Forex trading vs. crypto trading is one of the hotly debated topics these days. And traders have differing opinions on this.

It is unlikely that you will find a settlement to this debate about crypto and forex. The answer one gives to this question, depends on their experience of trading with each of these two asset types.

Are you someone who is asking the same question? Want to know if forex is better than crypto or vice versa?

So why rely on general opinion when you can read this article form your own? Cryptocurrency trading vs. forex trading is similar in some ways but different in many.

Surprisingly, people tend to have an opinion even without trading either or both these asset types.

In this article we explore whether forex vs. crypto is better. We do not give our opinion but lay out the facts for you to decide.

Why is cryptocurrency trading gaining popularity?

Any financial asset that gives you the opportunity to make money is popular. By this measure, cryptocurrencies fall into the same category. And so does forex!

But the question of whether cryptocurrencies play any role in the financial markets is debatable.

It is not surprising then, that traders can choose any market in the world. If you want to trade commodities like coffee, sugar, gold, or silver, you have the futures markets.

Likewise, if you want to trade national currencies or fiat currencies for example, you can choose the foreign exchange markets.

And if you want to trade stocks of a company, you go to the stock exchange. You can also find an exotic market in the world of derivatives trading.

Hence, it is extremely easy to find any market of interest that can give you the chance to make money. The type of trading you would employ however changes. Obviously, you cannot compare stocks to forex, or futures to stocks.

Every market has its own distinguishable characteristics that makes it different.

Cryptocurrencies are popular because firstly it is a new concept. Secondly, it was initially touted as being anonymous. Cryptocurrencies are also not under the control of central banks; the way national currencies are around the world.

The biggest reason why cryptocurrencies are popular is in their large return on investment.

Everyone likes to get rich quickly and cryptocurrencies make this possible. But the risks are also equally higher.

Therefore, for the most part, we can say that greed is one of the biggest reasons that cryptocurrencies are so popular today. People trade these digital assets without knowing the basics or the risks.

How to trade crypto currencies online?

Depending on what cryptocurrency is available from your broker, you can take your pick.

After you choose the asset, crypto traders can place buy and sell orders just as they would in the foreign exchange market. You can choose to trade any of the crypto instruments if they are available for trading.

But bear in mind that some crypto assets do not have the same liquidity as others.

You can then place your orders trading cryptos just as you would when you trade forex. Profit or loss is calculated based on whether you were right or wrong.

You can also use the same methods of analysis as you would when you trade forex. Hence, as far as trading cryptos go, it is no different from forex, or stocks or commodities… at least to an extent.

How does the forex market work?

You may already know how the forex market works, but here is a brief primer on how forex trading works.

Trading in the foreign exchange markets involves speculating on the currency movements. Traders buy and sell currencies depending on which direction they think the currency pairs move.

When forex traders are right, they can profit the difference and when they are wrong, they lose the difference.

Buying and selling currencies however is not a guessing game.

Forex traders need to look at the factors behind the price movement, known as fundamental analysis. They also employ other methods like technical analysis to predict future movement of the currencies.

Characteristics of the forex markets

There are specific characteristics in the forex markets that make it different to the rest. This is also one of the reasons that it draws so many forex traders.

For one, you can trade on leverage, meaning that you do not require huge upfront capital. Since you are trading on forex CFD's there is no question of underlying delivery of the asset.

The overall fees when trading forex is relatively lower comparing to other markets.

Since forex trading is done on currency pairs, you are buying and selling one currency for another.

Hence, there is a wide choice of forex instruments you can trade. From the more liquid EURUSD to the exotic GBPZAR, there is a lot of choice.

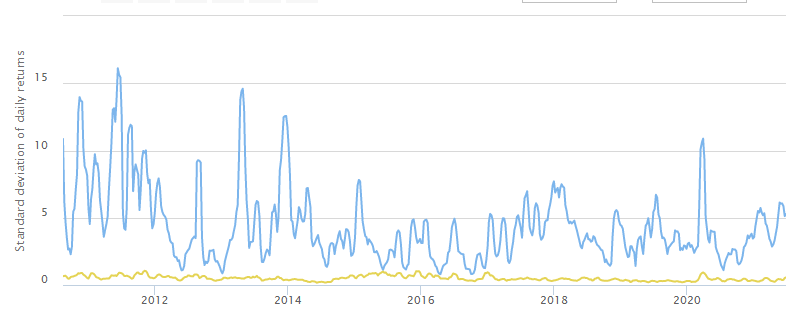

Volatility in the forex markets is higher than stocks for example. But this volatility is manageable and with enough practice, traders can make money trading forex.

Another feature in forex trading is that the price movements are closely related to the economies of the currencies you are trading.

Therefore, trading in the forex market requires you to have some knowledge about economies. This helps you to better grasp the fundamental side of the currency market trading.

How does the crypto market work?

Compared to forex, the crypto market is a bit different although both crypto and forex seem to have some similarities.

The crypto market is relatively a new entry in the financial world, comparing to the currency markets.

