When one thinks of finance, such as stocks or futures, probably the first thing that comes to mind is Wall Street. It is one of the most widely recognized names globally! Wall Street remains at the core, from die-hard fans to students aspiring to make it big in the financial world.

But ever wonder how Wall Street became so famous? What was it that made Wall Street stand out globally be recognized and be synonymous with the financial markets? If you have ever thought about these questions, then look no further.

The area that is known to be called Wall Street is very significant, as was the case in the 2008 Global financial crisis.

This article tells you all about Wall Street, from its humble beginnings to the events that made it famous, and of course the dominance of the United States in the world financial markets.

Humble beginnings of Wall Street

Every story has to start somewhere and with small beginnings. This is also true for Wall Street.

In 1792, a couple of financial brokerage firms decided to come together to form an alliance. The agreement is now known as the Buttonwood Agreement (often confused with the Bretton Woods agreement).

Prior to the agreement, the U.S Treasury issued $80 million in war bonds to the US Government. This bond issue was for the purpose of helping the government to pay for its Revolutionary War. The bonds were issued at a face value of $100 each.

This later led to the establishment of the First Bank of the United States, started by Alexander Hamilton, the then Secretary of the Treasury. Soon enough, stocks were issued and other banks and insurance agencies started to follow suit as well.

Did you know!

The First Bank of the United States was the first central bank set up in the United States, which operated between 1791 and 1811.

However, back in the day, there was no stock exchange. So trading of the stocks and certificates happened at informal locations such as coffee houses, auction houses, and within certain offices in New York.

The problem with this disintegrated trading setup was that prices were not uniform.

So, in 1972, some of the leading merchants who enabled trading met at Corre’s Hotel to address this issue. On May 17th, 1792, the merchants formally signed an agreement called the Buttonwoods agreement. It got its name as the agreement was signed under a buttonwood tree.

However, much before all of this, Wall Street was the center of the slave trade. Traders made fortunes trading slaves on Wall Street for nearly a century since 1711.

What is the Buttonwood Agreement?

According to the Buttonwood Agreement, merchants agreed that trading of securities would take place among themselves. The main driving force behind the Buttonwoods agreement was in response to the financial panic earlier in the year.

After the First Bank of the United States took on an easy loan policy, speculators tried to corner the debt securities market. In doing so, they ended up defaulting on the loans, leading to a bank run and panic selling.

Merchants who convened the Buttonwood agreement agreed not to participate in outside auctions and to adhere to commonly laid out rules. Within a year, interest grew and soon, the merchants decided to set up a formal place.

This was at a coffee house called Tontine Coffee House, (the historical place was demolished in 1905) on the corner of Wall and Water Streets.

The end result of the Buttonwoods agreement was that it led to the creation of the New York Stock Exchange or NYSE. The address was 40, Wall Street.

Did you know!

Although NYSE is attributed to the Buttonwoods agreement, the world’s first stock exchange was created in 1611 in the Netherlands, known as the Amsterdam stock exchange.

How did the name, Wall Street come about?

You could take a wild guess and you could be right about it. The name Wall Street comes from the fact that there was indeed a wall on the location. It was built by the Dutch in the 17th century as a protection against their settlement.

The settlement was called the “New Amsterdam Settlement” and the wall was built to protect them against the native Americans and the British. The wall was said to be a wooden palisade, 2.7 meters high and about 7 kilometers long.

Did you know!

Early Dutch settlers called the New Amsterdam Settlement as Waal Straat, giving way to Wall Street as we call it today.

In the current day, Wall Street is located in Lower Manhattan, stretching from Broadway to the East River. In total, Wall Street covers just eight blocks.

In 1920, Wall Street saw its first crisis, known to be called the Wall Street bombing. It was orchestrated by a group of anarchists and the incident killed thirty people. In its day, the Wall Street bombing was the deadliest act of terrorism.

However, the little strip of land managed to survive and become one of the leading financial centers of the world today. Still, Wall Street had its competitors, namely from Philadelphia and Chicago.

Connectivity between New York and other trading hubs began to rise, which eventually put New York’s Wall Street on the map.

How innovation led to the growth of Wall Street

After setting up the NYSE, it was the growth of inventions and innovations that continuously contributed to the growth of Wall Street. In 1837, Samuel Morse opened a telegraph demonstration, charging $0.25 as fees to see his invention.

Traders quickly realized its importance which led to quick growth in building an electronic communications network. Just thirty years later, Edward A. Calahan from the American Telegraph Company created the first stock ticker.

The machine had wheels of narrow paper strips with details of the transaction. This led to the name ticker tape as we know of today. The paper strips were delivered to typists who would then send the information via telegraph.

