It is common to find articles that talk about the best all-time traders in history. For the most part, you will find articles that usually talk about success in trading, regardless of the market in question.

However, there is an equally large number of trading failures as well. Such incidents tend to get lost in the great aspect of the crisis it creates. But it is well worth noting such incidents in a bid to learn something from them. For the general audience, the trading failures may seem a bit too complicated to understand.

And in general, the news media tends to sensationalize these trading failures and it morphs into something bigger such as issues at the banks that were involved and so on.

No matter what market or financial instrument in question has been the reason, trading is trading and it is all about risk management. So here we present the top five trading losses in history. We break down the reasons behind the trading failure and also try to cut the clutter from it.

Last but not least, we also try to narrow down the key mistakes that were made resulting in the trading loss.

Quantum Fund - $1.2 billion in losses due to Yen shorts

Tsingshan Holding Group - $8 billion in losses in Nickel futures

SemGroup - $2.4 billion losses in Oil Futures

CITIC Pacific - HKD14.7 billion losses due to FX Trading

National Australia Bank – A$360 million losses due to FX and options bets

Quantum Fund - $1.2 billion in losses due to Yen shorts

Quantum Fund is synonymous with big names such as George Soros and his protege Stanley Druckenmiller. Both these traders are well known for their big successful bets. Soros' broke the Bank of England and Druckenmiller is one of the most famous hedge fund managers of all time.

Still, the financial markets do not discriminate between the best and the worst traders. Acting as a great equalizer, losses can hit just about anyone; from the average retail trader to even the big names in trading. Druckenmiller was also not immune to trading losses.

In 1999, Druckenmiller took one of the biggest hits in his trading when his bet on the Japanese yen turned out to be wrong. One might wonder how one of the best traders in the world would have let this happen. But that is what risk management is all about. Although it helps you to manage your risks, it does not guarantee anything.

The Japanese yen volatility

At the time of the incident, Druckenmiller was managing a $7.3 billion fund at Quantum. Due to the Yen trader, the fund lost $1.2 billion, according to this well-documented article from the Wall Street Journal.

Interestingly, this wasn't the first time that Druckenmiller was proved to be wrong. It was just in the fall when many other big hedge funds were also betting on the Yen's decline. Other big names that got caught up in this trap included Tiger Management, which lost $2 billion.

The losses emerged largely due to unexpected news from the Bank of Japan. The BoJ, which was holding the USDJPY support at 113¥ announced that it would allow the currency to appreciate. Prior to the Yen’s decline in 1999, the currency was tipped to hit highs of 140¥, which it did.

But following the news from the BoJ, the currency fell sharply, breaking the 113¥ level and dropping to lows of 102¥.

If you want to learn more about the Historic Yen volatility of 1998/1999, then this academic paper makes for a good summary. The period also coincided with the Asian financial crisis, which hit Japan particularly hard.

Lessons learned?

Interestingly, there is very little on Druckenmiller post this fiasco. However, the Quantum Fund did not shy away from trading the yen. In years following, the fund continued to win and lose betting on the Yen. The earliest recovery was in the first quarter of 2013 when Soros managed to make $1 billion betting on the Yen’s depreciation (or a USDJPY rally).

Just because there were a series of bad bets didn’t mean that Druckenmiller or Quantum Fund gave up on the yen. Rather, they accepted the losses and managed to re-group. Losses are part of trading and it is important not to let emotions get in the way.

