As a trader, you might have come across other peers talking about the Fed, or the FOMC. It usually comes along with market volatility and puts traders in a frenzy. Whether you are trading forex, equities, or commodities, the Fed matters across all asset classes.

This article walks you through what the Fed or the Federal Reserve Bank is all about and the famous FOMC meeting. You will learn what the FOMC meeting is, how the Fed sets interest rates and how it impacts traders and investors alike.

What is the Fed?

The Fed is short for Federal Reserve.

History of Fed

The Federal reserve bank is the central bank of the United States. The dollar remains the world's reserve currency. Hence, the Fed, which controls the dollar is the most powerful central bank in the world. Any actions taken up by the Fed impacts all aspects of the global economy and prices of all asset classes.

The Federal Reserve Bank was established on December 23, 1913, when the Federal Reserve Act of 1913 came to be law. It was signed by US President Woodrow Wilson. You can read more about the history of the Fed here. But the history of the Fed dates a few years before 1913. It was in 1910 that the famous meeting at Jekyll Island took place. There are many conspiracy theories that abound. But the fact is that it was a meeting called by six of the wealthiest and most powerful men in the US at the time.

The Federal Reserve is an independent body. While lawmakers can only voice their opinions, the Federal Reserve makes decisions on its own.

Interestingly, the Fed, as with most other central banks in the world is the only authority that can legally issue money, the US dollar.

Composition of the Federal Reserve

The Federal Reserve bank is made up of the Chairperson and the vice-chairperson. The chairperson and the vice-chair are appointed by the President of the United States after approval from the Senate. The current president of the Federal Reserve is Jerome Powell.

Each chairperson serves a term of four years and can be staggered over a 14-year period. Some of the chairpersons who steered the US through periods of the financial crisis include names like Alan Greenspan, Ben Bernanke, Janet Yellen, and more recent Jerome Powell.

The Federal Reserve bank oversees twelve districts. This means that there are twelve regional Federal reserve banks. The governors of each of these Federal Reserve banks also serve on the monetary policy committee, on a rotating basis. The chairman of the Federal Reserve Bank of New York is automatically appointed as the vice-chair of the Federal Reserve

The twelve districts include:

- New York

- Boston

- Philadelphia

- Cleveland

- Richmond

- Atlanta

- Chicago

- St. Louis

- Minneapolis

- Kansas City

- Dallas

- San Francisco

Similar to the term of the Chairman of the Federal Reserve, each of the regional Fed governors also serves a four-year term.

The board of governors oversees the Federal Reserve System. The Federal Reserve mandates that the Fed conducts its monetary policy so as to foster maximum employment and price stability. It is also responsible for moderating long-term interest rates.

In the financial world, the Fed is known to follow a dual mandate of full employment and inflation stability.

There are many economic indicators that point to how the labor market and inflation are shaping. Hence, traders follow these economic releases closely.

This is because eventually, it shapes the Fed’s decisions on interest rates.

What is FOMC?

The Federal Open Market Committee or the FOMC is the Fed’s monetary policy committee. The FOMC was set up as the U.S economy became more complex. The FOMC is responsible for setting the interest rates and other monetary policy actions to achieve its dual mandate.

