Forex swing trading strategies, gives traders a different approach to markets.

Swing trading strategies are not suitable for all kinds of traders.

It takes a special skillset to be successful and requires a lot of practice in the forex market.

Successful swing traders have a lot of experience in the markets. So, to learn how to swing trade the forex market, you need to prepare yourself. It is often a long and lengthy road and takes a lot of effort on your part.

Swing traders use a both technical analysis and fundamental analysis. They also incorporate the concept of risk management and position scaling.

Swing traders also follow the price movements in the markets.

What is this forex swing trading guide for beginners all about?

The beginners guide to forex swing trading strategies prepares you as a successful swing trader. You will learn about:

- The basics of swing trading

- Difference between scalping and swing trading

- The concept and terminology that swing traders use

- Risks of using swing trading strategies

There are many successful swing traders. The most famous of them, often cited is a trader called Jesse Livermore.

Livermore is one of the pioneers of swing trading in the 18th century. He shot to fame in the book Reminiscences of a Stock Operator. Although Livermore focused on stocks, he is often referenced in the forex markets as well.

What is swing trading?

Swing trading is a trading style where trades are left open for a few days.

There is no hard and fast definition of swing trading. But any trade longer than a day, qualifies as a swing trade.

Swing trading sits between the short term scalper and the longer term investor. Hedge funds and money managers also use swing trading strategies.

It is a great way to trade the currency markets in the medium to long term timeframe.

This trading strategy uses the medium to longer term trends in the market. Swing trading can be either a trend following or counter trend following strategy.

Even the charts and technical analysis is somewhat different to other trading styles.

How swing trading works?

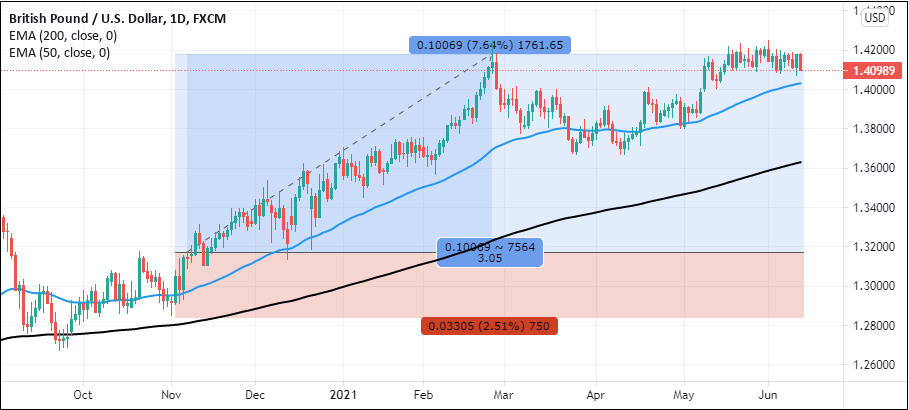

To best understand how swing trading works, look at the two charts below.

In the first trading chart, we have an illustration of a trade.

Forex Trading Chart Example #1

In the next chart, we have another example of the same. But this second chart is a bit different to the first.

Can you spot the difference?

Forex Trading Chart Example #2

If you haven't, let us break it down for you.

The first chart shows a scalping or a short term forex trade. The first chart shows a scalping or a short term forex trade. This is an example of a long position trade, following a breakout from a range.

The most important thing to notice is the trading time frame used for this trade.

If you now scan the second forex trading chart example, you will see something different. Here too, we have a long position example. And this too is a breakout strategy trade.

But look at the time frame in this second chart.

What you notice is the significant difference between the trades holding period.

This second chart is a perfect example of a swing trade strategy. The difference is all in the timeframe that a trader uses.

This might make you wonder...

Is forex swing trading all about the time frame?

The answer to this is a partial yes! Swing trading is all about the timeframe you will use. But it is not the only factor.

Think about this for a minute.

What do you need to do when you have a forex trade that is open over three days? Is it the same as scalping?

The answer is no!

When you have a forex position open overnight, there are extra factors that play a role. It is not about the trading strategy itself.

As a swing trader, you will need to pay attention to factors such as:

- Overnight swaps points that will be added to your long or short position

- You are exposed to the risk of large price movements (especially if you trade an exotic currency pair)

- There is a strong risk of price giving back all the gains it made

- Any outside influence such as a Black Swan event that may cause adverse market reaction

Having outlined the high risk of losing, you could now wonder why swing trade at all in the first place?

