Leverage in trading is perhaps one of the first things you may hear when opening a forex trading account. Many traders don't fully understand what leverage in trading is all about.

Traders tend to simply see the numbers and pick the one that is most favourable to them. Thus, it is not surprising to see traders often choosing leverage that is high.

Just until a few years ago, leverage in trading was as high as 1:2000.

And as more and more traders jumped onto the bandwagon, regulators had to step in. Nowadays, you would be lucky if you managed to find a broker who offers forex offering leverage of 1:500.

In the United States, for example, leverage is capped at 50:1. This came into force in October 2010 following a CFTC ruling regarding retail forex trading.

Of course, if you look outside of the United States, the leverage regulations change.

In the event of offshore brokers (who are not subject to stringent regulations), the forex leverage can be even higher.

The main reason behind most of the brokers who offer forex having a cap on how much leverage you can use is because of the risks.

Traders do not give much thought to the leverage they choose. The only criteria are to pick forex leverage that is as high as possible.

With leverage, you can obviously control higher contracts. But this comes at risk too.

So, what is leverage in trading and why you should pay attention?

Understanding how leverage in forex trading works is important in managing your risks. This will help you to open trades with reasonable contract sizes.

At the same time, knowing what leverage you are using, helps to protect you against adverse market movements.

Basic definition of leverage in trading

Leverage is a concept that is widely used in financial markets.

Leverage allows investors to raise their exposure to an asset, by paying less than the full amount that is required.

In other words, leverage is based on borrowing funds to finance the purchase of an asset. At the same time, you also put up small collateral.

In terms of the total purchase cost, your collateral is smaller compared to the full purchase price.

The best and simple illustration of leverage is a mortgage.

When you want to purchase a home, many would go to a bank to get a mortgage loan. One of the requirements of the mortgage loan is the initial upfront of the purchase amount.

This upfront or down payment can range from 5% up to 20% of the value of the home that you want to purchase. The bank, then finances the remainder of the loan, while keeping the home as collateral.

Example of leverage - Mortgage

Therefore, if you want to purchase a home that costs $500,000 and the bank requires you to put up 20% as the initial payment, this is leverage in action.

Your initial cost of purchasing the home worth $500,000 would be $100,000.

In this example, you are purchasing a home with a leverage ratio of 1:20.

If you apply this same concept to forex trading, instead of purchasing a home, you are purchasing some units of a currency (and in turn selling its equivalent of the quote currency).

If you have understood the above example, one question that may come to mind is, what’s in it for the broker?

How do brokers make money through leverage?

For example, when a bank gives you a mortgage, you know that they make money by charging you interest on the monthly payments.

A bank after all makes profits by borrowing at a lower interest rate and lending at a higher interest rate.

When it comes to brokers, the model is somewhat different, yet broadly the same.

While a broker doesn’t borrow any money, they do charge interest when lending.

Besides the mark-up on the spread, brokers also charge an overnight financing or rollover fee. We have covered this in many articles earlier.

And many traders are obviously aware of these overnight financing costs or overnight swap fees.

To explain briefly, an overnight rollover swap is ans extra cost (or interest) that you pay to your broker. This is the fee for trading forex on leverage!

The interest that you pay depends on the currency pair that you are trading and obviously, whether you are long or short. The duration of time that you keep a trade open also adds up to the overnight fee costs.

One of the main benefits of a broker offering leverage is that it attracts more customers.

If the leverage is low, traders need to have a much higher initial capital. This can be an obstacle for a potential trader to open a forex trading account.

On the other hand, if a broker can offer higher leverage, it reduces the initial cost of opening a forex trading account. At the same time, through leverage, brokers are also able to make extra money.

Thus, so far, we have a basic understanding of what leverage in trading is all about. We also know why brokers offer leverage to trades.

Leverage terminology explained

Let’s now take a look at the various terms and financial jargon that you will come across when trading. This is in the context of trading forex with leverage.

Leverage (or leverage ratio): This is a ratio number that shows your total account leverage. Thus, for a leverage ratio of 1:50, for every $1 you put up from your trading capital, you can borrow up to $50 from the broker.

Margin percentage: Margin percentage is merely a representation of leverage ratio in percentage value. To derive the margin percentage, divide 1/50. This is equal to 0.02 or 20% margin percentage.

The margin percentage tells you how much of the total value of the purchase (buy or long or sell or short) of the instrument is required to be financed by you.

Margin requirement: Margin requirement is the amount of money that is required from you as a trader.

Margin requirement gives you the exact dollar value. It is also dependent on the margin percentage. Thus, to calculate the margin requirement, you multiply the contract size x the price x margin percentage.

