Crude oil is a commodity that one can easily identify with.

This is regardless of whether you are driving a vehicle or living in a part of the world where heating is essential in the winter months. There are many byproducts of crude oil, and it is not just limited to fuel or heating gas.

Even beauty products such as Vaseline or other lubricants are a product of crude oil.

Often referred to as fossil fuel, crude oil is one of the few commodities that is highly sensitive to supply & demand as well as geopolitics.

Forex traders can gain access to the crude oil markets by means of oil CFDs. There are also other financial instruments including derivatives such as the futures market.

One of the distinctive features of crude oil is the fact that it is a highly volatile product. Prices can move by a couple of dollars intraday. It is not just trading positioning but also the global markets and politics that play a huge role.

Thus, trading crude oil requires a lot more understanding of the product. You cannot merely rely on technical analysis and expect to be successful in trading crude oil.

This beginners’ guide on crude oil trading lays the groundwork for you on how the oil market works. You will also learn the different types of crude oil and how they differ from each other.

How is crude oil produced?

Fossil fuel gets its name from the fact that oil is a byproduct of fossils found in the earth.

Through millions of years of decomposition and higher pressure, combined with lack of sunlight, the fossils emit a substance known as kerogen. This is then transformed into hydrocarbons.

Based on the different weather conditions around the world, hydrocarbons can be different. To learn more about how crude oil forms, read this excellent article.

It is no doubt that crude oil requires drilling into the cores of the earth to extract these hydrocarbons.

Besides drilling, more recent technological advancements have given rise to fracking. Fracking is a less capital-intensive method to extract the crude oil. Thus, the cost to extract crude oil from drilling or fracking can be different.

Read this primer on what fracking is all about, which is also a rather controversial way to extract hydrocarbons.

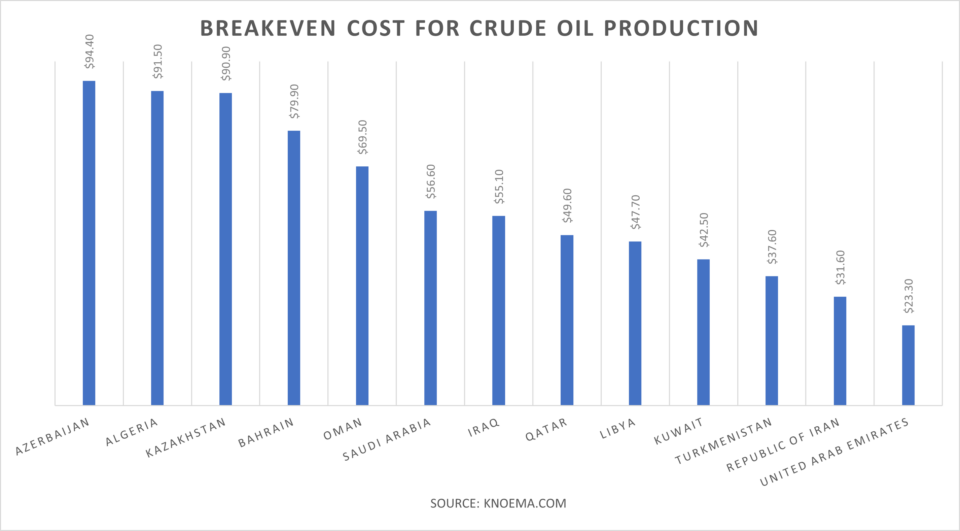

Depending on the geographical location, type of extraction used, the cost for producing crude oil can vary.

