Algorithmic or automated trading is a type of trading that makes use of computer programs to execute buy and sell orders. The trading is based on logic and the algorithmic trading system is only as good as the algorithm or the trading logic that it follows.

Algorithmic trading has become one of the go-to methods when it comes to the retail forex trading industry. This is because many traders believe that algorithmic trading or automated trading has many advantages over the traditional style of trading which is manual.

One of the most common reasons why a trader would choose an automated trading system is the fact that they find it easier to use a trading system to make money rather than having to analyse the markets and trade themselves.

This allows many traders with absolutely no trading experience to simply purchase an automated trading strategy into the world of retail forex trading. However, there are pros and cons with automated trading strategies as well. It is not a silver bullet that can make you rich.

Many traders tend to realise this only after they have traded using an automated trading system for a while. the reality, an automated forex trading strategy is not as simple as activating it on your trading terminal and expecting it to start trading. There is more to automated trading than what meets the eye.

In this article, we will take a look at what automated or algorithmic trading is all about. We will also show you some of the common pitfalls to avoid. By the end of this article, the reader should be able to understand what algorithmic trading is all about and also know some of the critical details that are essential to the success of trading with an automatic strategy.

What is algorithmic trading and what does it do?

The term algorithmic trading comes from the root word algorithm. Algorithms are commonly used when it comes to building computer applications or programmes. In technical terms, an algorithm is defined as a set of instructions or rules that a computer programme follows based on some inputs.

In the context of trading, algorithmic trading is nothing but a computer programme that operates based on the input that it is given and the logic of trading is built into it. In other words, algorithmic trading is a mix of both technology and trading.

As you may know, automation is one of the buzzwords these days. What can be done manually and can be automated is automated. Therefore for example, if you have a trading strategy that executes buy and sell orders based on simple market conditions, you can automate this strategy. This automation is nothing but algorithmic trading in action.

The term algorithmic trading can be traced back to the early days of electronic trading. Since more than more orders started being executed electronically, computers were able to read these orders and trade based on logic.

Therefore, no human intervention was required anymore. Once the automated trading or the algorithmic trading system is switched on, it would monitor the markets and when the market conditions were feasible the trading strategy would kick in and execute the trades.

Depending on the market in question, algorithmic trading is widely used in the most liquid markets. Therefore, it is not uncommon to see large financial institutions and investment banks making use of automated or algorithmic trading systems.

These trading systems are able to trade across all markets ranging from futures to forex, commodities and stocks.

Algorithmic trading on MT4

Algorithmic trading can be applied to any trading platform that is capable of accepting automated orders. This includes a wide range of trading terminals starting with the most commonly used MetaTrader platforms as well as other bespoke trading platforms such as Ctrader, and NinjaTrader.

although the method of execution is the same across all these platforms, the way these automated trading strategies are written can differ. This is because of the underlying architecture of the trading platform for which the automated trading system is being used.

Most of these trading platforms use some modified flavour of C or C#. Therefore, if you want to build your own automated trading system, it is essential that you have a piece of good coding knowledge in using the above languages.

For those who are technically challenged, there are quite a few resources that allow you to create an automated strategy using a graphical user interface that is easy to understand. Although such automated trading systems are not very robust, it is a great way to understand the underlying code behind these trading systems.

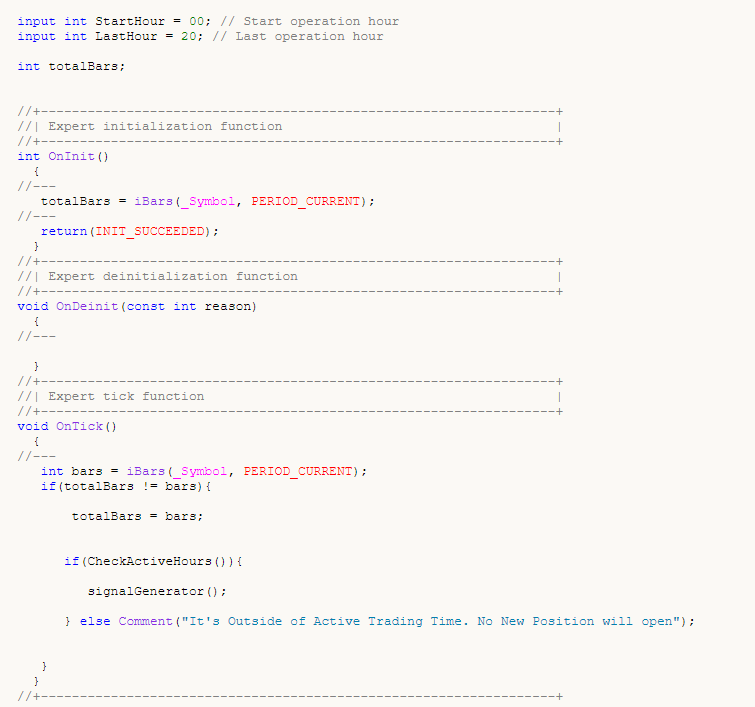

The algorithmic trading programmes are commonly referred to as expert advisers. These are nothing but compiled or executable scripts which can then be activated on the trading platform. In many cases, a bit of configuration is required to customise the EA. One should also note that the expert advisor may be written for a particular market. Still, despite knowing this, many traders tend to use an EA built for one market to trade in a completely different market.

