As forex traders, when one talks about the exchange rates, the obvious rate that comes to mind is the forex rate. For example, if one were to ask you what the current EURUSD rate is like, you would refer to your charts or your trading terminal or other source and give a number like 1.0891.

However, what if someone asked you what the real exchange rate for the EURUSD was? Or what if someone asked about the nominal exchange rate for the EURUSD? How would you answer? While the concepts of nominal and real exchange rate may not matter for forex traders who are day trading, it helps to understand these two important terms.

Nominal and real exchange rates are commonly used in the markets, especially in the financial and economic circles. However, many use these terms interchangeably, which is incorrect. In fact, both these terms denote two slightly different variations of exchange rates.

As a thumb rule, the majority of the time, when you hear about exchange rates, it is mostly referring to the real exchange rate.

What is an exchange rate?

The exchange rate or the forex rate is the rate at which you can convert one currency to another. When a trader speculates or day traders, they are essentially buying or selling one currency for another. Quoted as a currency pair, but resulting in a single number, this exchange rate tells you the cost of buying one currency by selling the other, or vice-versa.

For example, if the EURUSD exchange rate was said to be 1.0891, it means that you can buy one euro by selling 1.0891 US dollars. Likewise, you can also invert this same number to get the other side.

A USDEUR exchange rate is nothing but the inverse of the EURUSD exchange rate. As we laid out in the example:

If a EURUSD exchange rate is 1.0891, then the USDEUR exchange rate would be 0.91818.

To put this in more simple terms, traders already know that exchange rates are quoted in the form of the base currency and the quote currency. Thus, if EURUSD = 1.0891, it means that the exchange rate for 1 euro = $1.0891.

If you now inverse this concept, 1 USD = 0.91818 euro.

What you see above is merely an example of the nominal exchange rate.

What are nominal exchange rates?

The nominal exchange rates are the conversion factors for converting one currency to another. In many cases, when you read the daily financial news you will always come across the real exchange. It is referred to in short as NER.

The nominal exchange rate tells you the cost or the price of converting one currency to another. Depending on the quote currency in question, the exchange rate for the base currency can and will differ. This is because the nominal exchange rate or the forex rate is expressed as a conversion factor for another currency.

The nominal exchange rates are set by the market participants. As you may know, in the forex markets, the biggest participants are usually central banks and large financial institutions. The retail forex trading community is usually a minuscule part of the trading universe.

Thus, depending on supply and demand, as well as considering other factors the markets set the exchange rate as the fair value for converting one currency to another. Traders or large financial institutions account for other factors as well such as economic data, monetary policy, and even geopolitics.

The chart below gives an example of the EURUSD nominal exchange rate. As you can see, many readers will be familiar with this chart.

The word nominal exchange rate comes from the fact that you can use the nominal exchange rate for example to convert a nominal amount. Say for example a trader wants to convert a nominal amount of 100,000 euro.

Thus, using the nominal exchange rate, they can expect the USD equivalent of 108,910. Nominal exchange rates are used, besides day traders in the real world by large companies and financial institutions. It is, after all, the rate you would use to convert domestic to foreign currency or vice versa.

What are real exchange rates?

Real exchange rates on the other answer the question of purchasing power of a currency. In other words, real exchange rates tell you how much goods or a product cost when exchanged for similar goods or products of a foreign economy. Real exchange rates are also known as RER.

Using the nominal exchange rate, one would not be able to answer this question.

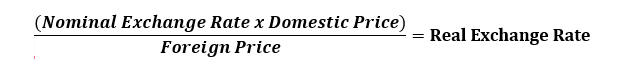

However, when calculating the real exchange rate, the nominal exchange rate plays an important role. The formula for calculating the real exchange rate is defined as below:

Using the above formula, one is now able to answer the question of purchasing power of a currency.

Let’s take the example below.

How much does an Apple iPhone cost in the US, and how much does the same iPhone cost in India?

In the U.S, the latest iPhone 13 Pro max, 128GB costs $999. In India, the same iPhone 13 Pro max, 128 GB costs 119,900INR.

Generally, one would make the mistake of using the nominal exchange rate of the USDINR to calculate the price of the iPhone in India. If we go by this logic, the cost would be: $999 x 76.21 = 76,133.80 INR. But as you can see above, this is not the price at which the iPhone is being sold in India.

The reason behind this is the real exchange rate. Using the formula outlined earlier, let’s now derive the real exchange rate.

| Domestic Price | $ 999.00 |

| Nominal Exchange Rate | INR 76.21 |

| Foreign Price | INR 119,900.00 |

| Real Exchange Rate | 0.63 |

From the above table, we can now infer that it is 63% more expensive to buy the iPhone in India, rather than in the U.S. An alternative way is to compare the converted price with the actual price. Thus, you can convert using nominal rate of the foreign price, which is $999 x 76.21INR = 76,133.80INR/119,900 INR = 0.63 or 63%.

