Inflation is the buzzword of the year 2022 and central banks around the world attempt to tame inflation by raising interest rates. Never seen before in nearly a decade, inflation has risen sharply across the world.

From the United States to China to New Zealand, consumer prices as inflation is referred to have seen a broad-based increase. This comes after decades of slow inflation growth, which sparked many central banks to loosen monetary policy.

In recent times, the rapid increase in inflation has also hit the average consumer. The reader may have experienced an overall increase in prices when at a store. Be it purchasing vegetables or just filling up gas in the car. Prices are higher and it is likely that they will continue to rise higher.

In such an environment, the question of one’s investment comes to mind. Is your investment really making money, or is it depreciating, a victim of higher inflation? This article walks you through the concept of inflation and why it is important to find investments that can beat inflation.

We also give the reader a brief overview of some investment ideas, based on the asset classes that can beat inflation. This is not investment advice and should not be construed as one either. On the contrary, this article gives you some insights and broadens your perspective into potential investment avenues that can beat inflation.

How exactly does one protect against inflation?

To answer this question, the first thing to understand is what inflation is all about. Inflation measures how expensive or cheap, a basket of goods costs compared to a previous period. Typically, economic statistics compiled measure inflation on a monthly, quarterly or yearly basis.

During inflation, the number of units of a currency it takes to purchase goods rises. What this means is that if it cost you $50 a month ago for a regular weekly set of groceries, then based on inflationary pressures, it may cost you $55 a month from now, for the same set of goods.

Another concept to understand is investing itself. Investments in stocks, property, gold and other artifacts are done, with the aim to earn a return. Therefore, consider an example of a $100 investment in a hypothetical property. A year later when you sell this investment, it gives you $150. In essence, you generated a return of 50% on your investment.

Inflation and investment go hand in hand. Therefore, investment of any kind needs to beat inflation in order to generate a positive return. In other words, if you don't put your money to work, it will end up depreciating in value.

Inflation is unavoidable for a host of reasons. From central bank policies to geo-politics and government mismanagement. So, if your cash remains as is, in the bank, it erodes rather than provide any value.

This is why it is important to invest where the returns are able to beat inflation and provide a positive return.

Understanding the impact of inflation on a currency

To put it in very simple terms, let's take the current example of the U.S. inflation rate which is 8.5% (annual). What this means is that $100 dollars are only worth $99.915. Therefore, in order to beat inflation, your investment should at least earn you 8.5% annually. But still, this will only beat inflation and not provide any positive returns, when adjusted for inflation.

Hence, it is essential that you invest spare cash in an effort to at least match inflation, if not beat it. This is where the topic broadens up to many possibilities for investment. It is common knowledge that to beat inflation you need higher returns. Going hand in hand with this concept is that the higher the returns you seek, the higher the volatility of the investment.

Even opting for a safe fixed rate of return will still fail to beat inflation as it continues to rise. Hence, it becomes important that investors pay attention to their investments. At any point in time, a fixed rate of return needs to be viewed with a grain of salt. If inflation continues to rise, and rises above the fixed rate of return you get, then your investment falls behind inflation.

In essence, despite taking some risks and generating some returns, it will still not be enough to beat inflation at the very least. This is where the type of investment you make is of utmost importance.

What are inflation-beating investments?

The answer to this depends on how financially savvy the investor is. We will look at some inflation-beating investments which vary in complexity.

Treasury Inflation-Protected Securities (TIPS)

TIPS are U.S.-specific security whose principal is tied to (or indexed) to the inflation rate. Thus, the TIPS' principal rises when inflation goes up. Likewise, during deflation (i.e: when inflation falls), the TIPS also tend to fall.

These are issued by the U.S. Treasury Department and in essence, they belong to the asset class of fixed-income bonds.

Similar to a bond, TIPS pay a fixed coupon rate. But since the principal is indexed to the CPI index, the coupon payments vary. Outside of the U.S. bonds that carry such a feature (tied to the inflation rate) are known as inflation-indexed bonds. These fixed-term debt securities track the inflation index. Thus, the coupon payments you get tend to reflect the rise or fall in inflation.

One of the factors to consider is that when trading TIPS or inflation-indexed bonds, during a deflationary cycle, they can fall. Secondly, since the face value or principal is adjusted, the difference is also taxed. For details on taxation, please refer to your local country's laws.

Short-term debt securities

Investing in short-term debt securities can be a prudent way to beat inflation. This is because borrowing costs in the short term can rise rapidly. Hence, investing in assets such as CDs (Certificates of Deposits), or in the money markets is a good bet.

However, when it comes to the retail crowd, there can be some additional costs that can vary from one jurisdiction to another. There are also tax implications for this which need to be considered. The final return you make, when adjusted for the transaction costs and tax should beat inflation. And this typically depends on the returns for the asset in question and the duration of the maturity of the security in question.

Investing in stocks

Investing in stocks can be a mixed bag. Depending on the economic cycle, stocks can either beat inflation or they can perform worse (especially during a recession). Therefore, the timing in the stock market is an important factor to consider.

The most ideal situation is when inflation is fairly stable while the economy continues to rise, as reflected by rising stock markets. In such circumstances, you are able to beat inflation if the markets closed out the investment period in the positive.