The automated trading market in general is also flooded with tons of automated trading systems. Therefore, when it comes to choosing the trader has many different strategies to choose from.

How does algorithmic trading work?

The way algorithmic trading works is very simple. The trader would initially purchase or use their own expert advisor file. This file is then used in the MT4 folders, which can then be accessed from the expert advisor folder from the terminal.

The trading strategy as we mentioned earlier is merely a set of instructions that are coded in. Take for example a strategy as simple as using only a moving average. Let's say that this strategy works very well where the trader takes a long position every time the price closes above the moving average and books a couple of pips of profit.

Likewise, a short position is taken whenever the price falls below this moving average. Since there is nothing complex about this, one only needs to monitor the market prices and the moving average line in order to decide whether to go long or short.

Therefore, this set of rules can be coded for the trading platform. Once this trading strategy is executed, the automated trading system will automatically look for market conditions that satisfy the trading criteria. When the trading criteria are met, a long or a short position is taken accordingly.

In using the automated trading strategy, the trader is no longer required to monitor the markets. In fact, they can keep their computer running 24 hours a day and allow this trading system to automatically trade on their behalf.

The limitations in using the expert advisor or the algorithmic trading strategy do not end there. The trader can now open multiple charts and apply this trading system. This way, the trader aims to maximize using the different markets and trade round the clock when the markets are open.

Advantages of automated trading

The benefits of using an automated trading system or algorithmic trading strategy are clearly obvious. Firstly, automated trading can help to remove emotions when trading. The trading is executed objectively and as a result, winning or losing trades do not really influence the trading system's performance. The trading strategy executes trades only when the conditions are met.

Automated trading also has a distinct advantage of not having to sit and trade. Since there are traders from around the world, with the different time zones, it may not be possible for everyone to trade when the markets are most active.

This is especially true for many traders in Asia where it is already well past the evening when the European and the US market are at their busiest. Therefore, automated trading can be of great help here. One no longer needs to sit in front of their computer but merely keep their trading terminal on and allowed the trading system to do its work.

There is no limit to the level of sophistication that can be used in deploying an automated trading system. Therefore, traders can find really unique and innovative ways of trading the market. It is more advantageous to build an automated trading strategy rather than purchasing a black box system.

While the budget for development may be an inhibiting factor, traders who are able to afford their own development of such trading systems can truly take advantage of an automated strategy.

On the flip side, automated trading comes with certain disadvantages as well.

Disadvantages of automated trading

Depending on the trading strategy in question, an automated trading system is bound to trade more than one would rate if using a manual method.

Clearly, this brings the disadvantage of increasing the trading costs. There are some trading strategies that tend to focus on the tick data and are configured to make profits from just a few pips of movement. If factors such as leverage and contract size are not taken into consideration correctly, but traders might end up losing money rather than making any money.

An automated trading system is only as good as its logic. As a consequence of this, there can be periods when the automated trading system can generate many losses. And contrary to what we mentioned earlier, due to the lack of emotions trading continues despite hitting a string of losses.

When using algorithmic trading, especially one that has been purchased off the shelf, traders need to customise it. However, not many follow the instructions and because of this, the trading system can easily lose money for you.

Traders also need to focus on other aspects such as hedging which is opening a long and short position on the same instrument, and news trading, which can vary from broker to broker.

An automated trading strategy needs to be thoroughly tested from both a historical perspective an also forward tested. Although past performance is no guarantee for future performance, backtesting is a common way to understand how good a trading strategy would have performed.

Many automated trading strategy sellers unfortunately tend to focus on this too much and fine-tune their trading system’s logic so that it shows great performance in historical periods. Hence, a trader may end up purchasing a great performing strategy only in the past.

How to get familiar with algorithmic trading on MT4?

If you are curious about algorithmic trading on the MT4 platform, then you will be pleased to know that by default traders get some basic expert advisors for free. We recommend that you make use of a demo trading account and put these expert advisers to the test.

One can then play around with the expert advisor configuration and apply the EA across different markets. This will help you to get familiar with using algorithmic trading on the MT4 platform risk-free. For those who are even more interested in deep dive into algorithmic trading, there are many online resources that will help you get started in understanding coding or programming.

Although it may be time-consuming, getting to know the underlying programming language can help you to build your own algorithmic trading strategies. Besides this, the mql5.com website also has tremendous resources that one can use for free. This will help you to build and solidify your learning of the programming language in question.

The online community also allows you to pose questions and get your doubts clarified. For those who have a bit of programming knowledge, the best way to get started is by downloading one of the many different automated trading systems and analysing the code. This will help you to understand what exactly the EA does and get to know the underlying code as well in the process.

In conclusion, algorithmic trading is the same as automated trading. It is not just large hedge funds and financial institutions but also retail traders who can make use of this technological advancement.

Although it may seem a bit intimidating for some, algorithmic trading can be seen as the next level when it comes to retail traders.