The use of leverage in the currency markets is one of the biggest factors that attracts many. There is literally no other market that can allow you to trade with small capital.

It is for this reason that many retail traders lose money. Using leverage can magnify your profits. But leverage, being a double-edged sword can make you blow up your trading account just as easily.

When trading with a small capital, leverage gains significance.

It is the ability to control large positions without putting up the entire amount upfront.

Position sizing or determining the number of contracts you want to trade depends on the leverage. This article gives you deep insights into how to correctly use position sizing and system monitoring.

Here is a quick primer on some of the core concepts.

Forex contract sizes

The contract size is the standard number of units that you are allowed to trade. In forex trading parlance, the contract size is measured in lots. You may have heard about lots or lot size. A lot is the number of units in the forex markets.

Below is the breakdown of the forex contract sizes.

| Forex Contract Size | Lots | Number of units | Pip value (One Pip) |

| Standard | 1 Lot | 100,000 | $10 |

| Mini | 0.1 Lot | 10,000 | $1 |

| Micro | 0.01 Lot | 1,000 | $0.1 |

Forex leverage

Forex leverage is represented as a ratio. Leverage of 1:10 means that for every $1 of upfront money you put up, you are allowed to trade with $10.

This $10 is the leverage or margin that your broker gives you. The forex leverage ratio may sometimes be flipped around such as 10:1 but it means the same thing.

The below table acts as a quick reference guide for leverage.

| Leverage Ratio | Your Capital (in USD) | Margin (in USD) |

| 1:10 | $1 | $10 |

| 1:50 | $1 | $50 |

| 1:100 | $1 | $100 |

What is position sizing in forex?

The concept of position sizing was made famous by trader Van K. Tharp. Tharp, in his works, wrote about how to use position sizing and its meaning. His book, The definitive guide to position sizing can be used by traders as a reference point.

The best way to look at position sizing is to understand the risk and reward.

A long position, with stop loss 5 pips away from entry and your take profit of 10 pips from entry make for a 1:2 risk to reward ratio.

Now depending on the contract size or lots, you trade the dollar value changes.

For a standard lot, one pip is equal to $10.

Hence, a risk of 5 pips can be $50, $5, $0.5 depending on whether you are trading a standard, mini or micro lot.

No matter what trading system you use, the concept of pip value, stop loss and take profit remains the same.

You may have come across the term risk to reward ratio. This is nothing but the total pips being risked and the total pips in reward. But of course, the risk to reward by itself does not tell you anything.

For a trader using micro-lots, the dollar value risked is much lower than someone using a standard lot size.

When using a trading system, traders pay attention to the risk to reward ratio. Executing trades with a 1:3 risk to reward is recommended. This is because it allows you to lose two times to go back to your original capital.

Trading is a game of odds and the risk to reward ratio helps you to measure these odds!

Position sizing techniques

There are different ways to use position sizing as below>

- Position sizing based on lots

- Trading based off fixed dollar amount

- Trading based off equity percentage

Depending on which of these three methods you choose, the results can vastly differ. There is no hard and fast rule on which of these methods you should use.

At the end, your leverage and the trading capital will determine the direction of your choice. Your trading strategy can also play a big role.

If you are prone to using wider stops and thus risking more, your may need to position size your trades based on lots. Using a percentage of your equity can lead to lower contract sizes you will use on the trades.

Let’s take a more detailed look at each of these three different position sizing techniques.

Position sizing based on lots

In this method, you will be choosing how many lots to trade and then derive the total risk you will take on.

Refer to the table in the first section of this article. We outlined how the pip value changes depending on the lot size used.

We will use the same example of a 1:2 risk to reward ratio with 5 pips stop loss and 10 pips take profit level.

With a standard lot size, a 5 pip loss amounts to $50, while a 10 pip takes profit amounts to $100. Likewise, this value can change to $5 and $10, and $0.5 and $0.1 when using a mini and micro lot.

If your trading capital was at $1000 then the amount you risk can change from 10%, 1% and 0.1% respectively.

Traders can choose what lot size they want to trade when using this method of position sizing. It offers a standard way of trade entry and exit.

Position sizing based on dollar amount

When using position sizing based on the dollar amount, things take a different turn. Position sizing using a dollar amount means that you are setting a fixed amount of risk.

This may seem similar to the first method of position sizing using lots. Indeed, position sizing based on dollar amount is the opposite. Instead of choosing the lot size, your primary factor to decide is the dollar value you want to risk.

The constant denominator here is the fixed amount of risk.

If you have a trading capital of $1000 and you want to risk 1% of your capital, it gives you 100 trade opportunities before you blow up your trading account.

Based on the fixed dollar amount, the lot size can now be determined.

Hence, to risk $10 on a trade with a 5 pip stop loss, you can now choose 0.2 lots on your trade.

Notice how position sizing concepts remain independent of your trading strategy?

Position sizing based on equity percentage

Another common way of using position sizing is by means of an equity percentage.

You may have heard about the phrase never risk more than 1% on any trade. This is nothing but risking a percentage of your equity.

In this method of position sizing, you are starting off with a percentage of your trading capital. From this, you derive the lot size that you want to trade. Note that depending on your trading capital, the lot size may change.

For example, if one trader has a capital of $1000, then a one per cent risk translates to $10. But if you have $50,000 in your trading capital, the one per cent becomes $500.

After deriving the dollar value from the equity percentage, you can then break it down into the lot size you want to trade.

To risk $10 with a 5 pip stop loss on a trade, you can, at best choose 0.05 lots to trade. Here, your trading capital will become the decisive factor. With a larger capital and higher leverage, you can scale up to 0.1 lots.

But with smaller capital, your options will become limited.