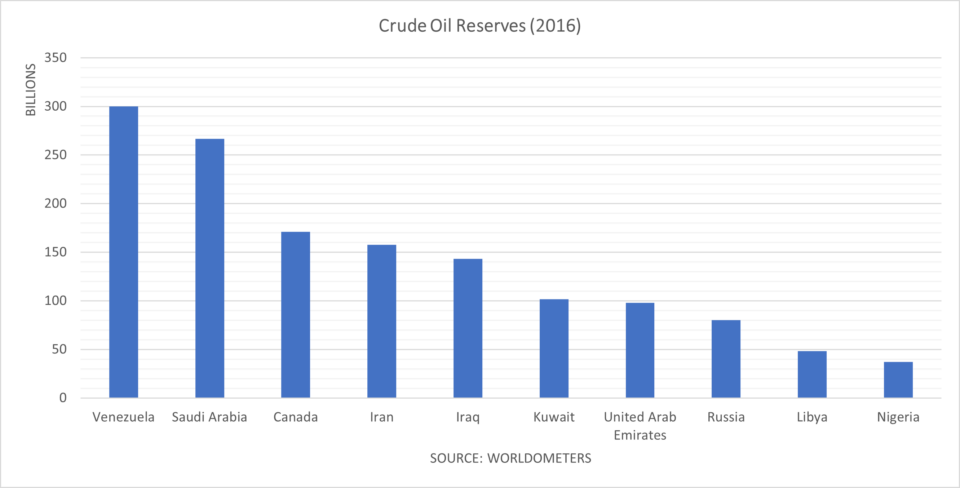

It is broadly said that the Middle East region has the largest concentration of the world’s largest crude oil suppliers. However, it is Venezuela that has the largest crude oil deposits or reserves.

According to the latest data available, UAE has the lowest production costs, while Azerbaijan has the highest at $94.4.

The price of crude oil certainly dictates whether crude oil is a profitable business or not. It is evident that Middle eastern countries enjoy a lower break-even cost than the rest.

Consequently, this has led to the rise of a cartel in the oil markets known as the OPEC.

What is OPEC and how is it relevant to the oil markets?

OPEC is short for Organization of the Petroleum Exporting Countries. The committee was set up initially by Iran, Iraq, Kuwait, Venezuela, and Saudi Arabia.

It later grew as more and more oil-producing nations joined in a bit to form a common voice. OPEC was established in 1960. It was more famous for the Oil Embargo in the United States in 1973. It was the first oil crisis, the world witnessed.

As an oil trader, it is worth exploring the history of OPEC, which can be found here.

In recent years, as fracking began to grow, OPEC’s relevance is not as high as it was decades ago.

Nowadays, Russia and Saudi Arabia are considered to be the leading voice of OPEC. This conglomerate is sometimes referred to as OPEC+.

OPEC holds semi-annual meetings where the member nations meet to discuss production outputs. This can in turn impact the price of crude oil.

Oil traders closely follow these meetings, and you can see strong market reactions around such events.

The chart above shows how oil prices make a steady rally into the OPEC meeting.

An important point to note is that when it comes to trading around the OPEC meetings, it is usually a case of buy the rumor, sell the news.

A historical study of the OPEC meetings often shows that oil prices tend to build up as speculation mounts. However, regardless of the OPEC meeting outcome, there is often a dip.

Knowing such patterns can give traders a potential edge and also prepare them to time the entry of their trades.

WTI vs. Brent – What’s the difference?

When you are trading oil, you often hear people talk about WTI crude oil and Brent oil.

Although both these names refer to crude oil in general, the prices are different.

The following chart shows the prices of both Brent oil and WTI.

For the most part, both WTI and Brent move in tandem. However, there are times when the prices can diverge. Typically, Brent oil trades at a higher level compared to WTI crude oil.

WTI crude oil is short for West Texas Intermediary. This version of crude oil is also known as the Light sweet crude oil. It is primarily produced and exported from the U.S. Gulf Coast.

Hence, the price of WTI crude oil depends on local weather conditions in the region. Since this area, if prone to hurricanes, weather disruptions can cause prices of crude oil to surge.

On the other hand, Brent oil is the international price of crude oil. The Brent oil is primarily produced in the Northern Sea. Countries such as UK, Norway are the dominant players here.

Reading the above, one might wonder how OPEC fits into the picture.

Although WTI and Brent are the dominant commodities in the financial markets, OPEC has the largest exposure. They export oil not just to the West, but also to the East. Thus, WTI crude oil prices tend to follow what OPEC suppliers are doing as well.

On the OPEC website, one can see other versions of crude oil as well. But these are not as highly traded or speculated upon compared to Brent or WTI.

Should you trade Brent oil or WTI crude oil?

Learning the difference between WTI and Brent, the obvious question is which of these two is better.

The answer is that both are different variations of the same underlying product, which is crude oil.

