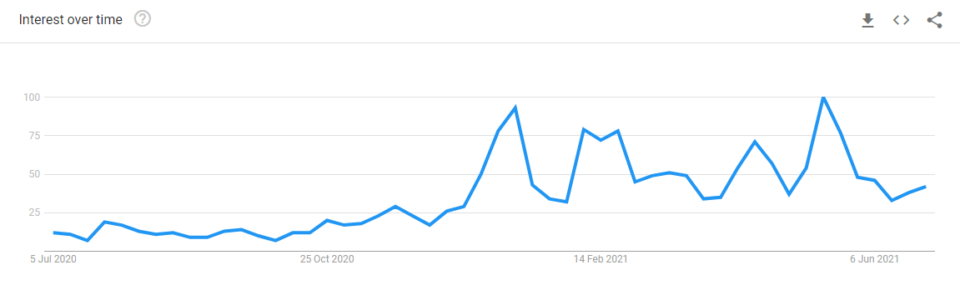

Cryptocurrency CFD trading in New Zealand continues to garner wider interest. The data from Google trends shows the average interest in cryptocurrencies in New Zealand over time.

A level of 100 shows peak interest.

For some, cryptocurrency trading is all about volatility. Others dream of cryptocurrency trading only to get a fast return on investment.

There are many ways to gain exposure to cryptocurrency trading in New Zealand. You can either buy the cryptos and own them, or you can speculate via cryptocurrency CFD trading.

The main benefit of trading cryptocurrency CFD is that traders can speculate in the cryptocurrency markets, without having to buy/sell the underlying digital currency. This creates a limited risk comparing to owning the actual asset.

Cryptocurrency CFD trading gives you an opportunity to take advantage of the underlying in the cryptocurrency markets.

But remember that with higher volatility, there is a high risk of losing money as well.

It is due to this increased volatility that central banks and other authorities remain skeptical.

As early as 2014, RBNZ’s deputy governor Bascand said that cryptocurrencies such as Bitcoin are speculative investment commodities.

Echoing similar views, central banks around the world are not convinced that cryptocurrencies may replace fiat money someday.

On the same note, governments are exploring ways to launch their own digital money. The RBNZ for its part is still mulling on the prospects of issuing its own official digital currency.

While the cryptocurrency landscape is still not clear, for the moment trading in cryptocurrency CFD’s remains more viable than owning the actual digital currencies.

What is cryptocurrency CFDs?

Cryptocurrency CFDs are contract for differences. These derivative instruments allow you to speculate on the price movement in the underlying market.

Consequently, with CFD trading in the cryptocurrency market you do not actually buy and sell the underlying digital currency.

The cryptocurrency CFDs that you will trade include cryptos such as Litecoin, Bitcoin and Ethereum to name a few. In many cases, these are priced against the USD. For example, LTCUSD, BTCUSD or ETHUSD.

CFD Crypto trading is similar to how forex trading works. The difference is in the way the underlying assets differ in their behavior. Forex spot markets have different characteristics and are less volatile than crypto assets.

Depending on the broker who offers CFDs, you may also have the choice to trade between cryptocurrencies themselves.

For example, you could trade ETH/BTC. This cryptocurrency pair shows the price difference between Ethereum and Bitcoin.

When ETH outperforms BTC, you can go long, and go short vice-versa.

Cryptocurrency traders should also note the trading specifications when speculating. For example, if you leave your positions open overnight, it will attract overnight swap fees.

There are margin requirements and swap fees involved, depending on the type of cryptocurrency that you wish to trade.