How achieve your trading goals with position sizing?

A trading goal is defined as consistently profiting a certain amount in profit over a duration. This can be daily, monthly, or yearly.

The main trick to achieving your trading goals is by position sizing. In this instance, the drawdown also plays an important role.

In retail forex trading, the key to making profits is consistency.

Traders focus on a trading system that is more profitable. But what matters is consistency. If you can make money on a steady basis, the number of winners and losers does not matter.

As George Soros famously said, it is not about whether you are right or wrong. It is about how much money you make when you are right. And it is all about how much money you lose when you are wrong.

Every trader should set up system objectives and trading goals. There are two key elements to this>

- Profits or returns on your trading capital

- Drawdown and risk you take to achieve the returns

For example, if your profit objective is 5% and the risk is 1%, then the number of trading lots you choose will depend on this. Since we are using percentages, the best position sizing technique to use here would be the equity percentage.

Extending the profit and risk over a horizon can also tell you how many trading lots you can risk. This improves the chances of you being able to trade. Which in turn raises the odds of you making a profit.

Remember that trading is a game of odds and probability! Hence, the trick is to increase your probability of being able to trade.

It is important that you keep track of your trading performance. While one can maintain a journal that requires manual entries, you can use automated journals.

Using a trading journal to log your trading activity

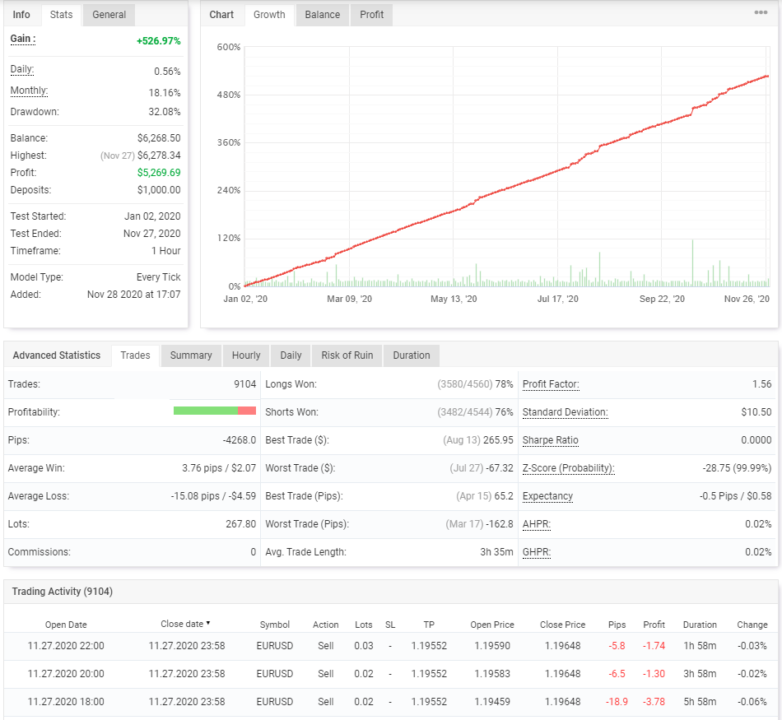

The Metatrader 4 platform automatically creates a log of your trading activity. You can also connect to a third-party website such as Myfxbook.com which allows you to connect your trading account.

It will automatically log all the trades you have made and builds up statistical data quickly. Remember to use your investor password to grant read-only access to your trading activity.

You can set up your journal to be private if you do not wish to share it with the public. Below is an example of a trade journal from Myfxbook.

The trading statistics will automatically give you information such as your trade performance, how well your strategy is working. Additionally, you can also gain access to other information such as profitability, profit factor and so on.

A trader’s cheat sheet to trading statistics

When you are advancing as a trader, you will come across quite a few trading terminologies. But do not let that hassle you. Below is a quick description of the various terms from a trading account perspective.

| Term | Meaning |

| Profitability | Profitability is the ratio of winning trades to the total trades. Represented as a percentage, it shows the probability of your trading strategy making a profit. |

| Profit factor | This is a measure of the number of times your gross profit exceeds your gross loss. A positive value and higher than 1 indicates a very good profit factor. |

| Sharpe ratio | This ratio measures the total reward from your trading strategy above the risk-free rate. It is a measure to account for whether your risk is being adequately compensated by the trade reward. A sharp ratio should not be viewed in isolation. But it can be a good comparison between two trading strategies or systems. |

| Z-score | Z-score measures the number of winning and losing streaks. A probability of 99% means that there is a high chance that a trading system can generate two profits consecutively followed by two losses. |

| Expectancy | Expectancy measures the average profit in dollar value that you can make on every trade |

The above statistics will be helpful not just for analyzing your own trading strategy. It is a great way to potentially filter out other trading strategies or trading signals as well.

It is the same way one would filter out potential trading systems or managed funds such as mutual funds or ETFs. But the difference is that here, you would be limiting the trading systems to the forex markets.

Position sizing and forex system monitoring – Final thoughts

In conclusion, this article gives you an idea of how to use position sizing when trading forex.

Traders should pay attention to using correct techniques when it comes to the currency markets. Risk management is an essential element in trading.

While many traders give this a secondary glance, it is of the highest priority. Hence, by utilizing this information, traders can pay more attention to the risks of trading.

A good trading strategy is only as good as the way it can manage risks. And forex trading is risky! Instead of chasing profits, traders are able to raise their odds when using the risk management methods mentioned here.

Monitoring your trading system is an ongoing process. This is a habit that traders should inculcate and be part of one’s daily trading routine. The better you know your trading system, the better you are able to monitor it.

This will in turn help you to have more control over how you utilize your trading capital.