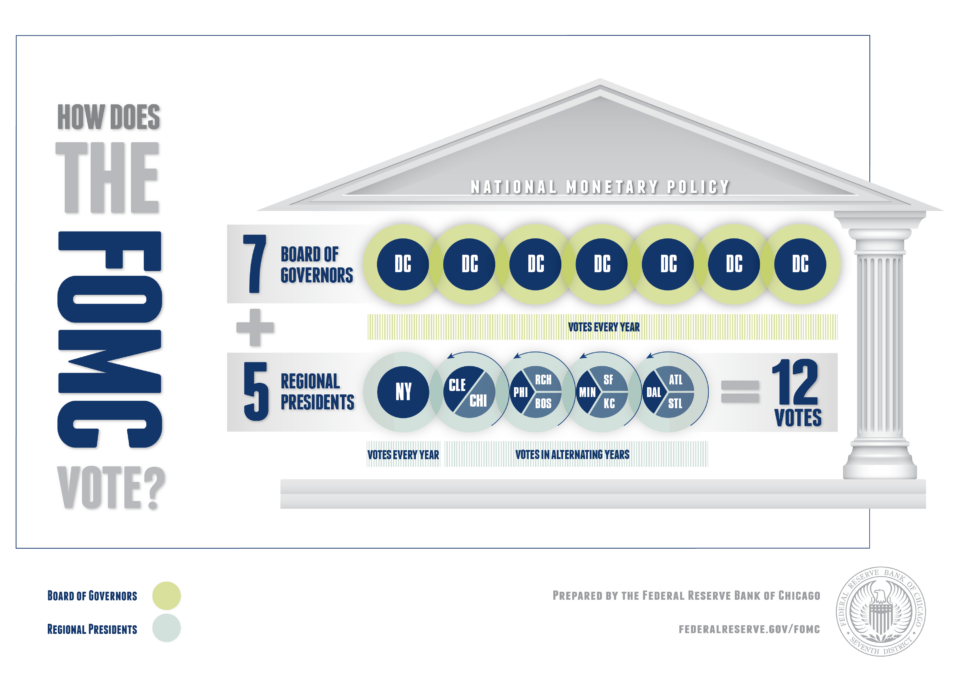

The FOMC has seven members from the Board of Governors as well as the vice-chair of the Federal Reserve. The remaining four seats on the FOMC committee are made up of any of the regional Fed governors who serve a one-year term.

All the twelve members on the FOMC have a vote when it comes to setting the monetary policy. The FOMC meeting holds eight times a year. The members hold a two-day meeting and upon conclusion, present their findings to the public.

This is when the investors and traders alike closely watch what the FOMC has to say. The Fed chair would televise FOMC and give the concluding remarks.

You can view the FOMC meeting schedule here or follow any economic calendars that are freely available online. Of the eight times, four times a year, the Fed also presents a comprehensive economic outlook.

Dot plot

This coincides with the four quarterly months of the year, namely, March, June, September, and December.

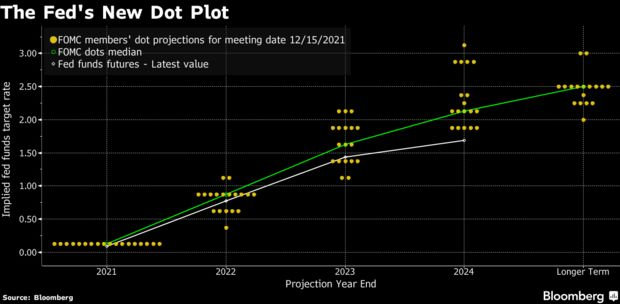

During these meetings, the Fed also publishes forecasts of the economy as well as on future interest rates. This is known as the dot plot, or the interest rate forecast.

The chart you see above is an example of one such dot plot.

The yellow dots are essentially individual forecasts of the FOMC voting members. It gives a broad idea of where the FOMC members expect interest rates to be during the next four years.

Monetary policy tools used by the FOMC. The FOMC uses a mix of various monetary policy tools. Some are straightforward as they directly or indirectly impact interest rates. Other monetary policy tools include expanding or reducing liquidity in the market.

The mix of these monetary policy tools helps the Fed to achieve its dual mandate:

For example, when inflation is high, the Fed can raise interest rates. On the other hand, when unemployment is rising, it can lower rates, so businesses have access to cheaper finance.

This will, in turn, foster economic development and in turn help in hiring.

How the Fed sets interest rates

As far as interest rates are concerned, the Fed uses what is called the Fed funds rate. The Fed funds rate is the rate at which banks can lend and borrow money from each other. The Fed funds rate is, therefore, an interest rate used for financing a bank’s reserve money.

The Fed funds rate is an overnight rate.

Depending on how cheap or expensive the borrowing is, it reflects on the commercial and retail bank’s ability to issue loans. The Fed funds rate sits within a band and is not an absolute value. Thus, if the Fed funds rate is said to be at 0.25%, it means that the overnight fed funds rate can move anywhere from 0% to 0.25%.

To lower the Fed funds rate, the central bank purchases government securities from commercial or retail banks. Thus, with the injection of liquidity, it lowers rates while flushing the market with more money. This in turn enables banks to lower the funding costs for the loans that it issues.