Tsingshan Holding Group - $8 billion in losses in Nickel futures

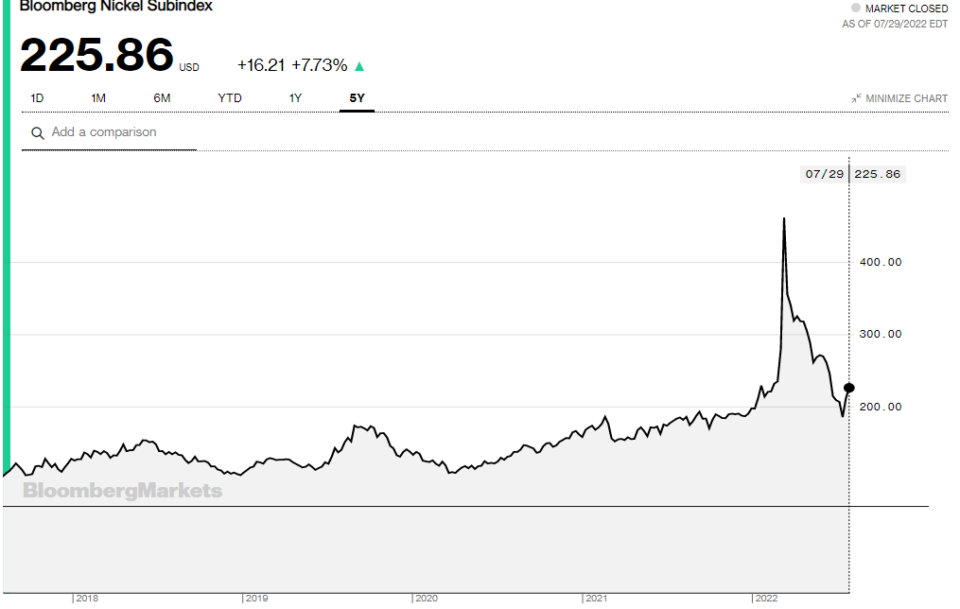

The 2022 Nickel market has been in the news in the early part of the year. This was around February/March when news of Russia’s invasion of Ukraine broke. Markets were in mayhem.

Tsingshan Holding Group is the world’s largest nickel and stainless steel producer.

The nickel futures trade at the London Metal Exchange (LME). On March 8th, the LME halted trading on Nickel futures due to a price spike. The large spike, which sent prices soaring as much as 250% in just two days caught many traders unawares.

Since the futures markets are primarily used for hedging, China’s Tsingshan Holding group had a short position. The unexpected spike pushed the company to a margin call due to their now unprofitable short position.

Dragging along with it, a major Chinese bank was also caught up in the trade due to Tsingshan’s exposure. The price rally came on uncertainty about supply concerns from Russia, due to the war and the prevailing sanctions.

The sudden supply shortage sent prices skyrocketing, leading the exchange to halt trading as well as voiding some trades around the volatile two-day period. Industry insiders were quickly reminded of LME’s previous incident surrounding Tin futures, aptly dubbed The Tin Crisis of 1985.

The short position was not a speculative bet but something normal that producers would do. Upon contract expiry, the producer would have to deliver the underlying asset at the agreed-upon price upon contract initiation.

Meanwhile, as prices continued to rise, they also had to mark-to-market their trades, meaning that they had to settle the price difference by either crediting or debiting their margin account at LME.

Lessons learned?

Although in hindsight it is easy to ask questions as to why one of the world’s leading Nickel producers did not see this coming, the answer is not as straightforward as it may seem. Firstly, the Russian invasion of Ukraine took the world by surprise.

Secondly, the consequences of the war were still unfolding at the time. Hence, for many, the uncertainty simply grew as the war continued. The impact of this was felt in the commodity markets, which together saw a large spike in prices.

For retail traders, futures such as Nickel may be out of reach. Still, it gives a great case study of how the futures markets are also at risk. It doesn’t matter whether you are long or short. Risk in the underlying asset can creep out of the blue, leading one to a margin call.

SemGroup - $2.4 billion losses in Oil Futures

Similar to the Tsingshan story, SemGroup’s losses on Oil futures are another case study on the risks when trading commodity futures. Oil markets, as you may know, are very volatile. It only takes an obscure piece of news for prices to turn volatile.

In 2008, just around the start of the Global financial crisis, SemGroup, an energy company and back at the time, the 12th largest private US oil company declared bankruptcy. The bankruptcy was a direct result of its oil futures bet.

The company incurred losses of $3.2 billion as it put on trade to hedge its oil trading business. The loss occurred on its oil futures bets it placed at the New York Mercantile Exchange (NYMEX). Oil prices, as we now know fell sharply since the early 2008 period.

Falling from a peak of $140 a barrel, oil prices settled at $44 a barrel by December 2008. This was an unprecedented 70% decline in the oil markets in a matter of just twelve months.

The company had to file for bankruptcy due to margin calls. Simply looking at the chart, one can assume what went wrong. SemGroup had a long position in the oil market. Various articles covering this incident show that the result of the trading losses was due to the trading desk.

Wrong trading conviction

Incidentally, the trading desk incurred losses earlier on, making the wrong call. During the rally in 2007, SemGroup’s trading desk was convinced that the oil rally to $100 was overvalued and took on short positions. As oil prices touched $140, this turned out to be a wrong call.

Likewise from the 2008 start, the same trading desk was now convinced that oil prices had much more room to rally. Thus, they ended up taking a long position in a bear market. Of course, at the time, it wasn’t clear which way oil prices would end up.

