creating your own NFT may sound very exciting bear in mind that there are many others who are doing this. And in many cases, such NFTs don't really sell, or go for very low amounts.

An NFT gains value only when there is a lot of media attention.

This will in turn garner a lot of interest and also creates demand, pushing up the value of your NFT.

Pros and Cons of trading NFTs

As NFTs have become popular, many of the masses have piled on, in hopes of making some money.

This has led to rise of many different forms of digital art. If you are unsure of what you are doing, it is highly recommended that you do not jump onto the gravy train.

Many of the NFTs you come across today are worthless, as you continue dreaming about becoming a millionaire or a billionaire.

There are many aspects of picking up NFTs that are really worth something. But for the most part, this requires a lot of research and understanding.

You need to know the ins and outs of blockchain, the digital asset in question and a lot more. Occasionally of course, one may get lucky. The current craze in NFTs have truly pushed valuations to bubble territory.

Therefore, if you are truly looking to invest some big bucks into NFTs, it pays to do your research thoroughly before you embark on such a journey.