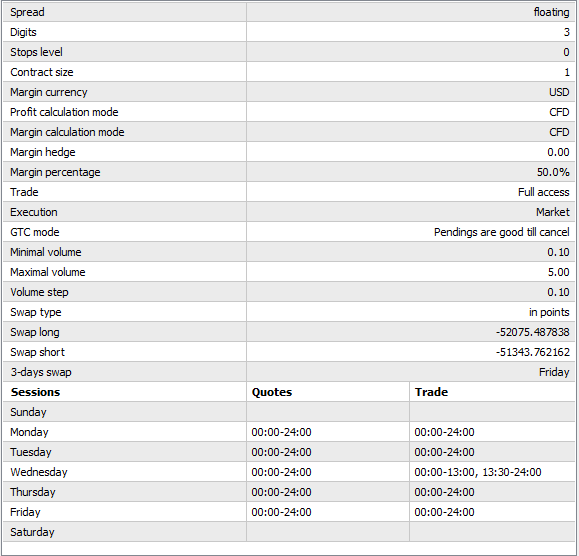

Cryptocurrency CFD trading specifications

As a cryptocurrency CFD trader, it is also important to understand the instrument specifications.

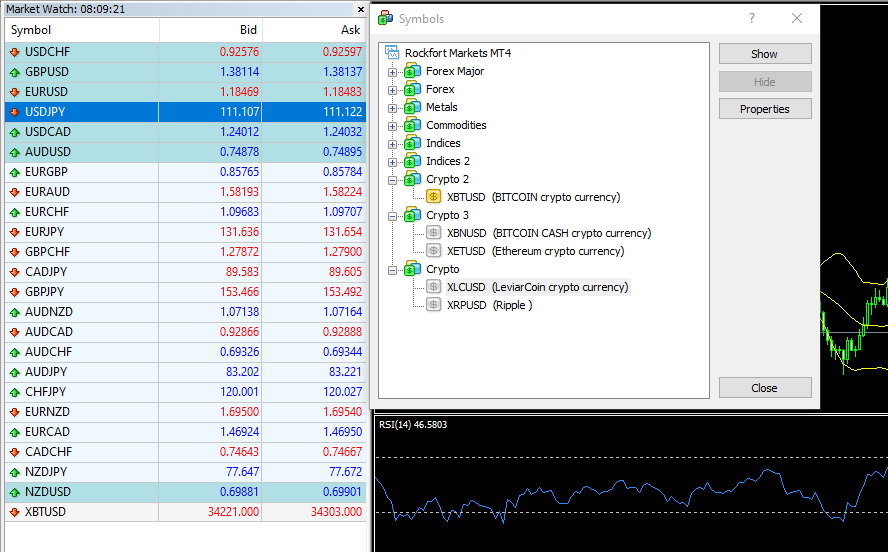

At Rockfort markets, you can trade the following crypto CFDs:

- XBTUSD: Bitcoin CFD

- XBNUSD: Bitcoin Cash CFD

- XETUSD: Ethereum CFD

- XLCUSD: Leviar coin CFD

- XRPUSD: Ripple CFD

Let’s take a look at how to understand the crypto CFD trading specifications.

Below is a summary of the cryptocurrency CFD specifications on MT4 trading platform

- Spread: Floating or fixed

- Digits: If it shows 3, it means that the pricing convention for the crypto is three digits (decimals)

- Contract size: This is the default contract size you can use to open a Bitcoin CFD trading position

- Margin currency: The currency in which the margin is calculated (by default USD)

- Margin percentage: A margin percentage of 50% means that a 50% leverage is applied. Hence, if you buy one full contract at a price of $30,000, the margin would be $15,000

- Swap long/short: This is the swap long and short points added to your crypto cfd position if it is left overnight

- 3-day swap: On Friday’s a three-day swap is applied. This is three times the swap long/short points

Three most popular cryptocurrency CFDs in New Zealand

The most popular cryptocurrencies are Bitcoin (BTC), Ethereum (ETH) and USD Teether (USDT).

| Name | Market Cap (USD) | Price (in USD) |

| Bitcoin (BTC) | $644,158,454,256.88 | $34,363 |

| Ethereum (ETH) | $257,551,552,653.03 | $2210 |

| Teether (USDT) | $62,387,831,932.32 | $1 |

| Binance Coin (BNB) | $45,373,781,730.88 | $295 |

| Cardano (ADA) | $43,111,852,193.40 | $1.35 |

Top Five Cryptocurrencies (Source: Coin.dance)

Each of these different cryptos are tokens on their own respective blockchains.