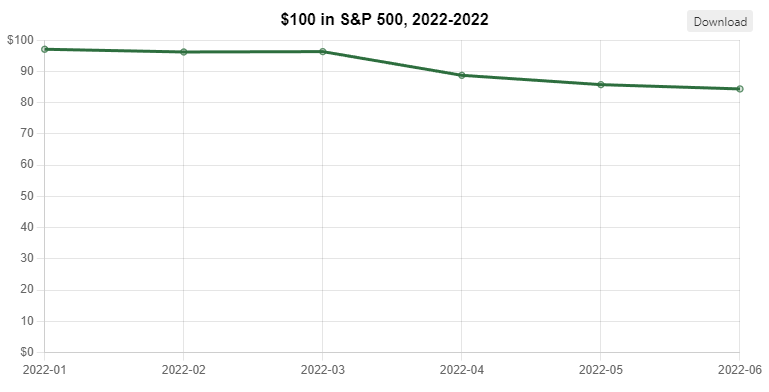

However, if inflation rises rapidly but stocks start to fall (as we are witnessing now in 2022), then investing in the stock markets (viewed as the S&P500 index) would see returns failing to even break even.

One way to overcome this is to actively invest. This can include various strategies such as diversification, such as picking high-growth stocks, seasonal stocks and so on, which are guaranteed to perform well during a rising inflationary cycle.

In this second chart, you will notice how in 2022, an investment of $100 in the S&P500 index gives you a lower return of just $84.40. This comes on the back an 8% increase in the annual inflation rate and a decline in the U.S. stock markets.

Hence, although investing in stocks is a good bet, the economic cycle should be taken into account.

Can you beat inflation by trading forex?

This can be a tricky one to answer. Firstly, forex trading is risky and there is a lot of volatility involved. In some ways, you should expect to see higher returns. But the risks are also greater with the possibility of losing your investment.

Secondly, it is not recommended to trade forex with your savings, due to the high risk of losing your trading capital. Having covered the above warnings, one can technically beat inflation by trading forex (assuming that you are able to turn a profit).

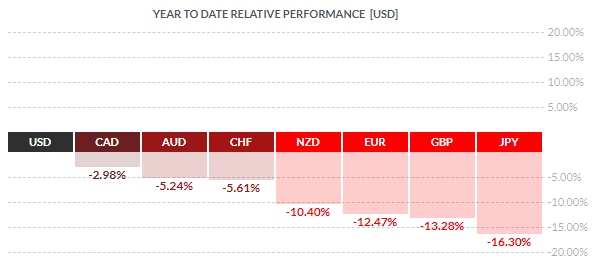

A quick look at the forex year-to-date performance reveals some interesting results. For example, if we look at the NZD, it has depreciated 10.40% on a Ytd basis against the USD. Thus, if you were short in the NZDUSD, you would have earned a 10.4% return.

New Zealand's inflation rate was recorded at 7.3% until the June 2022 quarter. Thus, even after adjusting for the inflation increase, your investment in NZDUSD short would have given you an inflation-beating 3% return.

But this view is in hindsight and investors should keep that in mind. At the start of the year, it would have been difficult to form a view of the markets as inflation started to creep up. Alongside a stronger USD, it has pushed the kiwi dollar lower.

Thus, when adjusting for inflation, an investment in the NZDUSD market of $100 NZD would have given you $110 NZD approximately, or about $103 NZD after adjusting for inflation.

Beating inflation with tangible assets

Having hard investments or tangible assets such as property is a proven way to beat inflation. This is because real estate tends to account for inflation as well. As the monetary value of a currency depreciates, real estate values tend to move in the opposite direction.

This applies to real estate that you have either purchased for yourself or for investment purposes (such as renting out). This is a blanket statement and should be considered carefully. Factors such as maintenance and upkeep of the property, land tax and other aspects should be taken into account as well.

Still, compared to other forms of investments such as the stock markets, forex, and so on, real estate investment can be a great way to not just own a tangible asset, but also one that tends to appreciate over time.

There are different ways to get into the property market as well. Starting from the very simple act of purchasing property or land, you can also invest in REIT or real estate investment securities as well. This will help you to gain decent returns that can beat inflation.

But it is not as easy as investing in some REIT that catches your fancy. Even within the REIT class, different funds tend to perform differently. For example, Claros Mortgage Trust Inc (NYSE:CMTG) has been volatile compared to the US CPI YoY. It currently boasts of a 13.54% return as of July, compared to a 13.33% inflation rate.

On the other hand, if you look at other REITS, they have been performing rather badly. Hence, one needs to do their due diligence before looking into REITS.

Last but not least - Commodities

We leave commodities as an asset class for the last, given that it is widely covered. When one thinks of commodities from an inflation context, the first thing that perhaps comes to mind is gold.

But besides gold, one can invest in many other forms as well, from commodity-backed ETFs to mutual funds and even the futures markets. For the most part, the latter involves a more active participation and is also somewhat risky compared to the other commodity investment options offered.

Still, it is widely known that commodities are sensitive to inflationary prices and are in fact one of the first to react. This is what we have seen during the early part of 2022 when commodities across the board rallied strongly; from the energy (oil) markets to food (grains, wheat, etc), commodities, on the whole, have risen sharply.

Thus investing in commodities, no matter in which form can be a great bet against inflation.

Before we conclude, we should mention that while it is easy to look at the markets in hindsight, it is a difficult task to view this as the markets unfold. Still, when it comes to investments in general, it is prudent that the investor also accounts for inflation in order to generate true returns that can keep your investment value above the inflation eroding prospects.