There are many reasons for this. But first, let's understand the difference between day trading and swing trading.

Day trading vs. Swing trading

Traders prefer swing trading only after gaining experience with day trading or scalping.

If you are a beginner to forex, then we always recommend that you sharpen your scalping skills first. You will find a lot of trading opportunities. This allows you to experience different market behavior.

Day trading and swing trading are two completely different beasts.

As the names suggest, day trading is when you open and close a trade within the normal working hours. Hence, the term day trading. The trade can last for as little as a minute to as much as a few hours of the day.

But swing trading can last from two days and longer.

If you are familiar with forex scalping, then you might have had at least one swing trade. Below is a quick comparison between these two trading styles.

| Day Trading | Swing Trading | |

| Chart Time Frame | 1m – 15M | 4H – 1D |

| Avg. Duration of Trade | 8 hours approximately | 24 hours and more |

| Avg. Stop loss | About 5 – 10 pips | At least 50 pips or more |

| Avg. Take profit | About 15 – 20 pips | At least 100 pips or more |

| Additional costs | N/A | Overnight rollover fee |

| Main influencers | Intraday volatility | Longer term trends |

Which forex strategy is best for swing trading?

We now know what swing trading is all about. And this can lead you to ask the next question about which forex strategy to use.

Well, the answer to this depends on many factors.

You will find many articles on the web on this topic. They range from a simple swing trading strategy to one which promises to make you money. But there is a fundamental mistake within this mindset.

Forex traders make the mistake of putting too much focus on a forex strategy.

A forex strategy is like a car! Even the best and most expensive car in the world can be useless, if you don't know how to drive.

As forex has a high risk of losing, traders think that choosing a best forex trading strategy helps. they can avoid this. This is not true.

The best swing trading strategy is the ability to manage different aspects of the trade. It helps to reduce the high risk of losing money.

It does not work that way.

You can pick any strategy and apply it to swing trade. As long as you know what you are doing, you can be successful with this method.

What strategies are best suited for swing trade?

So far, we established the fact that the best swing trading strategy is one that you are the most familiar with. But there is a caveat to this.

Not all trading methods yield the same results. Here are some quick pointers a swing trader should remember:

- You can use both indicators and price action methods

- The trend is the preferred way to swing trade the market. It is less risky and you trade in the direction of the main trend

- Traders prefer counter trend strategies as well. It allows you to capture part of the counter trend price movements

- You can use price action methods like support and resistance

- Swing trading is a long term trading style. This style of trading requires you to have a higher risk tolerance

- Your swing trading strategy must allow for wider stop loss

- Position scaling and risk management are important swing trading concepts

- Swing trader must dedicate a significant period of time to nurture their trades

- Price still retains its importance in this long term trading style

- The trading opportunities are not that often with swing trading

What is the best indicator for a swing trading strategy?

You might answer, the moving average or any other popular indicator. But you can use any technical indicator to swing trade.

Forex traders prefer indicators that complement the swing trading style.

These indicators include the

- moving average indicator

- oscillators such as the RSI, Stochastics, MACD, etc.

- Fibonacci retracement tools

- support and resistance

There is no single best indicator for a swing trading strategy. Pick one that you are most comfortable with.

You can use the moving average indicator as a trend and counter trend following method. Within this, you can also use the oscillators to pick the turning points in price.

Moving averages - The most popular trading indicator

There are many combinations that you can use to trade the forex currency pairs. But we recommend you stick with not more than three currency pairs if you want to swing trade.

Swing trading success is not determined by what trading indicator you use. It is a mix of your trading skills and risk management.

The most important element in swing trading is patience

You can use any number of technical indicators that you think is the best.

But if you are not patient, you will not succeed at swing trading.

What skills do you need to a better swing trader?

Patience is the most important skill you will need to trade the long term charts. Unlike the short term trading style, you will invest a lot more of your time.

It can be disappointing to see a trade that is open over several weeks to end up at break even or at a loss.

This frustration can lead a trader to get impatient. This is when mistakes can prove to be costly.

Below are some tips to help you get acquainted as a long term trader.

