Gold CFDs are one of the most popular financial instruments for trading among forex traders.

One of the reasons behind this is because gold enjoys the status of a safe haven instrument. Furthermore, as a commodity, gold offers day traders the much needed diversification from currencies.

Although prices of gold CFDs may look similar to currency prices, the way gold CFDs behave is quite different.

Furthermore, the tick value for gold is much higher, which means that you are able to make more per tick than trading currencies. But this also raises the odds of gold being a risky instrument to trade as well.

If a day trader is not sure how to trade in the gold markets, they can easily lose their trading capital.

In this article about how to trade Gold CFDs we give you the complete details on what gold trading is all about. You will learn how gold CFDs are different from other traditional financial instruments.

Last but not the least, you will also learn how you can trade Gold CFDs with your MT4 broker.

An insight into gold trading

Gold is a precious metal that is mined.

Due to its limited supply, gold is always in demand. The typical lifecycle for gold is that it is mined, processed to remove impurities. The final product can be used in many ways ranging from jewelry to components in electronics.

In some cases, gold also finds its use in medicine as well as in some food products.

Given its wide range of use, humanity has had a very long relationship with gold in history. And this remains true to this day.

Prior to the current day fiat currencies, gold was the standard when it came to money. Since 1834, the U.S. dollar was backed by gold. This came to be known as the Gold Standard. It remained this way for a while as many other countries pegged their currencies to the US dollar.

But in 1971, the US broke away from the gold standard under the Bretton Woods agreement paving the way for the currencies as we know today.

Read more about the fascinating history of gold here to get a more detailed understanding into this precious metal.

While the debate still continues on the pros and cons of using a gold backed security, the precious metal remains the cornerstone of safety. During times of turmoil or economic crisis, gold prices typically outperform any other financial asset.

This is because one can invest in gold in different ways. From taking on a financial position in the gold derivatives market, to physically purchasing the asset in the form of jewelry or gold bars.

How does Gold CFDs work?

Gold contracts for differences or Gold CFDs are derivatives.

Gold CFDs track the performance of the gold spot market. The spot market is where you would pay the spot price to purchase an ounce of gold.

With Gold CFDs you are merely speculation on which way the price of gold will move. Thus, you can go long using Gold CFDs when you think that gold prices will rise. You can also go short on Gold CFDs when you think that gold prices will fall.

Almost all MT4 brokers offer trading on Gold CFDs. You can of course trade gold futures as well, which has different margin requirements and slightly higher trading capital.

But different brokers have different trading specifications when it comes to gold. Hence, traders should check the fine print before they start trading gold CFDs.

This includes the pricing format as well. Some brokers have gold price up to three decimals, while other brokers have pricing up to two decimals. Furthermore, the swap long and swap short overnight rollover rates also differ from one broker to other.

Leverage for Gold CFDs typically range from 1:10 and can go as high as 1:50, depending on the broker that you trade with.

Trading Gold CFD’s – What you should know!

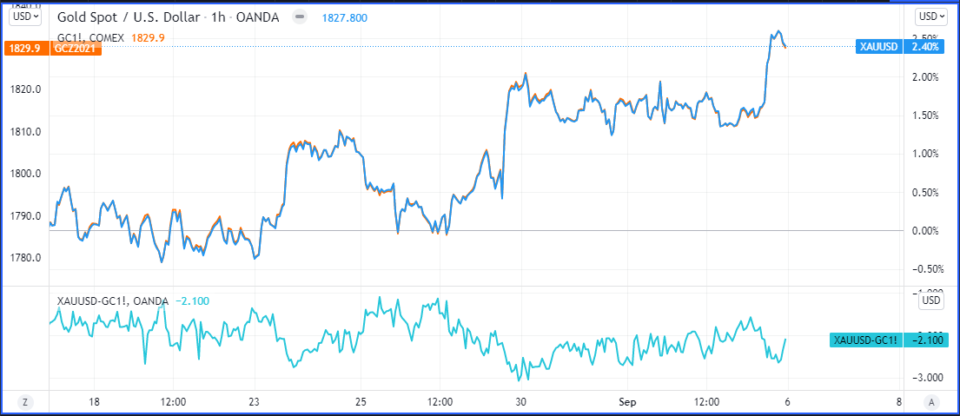

An important aspect when trading Gold CFDs is that the price you see can differ from the actual market. For example, the price of a gold futures contract can vary from the price of Gold CFD contract.

This difference comes from a number of reasons, including the mark-up on the Gold CFD contract. The spread on the price between a gold CFD contract and a futures contract can also vary. However, the reason behind this is because gold CFDs are easier to trade and allow higher leverage than trading gold futures.

Hence, for this ease of access, traders pay slightly higher costs when trading Gold CFDs rather than gold futures contracts.

Another major distinction is that when you trade gold futures, you have to rollover your contract in order to avoid taking delivery if you have a long position. Whereas with Gold CFDs, you can keep your position open for however long you want.

The above chart shows the visual representation, where you can see the price difference between Gold CFD and Gold futures contracts in the second pane of the chart.

These additional benefits of Gold CFDs is what makes the price slightly higher than gold futures contracts.

Trading Gold using Technical Analysis

Technical analysis is widely used for trading gold CFDs.

Because gold is a commodity, it tends to exhibit certain characteristics such as seasonality as well as reflects the market trends.

Trends in the commodity markets span over a prolonged period of time. This gives gold CFD traders a good chance to use technical indicators.

Moving averages are widely used with gold CFDs to determine the trends. Traders can employ a variety of trading strategies such as trend trading or counter trend trading.