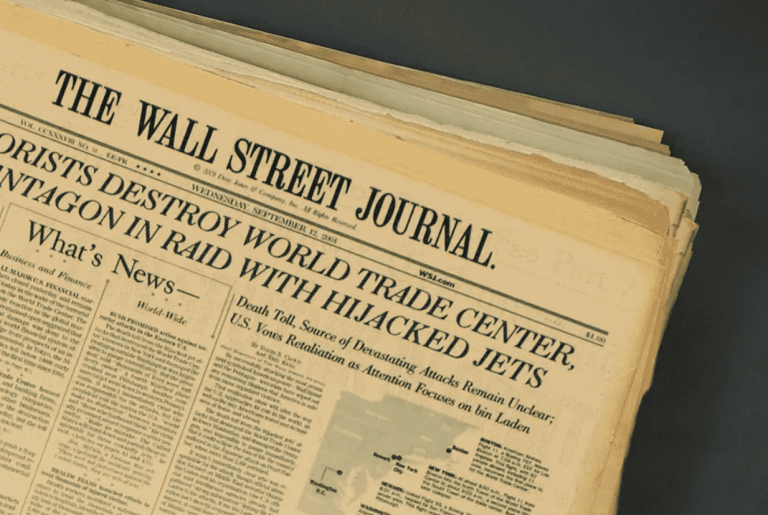

In 1882, Thomas Edison set up the electricity plan at Pearl Street, lighting up over 7000 street lamps on Wall Street. Innovation continued to grow, with the start of the Wall Street Journal, which was set up in 1889.

The journal debuted at a $0.02 cover price and was published by the Dow Jones & Company. The most popular making of this journal was the Dow Jones Industrial Average, which measured the stock performance.

The company was started by Charles H. Dow who started off as a financial journalist. He moved to New York in 1880 as a reporter for a news service. In 1882, Dow joined hands with Edward D. Jones to form the Dow Jones and Company.

In 1964, NYSE installed IBM computers leading to the growth of automated quotes a year later. Soon enough, by 1978, the Intermarket Trading System was established, starting a technology race and marking the start of automated trading.

How Wall Street beat its competitors

Although Wall Street is synonymous with the creation of the NYSE, the New York Stock Exchange is not the first stock exchange in the United States. In fact, it was the Philadelphia Stock Exchange that takes first prize.

Did you know!

The Philadelphia Stock exchange, the oldest and the first stock exchange in the United States is now owned by Nasdaq Inc.

The Philadelphia Stock Exchange was set up two years before the New York Stock Exchange and is the first stock exchange in the United States and the third oldest stock exchange globally. The stock exchange originated in 1746 by none other than Alexander Hamilton who provided start-up funding.

One of the main reasons that Philadelphia became the first financial hub in the US was due to a deal between Alexander Hamilton and Thomas Jefferson. They agreed to move the capital from Washington DC to Philadelphia for ten years.

By the 1800s New York’s population burgeoned and started to grow in size. But in the 1830s, the American boom came to a halt on rising interest rates and falling stock markets. It led to the state of Pennsylvania holding a debt of $20 million, which was big in its time.

As the state defaulted, New York became the obvious choice. The Exchange, Bank of New York, and the Bank of the United States were the first formal occupants of Wall Street. By 1825, the Erie Canal was opened, leading to a proliferation of many other banks and financial institutions.

As we mentioned earlier, innovation was the core of Wall Street and this led to rapid developments. In 1971 NASDAQ was formed. It initially started to offer only quotes and later moved to an OTC trading format.

It wasn’t until 1980 that NASDAQ rose to prominence, thanks to Apple’s listing.

What are the businesses located on Wall Street?

Just about every big name that you hear on the news or read about have offices situated on Wall Street. Some of these include:

- Goldman Sachs

- Morgan Stanley

- Deloitte

- Blackrock

- JPMorgan Chase

- Credit Suisse

- Deutsche Bank

- Citigroup

Besides the above, taking up space at the most famous address in the financial world include stock exchanges, investment and commercial banks, brokerage houses, underwriters, and many more. Having an address on Wall Street is considered in many ways to be prestigious.

It is not just businesses but also employees. If you look at various forums for studies many aspire to work in New York at one of the institutions listed there. And it’s not only students but many retail forex traders as well.

Many aspire to make it big as a trader to either land a job on Wall Street or at least aspire to be one. This is only fuelled further by the fact that Hollywood is fascinated by the financial hub. Some of the big movies such as Wall Street, starring Michael Douglas, and many other movies have only fuelled our imagination.

It is very likely that Wall Street will continue to maintain its dominance in the global financial markets. This is despite the fact that Wall Street is the second-largest financial hub in the world, after London. It has survived numerous stock market crashes, and geopolitical events but continues to stand tall.

Facts such as these are a mere testament to the history and the culture that started this financial hub and quickly became the number one financial destination in the United States.

Top 10 facts about Wall Street

#1. While the Buttonwoods agreement and the creation of NYSE happed in 1792, it was only in 1913 that the Federal Reserve Bank, as we know it today came into existence

#2. As of 2021, the NYSE remains the largest stock exchange operator in the world, by market cap, boasting $27.21 trillion.

#3. The Amsterdam Stock Exchange is the world’s first stock exchange, set up in 1611

#4. The Financial District of Wall Street is home to the Federal Reserve Bank of New York. It has an underground vault holding the largest gold repository in the world

#5. NASDAQ also has its address in the same financial center where NYSE and the FRBNY are located

#6. Around the 19th Century, both commercial and residential establishments were located on Wall Street

#7. The First President of the United States, George Washington had his presidential inauguration held on Wall Street

#8. Wall Street survived two major incidents, the Great fire of 1835 and the 1920’s Wall Street bombing

#9. The first stocks to trade on Wall Street were the Bank of North America and the First Bank of the United States and the Bank of New York

#10. The Dutch East India Company was the first to issue stock, making it de facto, the world’s first IPO.

Sources and additional reading

If you are interested to learn more about the History of Wall Street, we have compiled a list of resources for you.

The below-curated list of articles will give you more insights and fascinating discoveries about Wall Street.