Geopolitics in the Middle East certainly plays a role in the pricing of both these versions of crude oil. Besides this, local factors such as weather, supply conditions, and pipelines are some of the factors that can influence the price.

Regardless of whether you are trading WTI or Brent, you will have to keep track of the global situation.

This is what makes oil trading so unique. For example, when it comes to currencies, you can limit your knowledge to the two respective economies of the currencies you are trading.

But since Oil is largely concentrated in production in one part of the world, while it is exported globally, there are a lot of moving pieces to the puzzle.

What reports should you follow to trade crude oil?

Fundamentals in the oil market are important if you want to be successful.

The Oil markets release certain reports on a scheduled basis.

Firstly, we have the twice-a-year OPEC meeting. This is where the largest oil producers meet to set supply limits. When the supply is cut back, it can be either to raise the price of oil or to meet lower demand requirements.

Depending on the prevailing scenario, OPEC members can decide how much oil they want to supply. Within the OPEC members, Saudi Arabia and Russia have the largest voice. Hence, it is worth following their respective oil ministers’ comments.

Besides this, oil traders can also look up the weekly EIA Crude oil inventory report.

This report is released by the U.S. Energy Information Administration department. This report, released on Wednesday or Thursday gives out details for the U.S. storage levels for Crude oil, Gasoline, and other products.

Since the U.S. still dominates as the largest oil consumer, these reports can bring temporary volatility to the oil markets.

Ahead of the weekly EIA report, there is a little-known report released by the American Petroleum Institute every Tuesday.

The API report is similar to the EIA’s. The only difference is that it is not considered to be an official report. There are times when the EIA numbers can match with API and there are times when the numbers diverge.

On Fridays, Baker Hughes releases the weekly oil rig count report. This report is more concentrated on the production side of the business.

It counts the number of new oil rigs being used as well as the total count.

When there is an increase in oil rig count, it points to higher supply.

Technical analysis for the Crude oil markets

The first thing you should know about the Crude oil markets is that you are essentially trading CFD products. CFD or Contract for Differences are derivatives of the Crude oil spot.

Therefore, with crude oil CFDs, you do not need to worry about rolling over your positions, which is required if you trade oil futures.

Secondly, crude oil CFDs allow you to take advantage of leverage. This leverage however comes at a cost of overnight financing. So, when you have an oil CFD position left open, overnight, you will pay a swap fee to your broker.

This swap fee changes and is mostly negative meaning that you often always have to pay the swap fee to your broker.

Depending on the broker you trade with, you may see a fixed spread or a variable spread. If you are trading with a variable spread broker, then liquidity often falls during the early Asian hours and the late U.S. session.

This is when the bid/ask spread can widen quite a bit.

The technical indicators that you use for crude oil are nothing special. You can simply make use of your regular indicators such as moving averages, oscillators, and so on.

However, how you use these indicators can depend on your trading style and your trading goals.

An intraday oil trader may use support and resistance and price action methods. On the other hand, a medium to long-term swing trader might prefer trend following instead.

Within technical analysis, traders should also make note of seasonal patterns in the oil markets.

Seasonality in the commodity markets is common and hence, traders should consider this aspect as well.

Can you be successful trading crude oil?

To conclude this article, let us address the commonly asked question of whether you can successfully trade crude oil.

Firstly, it is important to note that Crude oil isn’t a product that is predictable, just like any other financial instrument.

However, since it is a product that has a direct impact on the economy, there are some ways one can use oil trading smartly.

This means you will need to be very adept in international geopolitics. It is not just this, but also keeping track of the supply routes.

For example, the Suez Canal is one of the key chokepoints for crude oil. Hence, any skirmishes around this region often send oil prices surging.

Traders should combine a mix of technical and fundamental analysis when it comes to trading crude oil.

Learning about the history of crude oil is also important. It will not only give you insights into the oil markets but alerts you to the key things to watch out for.

There are a number of documentaries available on Youtube for free in regard to the oil markets. Watching these can give you a wealth of information, which can be used when trading oil CFDs.

As with any financial instrument, trading crude oil is risky. Therefore, traders should consider if this is a good instrument to invest in, especially since it is more volatile than forex markets.