Although cryptocurrencies were around for close to a decade, it was only recently that it started gaining mainstream attention.

The crypto currencies as we know are called tokens.

Computers make use of their processing powers to process complex algorithms. In return for this, the computers are rewarded with a token. The token can be stored in a wallet.

A token can be BTC (Bitcoin), ETH (Ethereum) and so on.

If you want to transfer a cryptocurrency to your friend, it requires some computing power. Hence, there is a transaction fee to pay. Depending on how much you pay, your transaction speed is much faster.

While the role of tokens remains the same today, they have taken a different meaning in the financial world. You can exchange these tokens for fiat money.

As more and more people get involved in trading crypto currencies, it has given rise to its volatile nature too.

Cryptocurrencies gain attention of the mainstream world because we have not seen such a volatile asset before.

The crypto market volatility can literally make millionaires overnight. At the same time, the crypto markets volatility can easily make you bankrupt too.

Let's take a closer look at how the crypto markets work and how you can trade them.

Speculating with cryptocurrencies

When Bitcoin was first created in 2009, it was mostly relegated to the tech community.

Nobody back then thought that crypto currencies would be as they are today. In fact, since Bitcoin's creation, we now have over 200 different types of tokens.

This is truly mind boggling, even for someone with a forex market background.

Since its inception, the value proposition for cryptocurrencies was that it was decentralized and did not require any central monitoring authority.

Combine this with the fact that transactions in cryptos are anonymous, led to an instant appeal among the wider population.

Overtime, as popularity grew, brokers who offer CFDs started adopting cryptocurrencies too. Who doesn’t like volatility, right?

We now have just about every broker offering cryptocurrency assets for day trading as well. BTC, ETH, LTC, XRP, you name it!

When you trade cryptos, you are essentially trading the cryptocurrency CFD (contract for difference). This is similar to how you trade in the forex market.

You do not own the underlying cryptocurrency. With crypto day trading you only speculate on the direction of the price.

What moves the price of cryptocurrencies?

The price movement or the volatility in cryptocurrencies comes because of large transactions. There is no central exchange (same as forex, which trades over-the-counter).

Therefore, all it takes is a large buyer or seller with a big enough volume. This is enough to move the crypto markets. Look at this Forbes article on the biggest cryptocurrency tycoons. And besides this, we also have large hedge funds in the game now.

But this is just skimming the surface. There are even more big cryptocurrency holders than we have on record. Every time a large transaction takes place in the market, you can see volatility rising in cryptos.

These days, crypto traders also follow tweets and other news events.

Known as social sentiment, these factors also play a big role in shaping the volatility in these digital currencies.

Final Thoughts - Is forex better than crypto trading?

So far, we covered the basics of cryptocurrencies vs. forex and also looked at the trading market between these two assets.

Now comes the time to ask yourself whether forex is better than crypto or vice versa.

Coming from a day trading perspective, traders now have a wide choice in the current market.

Depending on the broker you choose you can easily buy and sell cryptos just like you would do with forex. The bottom line is the same.

The profits (and losses) you make from trading crypto currencies is yours to keep. It is no different from how the general market works (stocks, futures, forex, etc).

Electronic trading has now made it easier for a day trader to choose between the forex market or the cryptocurrency market.

At the end of the day, whether you are into forex trading or crypto trading, you should ask yourself why you want to trade that particular asset.

Cryptocurrency trading - Mind the volatility!

Do you want to trade cryptos just because your friends are doing the same? If peer pressure is your reason, then crypto trading is not the right choice.

Just as with forex trading, you should understand what is happening in the world of cryptocurrencies.

Unlike trading currencies, where you know that the market is moving because of a news event, cryptocurrency trading can be baffling at times.

Take an example of this.

A mere tweet by Elon Musk, founder of Tesla, among other companies can move the prices of cryptocurrencies very strongly

On May 13th, 2021, Musk tweeted that his company Tesla will not use Bitcoin in its car sales.

This tweet alone shaved off close to $360 billion in Bitcoin's value.

If you were trading in isolation, and let's say purely off technical analysis, you would not see this coming.

The cryptocurrency volatility alone defies the regular logics of technical analysis. And there is no fundamental analysis that you can on cryptocurrencies. At least not yet.

There is volatility in the forex markets too!

In all fairness, we should point out that the currency markets are also volatile.

The only difference is that with currency trading the volatility does not come that often. Furthermore, you can always find a legitimate reason.

The currency markets do not move just because someone tweeted that they do not like a particular currency

The mess of the Swiss franc de-peg against the Euro is a fading memory worth reviving.

On a single day, the CHF soared 13% on the surprise announcement by the Swiss national bank.

But volatile moments like these (Black swan events) are not quite so common in forex.

At the end, it is up to you, the trader to decide which markets you think is better.

But comparing forex to the cryptocurrency market is comparing Apples and Oranges. Both these asset types are quite different and used for different purposes.

The most important thing that traders should bear in mind is whether they can digest the volatility in the respective markets. Not many traders have the same risk tolerance, and this is where you will find your answer.