- You should know how to use different time frames for your trades. Swing trading requires a trader to be good as multi time frame analysis

- Learn to understand how to read the daily charts. A trader should understand the long term trend. So do not focus only on the technical indicators

- Choose one currency pair for trading if you are a beginner to forex swing trading

- Swing trades need wider stops and good risk management. So, make sure that you have enough capital in your trading account.

- Start slow to build confidence in your abilities. This means being patient because there won't be that many trading opportunities.

- Spend enough time to practice swing trading strategies on a demo trading account. Practice swing trading with different trading indicators. Also use support and resistance methods

- Because the trend is your friend in swing trading, focus on trading CFDs like commodities. These are not complex instruments and come with the same market rules

- Overnight swap fees can eat into your profits. Consider whether you understand how this works and comfortable with the extra costs

How much do forex swing traders make?

The amount of money a swing trader makes can depend on different aspects of their swing trades.

The lot size plays a big role for traders. The market that one trades is also another big influence.

Trading cfds like commodities gives traders the opportunity to make more money.

But there is also a high level of risk of losing money rapidly due to larger volatility.

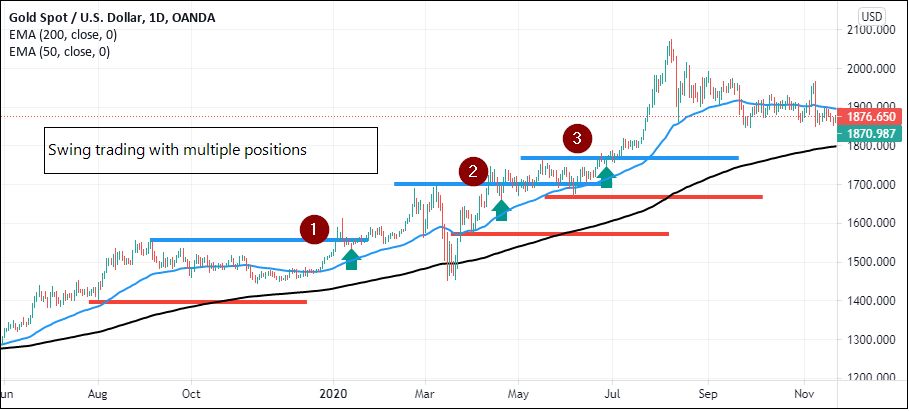

Let's take an example of trading cfds like gold. In this long term set up, we use moving averages and price action set up.

Swing trading example

Swing trading example

We take a long position in the direction of the trend. We also see that both moving averages are bullish, validating our bias.

In this long term trend set up, we have the choice to use a fixed risk to reward ratio. Or we could also attempt to open multiple trades in the trend.

Using stop losses and position management

Because of the high risk of losing money, we will first set a rather wide stop loss. This will enable us to manage the risk. The subsequent trades we open require the gold markets to remain in a steady uptrend.

If you used a fixed stop loss and a fixed take profit, then at best, we could make $x in profits. But what if we also opened another position due to the strong trend markets?

In this instance, the stop losses should be moved.

If the markets are in a strong trend and there is good price movement, we can move the stop losses to break-even. This is when your trades do not have any more risk.

If your stop loss is hit, then your trading account won't lose anything. (Perhaps only the time invested in the trades).

Taking the above example, you can now calculate the pip value for the gold market. Use the lot size per trade and you will have your answer.

Swing trading for beginners - Final thoughts

Swing trading, by no means is a short term trading strategy. It carries a high level of risk which is not suitable for all. Traders need to be able to accept the wide swings in the market.

This can cause large drawdowns in your account. So traders should ask themselves if they are ready to accept this risk.

Don't focus on trading strategies alone

This will not get you anywhere. Take time to consider whether you understand how the markets work. It is important to learn about the markets you trade, besides the strategies that you plan to use. You can use the forex cfds, commodities, and even futures markets for swing trading.

Practice makes you perfect

If you are just starting out in the forex markets, then spend time trading on a demo account. This enables you to test your strategies with no risk. A demo account also helps you to get familiar with the markets.

Gain confidence in the instruments you trade

Focus on just one market and build yourself from there on.

Swing traders should have a couple of markets that they are familiar with. Swing trading is not that dynamic, so keep an eye on the market to spot potential trading set ups.

Do not rush things

Traders should never rush swing trading. The trick is to be consistent, and practice regularly. Do not focus too much on money.

If you are confident in your strategies and the markets that you trade, traders will notice that the money will follow.