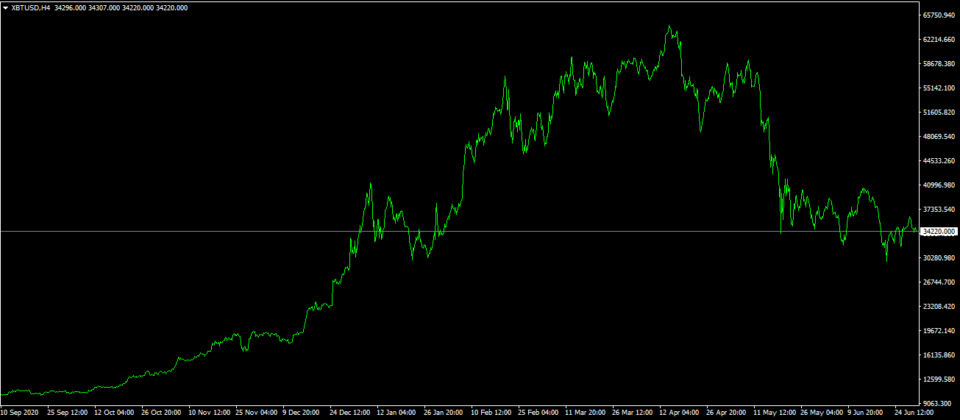

BTC: BTC is the token on the Bitcoin blockchain. It is by far the most popular cryptocurrency because it was also the first. But BTC is also volatile. In the crypto trading world, Bitcoin is the big brother of all.

ETH: ETH or Ether is the token on the Ethereum blockchain. It was developed by Vitalik Buterin to address some issues that Bitcoin could not. ETH blockchain is also the powering force behind smart contracts and decentralized apps or dApps.

USDT: USD Teether belongs to a subcategory of stablecoins. A stablecoin is one whose value is directly pegged to a fiat currency. Going by the name, the USDT is pegged to the US dollar. A stablecoin should have enough reserves to back it.

But due to lack of transparency, the argument of whether there are enough reserves is debatable.

There is no major difference between trading BTC/USD or BTC/USDT. The only difference is that USDT is also a token.

Bitcoin and Ethereum are the most popular CDFs that you can trade due to its large liquidity

However, bear in mind that because Bitcoin Ethereum are so popular, they are also very volatile compared to other digital instruments.

Quite recently, a New Zealand based financial service provider launched a digital token for the New Zealand dollar. It works similar to the USDT and is a stable coin.

As you can see from the above, there are more and more cryptocurrencies and stablecoins being added.

How to trade cryptocurrency CFDs?

Trading cryptocurrencies is not quite different from trading forex.

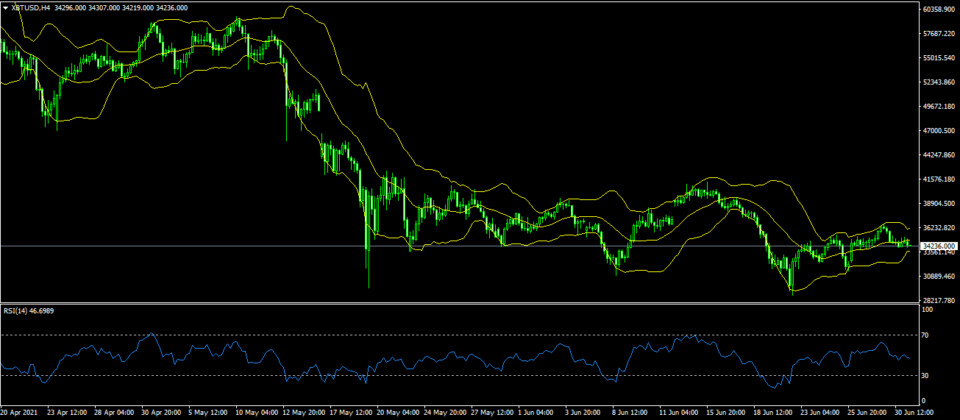

In terms of technical analysis, you can make use of the same technical indicators that you would use when trading in the currency markets.