But one thing to remember is that gold can be quite volatile. And hence, it can change direction rather quickly within a short span of time. Hence, using stop loss is essential when trading gold CFDs. Without proper stop orders, you are at risk of losing your money.

The timeframes to use when trading gold CFDs is a matter of personal choice. Many day traders prefer to use short term strategies using the 15-minute or the one-hour chart. For swing traders, the 4-hour or the daily chart time frame is commonly used.

What are the fundamental factors that determine gold prices?

When trading Gold CFD’s or gold based instruments, investors and speculators need to focus on the fundamentals.

One of the key things about gold is that it is very volatile. Investors can drive prices up or down at the drop of a hat.

Since Gold CFDs are just one of the many derivative instruments, traders have to keep an eye out on the other markets.

Firstly, the relationship between risk on and risk off factors plays a big role. These are two terms used to describe whether investors are bullish or bearish.

What is risk on in the financial markets?

The term risk on is used when investor appetite grows to take on more risk. During these times, investors tend to pile in more money into riskier assets such as equities and high yield bonds.

When the markets are in a risk on mode, you will often see the stock market rallying to new heights. While riskier assets post a strong rally, the safe haven assets depreciate, for the fact that they produce fewer returns in comparison.

What is risk off in the financial markets?

A risk off sentiment is used to describe when investors grow wary of taking on more risk. They prefer to invest money into safer financial instruments like bonds or precious metals like Gold.

The safe haven instruments don’t provide as big returns as their riskier counterparts.

During a risk off sentiment, safer financial instruments tend to outperform the equity or the high yield bond markets.

Fundamental analysis in gold

Now that you have an understanding what risk on and risk off means, let’s take a look at some fundamental factors when trading gold CFDs.

- Inflation: Inflation is the biggest threat for investors as it erodes the value of money over time. Hence, whether you are a short term investor or a long term investor, inflation remains one of the core aspects. Gold traders should pay attention to inflation data that comes out a monthly basis. When there are signs of inflation rising, gold often appreciates in value.

- Interest rates: Interest rates also play a big role in determining on how the economy s faring. Because Gold is priced in US dollars, the US interest rates are important when trading gold CFDs. Higher the interest rates, the more chances that investors tend to slowly invest into the gold safe haven instrument.

- Monetary policy: Monetary policy basically combines all the aspects of the economy such as GDP, inflation and unemployment. These datapoints in turn determine whether the central bank policy makers should hike or cut interest rates. This decision in turn plays an important role when trading gold CFDs.

Why is gold a safe haven asset?

Traditionally, gold enjoys the status of a safe haven asset. The term safe haven comes from the fact that financial instruments are broadly divided into two kinds.

Risk assets are those which are risky but promise higher returns. A typical example of risk asset would be the equity markets.

When it comes to the currency markets, forex pairs such as AUDUSD, NZDUSD are risk assets. On the other hand, safe haven assets are those which are less risky. But due to this, the returns they provide are much smaller.

An important fact to mention is that while safe haven assets are less risky, they can be volatile. Hence, traders should not misinterpret the term safe haven.

You can lose money trading risk assets, just the way you would by trading safe haven assets.

Gold earns its safe haven status for the fact that it is a physical commodity. While it is used in different aspects of manufacturing, people all over the world, value gold for its worth.

Hence, this aspect of gold being a physical asset makes it more tangible comparing to fiat money, which are currencies.

When investors are wary about how the markets would perform, or during times of inflation, gold prices tend to appreciate for this very reason. Another class of securities that fall into the safe haven category are bonds as well.

U.S. bonds, which are issued by the Treasury department are considered safe instruments due to the fact that they are backed by the full faith of the U.S. Government.

FAQ’s on how to trade Gold CFD’s

What is the symbol of Gold CFD?

The ticker for Gold CFD is XAUUSD. Depending on your broker, you can also see other symbols such as GOLD. The main distinction is that Gold is by default priced in US dollars. You can also see some brokers offer you gold trading on other currencies such as AUD and EUR. These are derived prices by applying the respective exchange rate on the standard XAUUSD CFD contract.

How does Gold CFD work?

When trading Gold CFD, you can take a long or a short position in the market. The Gold CFD prices are derived prices from the spot gold market. There is a small mark-up from the spot prices. Unlike other gold derivatives, you do not have any exposure or worry about the underlying delivery of the gold contract.

Gold CFD is traded on leverage and it also incurs overnight financial costs if your positions are kept open before the close of the day. Similar to forex, gold markets also operate close to 23 hours a day, five days a week.

Is Gold CFD trading profitable?

Gold trading is profitable as long as you know what you are doing. But bear in mind that volatility in gold markets is much higher. Further to this, the tick value in gold is also higher comparing to regular forex CFDs. Hence, there is a big potential to make large money or lose significant amount of your trading capital when trading Gold CFDs.

What trading strategies work best for gold trading?

Gold is primarily a commodity and as such it exhibits strong and pronounced trends in the market. Traders can use trend following strategies. But one should also pay attention to the fundamentals that drive prices in gold.

Hence, economic indicators and news releases play a large role. Countries such as China and India are predominantly gold loving countries, both as an investment and as jewelry. Hence, supply and demand plays a large role when trading gold.

Is trading gold risky?

Just as any financial instrument, gold CFDs are risky because they are leveraged instruments. The ability to lose money trading gold CFDs is just as high as you are able to make money. Traders need to have a certain risk appetite when trading Gold CFDs.