The Lehman crisis started only in April of 2008 and it wasn’t until the third quarter of 2008 did one really get a grasp on the seriousness of the crisis. Still, the traders at SemGroup were so convinced that they continued to absorb the losses until it was too late.

Lessons learned?

Sometimes, we as traders tend to get drawn into a trade that we are very convinced about. This can lead us to ignore the obvious and continue to nurture the trade, even if it is running at a loss. This is a classic case of emotions at play when trading.

No matter what, it is always good to draw a line when you are wrong. The best strategy is to simply cut your losses short and live to trade another day. Many retail traders, especially those just starting off tend to make this mistake. Lessons are learned only after a margin call, which by then is too late.

CITIC Pacific - HKD14.7 billion losses due to FX Trading

In October 2008, Citic Pacific had to suspend trading on the Hong Kong stock exchange. It announced a total loss of HKD 15.5 billion or about $2 billion US dollars. The trading loss was due to its Australian dollar, euro and renminbi trade going wrong in the forex futures market.

The forex futures markets as you may know trade similar to any other futures market. The difference is that, unlike forex CFDs, you can actually trade the futures markets for either cash settlement or delivery of the underlying asset, which are the currencies in this case.

The company maintained positions in the said currencies to hedge its forex risk for its Iron Ore project in Australia. After discovering this, the company blamed its finance division, firing its finance director and controller as a result. The shares of the company fell 55% as the news broke.

The currency markets around the 2008 and 2009 period were in turmoil at the height of the Lehman crisis and the following global financial crisis that followed. The U.S. dollar strengthened amid a global rush to safe havens.

This pushed commodity and riskier currencies such as the AUD to make a sharp fall due to the crisis. CITIC Pacific was betting on the opposite end. Of course, while it is easy to see this in hindsight, as the crisis unfolded, it was difficult to ascertain the true impact of the financial crisis.

Lessons learned?

Firstly, one must understand that the currency futures positions that CITIC Pacific took were a hedge on its new project in Australia. Hence, such companies usually enter into forwarding or futures contracts in order to lock in price stability.

Still, the risk of trading in the futures markets is that trades are marked to market every day. Thus, despite being a hedge, there is a daily settlement risk. When this margin is breached, it can lead to a margin call. The margin account either has to be shored up or your trade ends up being liquidated.

Given the unfolding of the financial crisis, in hindsight, a bit more prudence might have saved the company from such huge losses. Furthermore, hedging the long positions by purchasing PUT options could offer some kind of insurance against the downside move.

Risk management is not just about managing your trades, but also using different financial derivatives to hedge against market risks.

National Australia Bank – A$360 million losses due to FX and options bets

The National Australia Bank or NAB had its moment of infamy back in 2004 – 2005. The bank was embroiled in a scandal involving certain people from its trading desk.

The scandal came on the back of an unauthorized trade, in the amount of A$360 million. The main perpetrators were Luke Edward Duffy and three other traders from the bank, during the period between December 2003 and January 2004. The traders falsely claimed of achieving their yearly budgets of A$37 million to receive hefty bonuses.

However, it was a different story in reality.

Duffy entered a number of false forex trades in the amount of $118 million. The actual trades were FX options, where they were long on the US dollar. However, around 2003 - 2004, the US dollar fell sharply against the AUD and NZD. They bought and sold options meaning that as a seller, they were on the hook.

To circumvent this, the traders at NAB used their trade reporting systems to enter false fx trades. Due to the different systems in use, it was difficult to validate the accuracy of the reports.

During the time the options were live, the counter position to the USD led to daily limit breaches. However, it is said that the bank continued to write these off without proper investigations. When the losses were discovered, it was almost 110 times the daily VaR (value at risk).

Lessons learned?

The NAB incident shows how even the most seasoned professionals can get the market wrong. Once again, this incident shows how conviction played into the trades. The traders were convinced that the dollar would fall, leading them to continue entering bad trades based on this conviction alone.

As retail traders, one does not have the luxury or large capital. Hence, it is absolutely essential that one does not let their emotions dictate their trading decisions. It is advisable to not get married to the trades, meaning that one needs to take an objective look at their analysis.

To conclude, trading losses are part and parcel of trading. It can hit just about anyone and trading losses show that it doesn’t matter whether you are a seasoned trader or a beginner. The key factor that will differentiate a bad trade from a very bad trade is how you choose to deal with it.

Letting one’s emotions and having a strong conviction can be detrimental to one’s purpose. It is therefore important that traders pay attention to their trades and focus on ensuring that they are not trading on a false bias.

As a famous phrase in trading goes, the markets can remain irrational, longer than you can remain solvent.