This means you can employ your regular trading strategies such as trend following or breakout methods in the cryptocurrency market.

You will of course need to pay attention to the contract sizes as this may not be the same as with forex CFD's. The same goes for the margin requirements when trading cryptocurrencies.

You will be able to access the cryptocurrency market directly from the trading platforms. Hence, you can switch from one market to another. This makes it easier for you to use the same trading platform templates and trading strategies.

Which trading platform allows for cryptocurrency trading?

Cryptocurrency trading via contracts for difference can be executed via your forex broker. You will find the cryptocurrency CFDs grouped under the Crypto group.

To access this, right-click on the Market Watch window in your MT4 trading platform. Then select symbols or Ctrl+U to open the full list.

In the following window, you will find the Crypto group (the name may change from one broker to another). You can expand this group to find the full list of cryptocurrency contracts for different contracts available on your trading platform.

After adding the contracts for different CFDs on your trading platform, you can right-click on it and select specification.

This will allow you to see further details such as margin, contract size, stop levels, long and short swap points, etc.

Difference between trading cryptocurrency CFDs via a forex broker and an exchange

You can gain exposure to the cryptocurrency markets in different ways.

Most commonly, you may have heard about cryptocurrency exchanges like Binance, Coinbase, and so on. These are exchanges that operate like a stock exchange such as NASDAQ or NYSE.

The main difference with exchanges such as Binance and Coinbase is that you can engage in buying and selling actual tokens. To do this, you will have to open an account, create a wallet, and deposit funds.

Within these cryptocurrency exchanges, you can buy the digital tokens by selling USD, and you can also convert one digital token for another.

With specialized cryptocurrency exchanges also available, you may wonder why you should use a forex broker to trade cryptocurrencies. The answer to this depends on what you wish to do.

If you want to own the underlying tokens, then using a cryptocurrency exchange is ideal. But, if you only want to speculate on the price movements, you can trade cryptocurrencies via a CFD trading platform.

The main drawback in using an exchange instead of trading cryptocurrencies is that you won't have access to a good charting platform.

Hence, if you wish to do your technical analysis study when trading CFDs such as BTC USD, an exchange isn't the right place. You will either have to use an independent charting platform or use your forex broker for trading CFDs.

The trading fees are also lower with CFD crypto trading than compared to using a specialized cryptocurrency trading exchange.

Benefits of cryptocurrency trading CFDs over Forex in New Zealand

In conclusion, there are clearly some pros and cons of crypto CFDs trading over owning the actual asset.

But first, let’s talk about the legal aspects.

While it is still not clear on New Zealand’s stance on cryptocurrencies, this report from Deloitte reveals that cryptocurrencies in New Zealand are taxable.

This gives a huge advantage to cryptocurrency CFD trading. Although the gains are still taxable, it is easier to report your earnings.

It is similar to how one would report their earnings if they were trading forex in New Zealand.

| Buying Cryptocurrencies | Trading Cryptocurrencies (CFD) |

| You will need to create an account at a crypto exchange | Trading CFDs in crypto is easier to manage and understand |

| Higher transaction fees | Lower transaction fees |

| Used for long term investment purposes | Used for short term/day trading/speculative purposes |

| Not enough tools for technical analysis | Good tools for technical analysis as you will be using a forex trading platform like MT4 |

| You have to manage your wallet (public and private keys) | You only need to login to your trading platform |

| Higher risk of volatility | Take advantage of volatility to day trade cryptocurrencies |

| More complex tax reporting | Easy tax reporting structure when day trading in cryptocurrency CFDs |

| Requires additional KYC | Once your account is verified, no further verifications are needed |

| You cannot use a stop loss. If there is a crash in cryptos, you will have to sell your cryptos | Using stop loss you can manage your risks better with cryptocurrency CFD trading |

In final thoughts, the choice of trading cryptocurrencies or crypto CFDs is up to the trader.

Depending on your investing goals, you can choose to either directly own cryptocurrencies or use CFD trading for speculation.