On the other hand, when the central bank wants to tighten monetary policy, it sells the government securities in order to reduce the money supply. This in turn lowers liquidity and leads to higher rates. Besides the Fed funds rate, since the 2008 global financial crisis, the Fed has also engaged in quantitative easing.

What is quantitative easing?

Quantitative easing or QE became the buzzword in over a decade.

This is a monetary policy tool that allows the central bank to purchase government securities directly from the US Treasury. It leads to lower financing costs for the US government.

QE is aimed at directly injecting more money into the market instead of the Fed funds route. As the US government has access to cheaper credit, it is passed on to the public as well.

The downside of QE is that surplus cash can lead to inflation. You can read more about quantitative easing here.

In 2008, the Fed’s QE operations rose to over two trillion USD. The Fed continued its QE operations, naming it QE1, QE2, QE3. By the turn of 2012, the Fed’s balance sheet rose to nearly three trillion.

Quantitative easing is a hot topic with valid arguments on both the pros and cons.

How does the FOMC impact forex?

Learning about the FOMC so far and how it impacts interest rates, let’s now take a look at how the Fed can impact the forex market.

As you already know, the USD is the currency that is impacted by the Fed’s policies. When there is lower liquidity, it leads to a higher US dollar price. Conversely, when there is higher liquidity, there is an excess of US dollars available. This in turn leads to lower prices in the US dollar.

The US dollar can be measured via the US dollar index which you can read more about here. Thus, when the USD rises, you can expect almost all of the other currencies to fall, and vice versa.

A very good example of this can be seen in the chart below.

You will notice the large spike in the US dollar index. This was around the time when the pandemic hit the United States as well. This led to a sudden demand for the US dollar leading to higher rates.

The Fed reacted by cutting interest rates and also announcing a fresh round of bond purchases. These actions led to a calming of the nerves as the market was once again flushed with more dollars. Eventually, over the one-year horizon, you can see how the dollar continued to fall.

This decline in the dollar index can be seen with many of the other currencies appreciating against the dollar.

The above chart shows the EURUSD chart. You can see how the euro rose against the dollar following the Fed’s actions.

How to assess the Fed’s policies?

For forex traders, the most important aspect is to assess what the Fed will do in one of the upcoming meetings. You already know about the Fed’s dual mandate.

Therefore, it is imperative that traders keep an eye on the fundamentals. More importantly, tracking economic indicators such as the following can help:

- GDP reports

- Monthly payrolls (Nonfarm)

- CPI and PCE data

Each of these reports impacts the FOMC’s decision-making. And in turn, each of these reports, which are lagging in nature can also be forecasted.

There are a number of indicators such as durable goods orders, automobile sales, and so on. These reports are timely and give an initial glimpse into the economy. These reports tend to make up the final GDP reports.

One can also look to the weekly unemployment claims and follow developments or large employers such as Walmart, McDonald’s, Apple, and so on. News about potential layoffs, worker or union protests can impact the unemployment report.

Regarding inflation, traders can keep track of oil prices, which feeds into the overall headline inflation data. Higher oil prices lead to higher transportation costs, which can impact goods across all sectors.

The core CPI essentially strips off the effects of oil and other volatile components. The Fed in particular looks to the PCE or the personal consumption expenditure as means to assess inflation.

In most cases, the Fed also communicates its intentions. This is done via public engagements such as speeches and forums. Fed members tend to speak out during such events to communicate to the public on its monetary policies. Hence, traders should also pay attention to the Fed speeches in the run-up to an FOMC meeting.

The Fed and the FOMC – Conclusion

To conclude, as a forex trader, no matter how strong one is in their technical analysis, fundamental analysis plays a big role. Tracking the Fed is important for traders so that any monetary policy actions do not catch you off guard.

While you may find coincidences between the Fed’s actions and technical analysis, it is always better to be informed. Traders should also be aware of the various commentary given by financial news networks, broker blogs, and so on.

Do not get too influenced by reading these news articles as it usually is an opinion piece.

When you are on the right side of the market, the FOMC meeting can be a great moment to trade the forex and equity markets. But beware that volatility can rise significantly. Hence, paying attention to your risk tolerance is also important besides merely focusing on gains.