Difference between Real Exchange Rate (RER) and Real Effective Exchange Rate (REER)

Quite commonly, you may also come across the real exchange rate cited as REER, or the real effective exchange rate. The REER, although interchanged with RER, is not one and the same. The real effective exchange rate is an index created with a view to understanding if a currency is over or undervalued against its trading partners.

Typically speaking, the real effective exchange rate is derived as the product of different foreign currencies, where each of these currencies is assigned a weight. The weightage for each of these currencies is determined based on the trading volumes in question. For example, if the U.S. traded solely with Australia and the UK, the real effective exchange rate is a product of the GBPUSD and the AUDUSD nominal rates with the trade-weighted average (in this example it would be 0.50 and 0.50 respectively).

In doing so, one currency can be determined to be either overvalued or undervalued. The REER is the real effective exchange rate index. Despite being an effective tool to fundamentally derive the relationship of one currency to another, REER also has its limitations.

The most common issue pertaining to the real effective exchange rate is that it does not account for price changes and other factors that can impact trade. If for example, prices in an importing currency are higher trade may increase. But on the same hand, if the price of the importing currency is lower, it becomes more expensive to trade, thus reducing the trade weightage in the REER formula.

Thus, a country that has a higher REER indicates that the cost of imports is lower compared to the cost of exports. This can lead to a trade surplus. Conversely, a lower REER suggests lower import costs and higher export costs, leading to a trade deficit over time.

Quick summary of differences between nominal vs. real exchange rate

The quick summary below gives an overview of the differences between the nominal and the real exchange rates.

| NOMINAL EXCHANGE RATE | REAL EXCHANGE RATE | |

| What is it? | The amount of currency that can be bought by exchanging the other currency | Compares the purchasing power of a country’s currency |

| How is it calculated? | Set by market factors, economic data, supply & demand | Makes use of domestic, foreign prices and nominal exchange rate |

| Exports/Imports | Used for export and import of goods and services | Can be used to assess the import/export competitiveness of an economy |

| Usage | Used for converting one currency to another. Has a practical daily use | Used to assess the overall economic competitiveness. Find out whether a currency is fundamentally overvalued or undervalued |

Depending on the real exchange rate, one can deduce whether the currency is fundamentally overvalued or undervalued. For overvalued currencies, there is a tendency for the nominal exchange rate to depreciate. Similarly, for undervalued currencies, there is a tendency for the nominal exchange rate to appreciate.

How can traders use REER in trading forex?

For purely speculative purposes, traders can go the extra mile to dig into the details of the REER. After determining the real effective exchange rate, traders can then form a bias. As mentioned, a lower REER means that it is cheaper to import than export.

This could potentially mean that the economy in question is doing well. Depending on where the economy is in the economic cycle, traders can then look to the monetary policy. In many cases, to prevent the economy from overheating, central banks can turn hawkish to tame inflation.

Thus, this could potentially lead to the current nominal exchange rate falling or depreciating. This can in turn open up potential short-selling opportunities. However, we should mention that since these concepts are fundamentals, you will not see the immediate effect in the day trading universe.

Such trading strategies are more suitable for long-term swing traders. Even other derivative forms such as forex options can play a good role if one wants to take such opportunities in the market. But bear in mind that all professional traders especially at financial institutions look at all the available fundamental data.

Hence, the window for arbitrage remains open for only a short period of time.

But besides purely using REER for spotting trading opportunities, traders can run ahead of the curve by estimating what the central bank policies may be. Of course, one should also consider other aspects such as GDP growth and the unemployment landscape before coming to conclusions.

Real vs. Nominal Exchange Rate – Conclusion

To conclude, the real versus nominal exchange rates are two different types of measuring the exchange rate of an economy. The nominal exchange rate is generally used as the conversion rate for one currency to another.

This also refers to the most common way, forex traders read the exchange rates and trade based on them. The real exchange rate on the other hand is a way to fundamentally understand whether a currency is overvalued or undervalued against another currency or its peers.

The nominal exchange rate is based on the formula that includes the real exchange rate. Traders should not make the mistake of trying to predict the nominal exchange rate through the real exchange rate. On the contrary, the former merely tells you the value of one currency against the other, while the latter gives you an idea of the purchasing power of one currency to another.

Economists mostly use the real exchange rates as a way to understand a country’s trade against its peers. Likewise, the real effective exchange rate and the nominal effective exchange rates are different. The former is an average of the spot rates, while the latter makes use of a trade-weighted average against one or a basket or currencies.

Although the real exchange rate is more useful fundamentally or from an economic perspective, it can still be used in the longer term fundamental analysis of a currency. This is done by analyzing one currency against the other, and as such traders can get a better idea of how the long-term rates may shape out to be.