For example, if you want to buy 1 lot of EURUSD as 1.3000 at a margin percentage of 20, then your margin requirement would be:

1 lot = 100,000

100,000 x $1.3 x 0.02 = $2600

This $2600 will be the margin amount that will be deducted from your trading capital and locked in by the broker for the duration that the trade is open.

The importance of maintenance margin

Maintenance margin: Maintenance margin is another term you come across. This is closely related to a margin call. A maintenance margin is the minimum margin amount you should have on your trading account.

Maintenance margin is also called free margin in forex.

If your trading capital falls below the maintenance margin, it will result in a margin call. In such an event the broker will close out your positions.

Traders should ensure that their maintenance margin is at a healthy level.

It is important to note that the maintenance margin keeps fluctuating depending on the positions that you have open.

This means that there is a direct relationship between your floating PnL and your maintenance margin.

Depending on the usage, the maintenance margin is also referred to as a floating margin.

If the above terminology seems a bit complicated, read the next section where we illustrate leverage and margin in trading with an actual example.

Leverage and margin trading in forex explained with an example

The best way to understand leverage in forex trading is by taking an example.

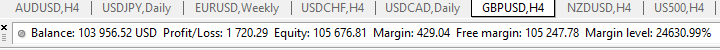

In the below screenshot we have the following information:

We can summarize this information as follows:

| Balance | $103,956.52 |

| Floating PnL | 1,720.29 |

| Margin | 429.04 |

| Leverage and margin details (output) | |

| Equity (Balance + Floating PnL) | 103,956.52 + 1720.29 = 105,676.81 |

| Margin Percentage (margin/balance) | 429.04/103,956.52 = 0.41% |

| Leverage Ratio (1/margin percentage) | 1/0.41% = 2.4 or 1:2.4 |

| Free Margin (equity – margin) | 105,676.81 – 429.04 = 105,247.78 |

| Margin Level (equity/margin) | 105,676.81/429.04 = 24630.99% |

How to manage risk when trading on leverage?

Since leverage has an impact on the positions you can trade, it is important for forex traders to have a good risk management framework in place.

The biggest detriment to leverage is when your trade moves against your position. Hence, it is absolutely essential for traders to use stop-loss orders. The stop loss on the trades you make will help prevent you from margin called.

Besides the stop loss, the trading lots should also be given some thought. You cannot go about trading large lot sizes simply because you have higher leverage. This can quickly result in a margin call even when price moves by a few pips.

Higher the lots, higher the dollar value per tick. This in turn requires you to use tight stop losses. Depending on the volatility of the forex currency pair you trade, you may need to adjust your stop losses from 5 pips to maybe even 50 pips.

In such instances, higher lot sizes will not help. Thus, trading on smaller lot sizes, depending on the leverage you use can allow your trade some breathing space.

Frequently asked questions on Leverage and margin in trading

Finally, we summarize all that we have learned about leverage and margin in trading.

How does leverage impact margin?

Leverage and margin and two terms that reflect the same thing, which is the amount of borrowed capital you are trading on. Thus, when you choose lower leverage, you are required to invest a higher capital from your end. Conversely, when you choose higher leverage, you are required to invest a lot lower.

Higher leverage allows you to control larger positions. But this also increases your risks on the trade. Margin and leverage have an inverse relationship. Higher the leverage, lower the margin requirements. Likewise, if you choose lower leverage, the margin requirements rise.

Why do margin requirements change?

Margin requirements or maintenance margin changes depending on the PnL of your positions.

This can directly impact your trading capital positively or negatively. When the PnL positively impacts your trading capital, the maintenance margin level increases.

On the other hand, if your PnL impacts your trading capital negatively (i.e: your trade is in a loss), it will reduce the trading capital. Because of this, the maintenance margin requirements also fluctuate.

What is required margin in MT4?

The required margin in MT4 is the initial margin that is required by you as a trader. This initial margin or requirement margin depends on the leverage you choose. The required margin is locked and cannot be used to open other positions during the duration of an existing open trade.

What is the difference between fixed or initial margin and maintenance margin?

Fixed margin is the initial margin or the amount that you need to up from your trading capital. Following this, the remaining capital, minus the initial or fixed margin is available to open other trading positions.

However, the maintenance margin gives a snapshot of how leveraged you are. When the maintenance margin starts to drop, it can be a result of your positions running at a loss. This will impact your trading capital.

Many brokers who offer forex have a maintenance margin requirement. When it falls below the threshold, it results in a margin call, or your positions being closed out as a result.

Is it good to trade forex on margin?

In general, traders use leverage to trade forex on margin. The exception to the rule is of course when you have a larger trading capital. To trade 1 forex lot without margin or leverage, you would require more than $100,000 or more.

But even with the above example, trading with a 1 lot will lock up the entire amount if not more. On the other hand, with a $100,000 trading capital, you can trade a mini-lot of 0.10 or 10,000 units. This would give you a 10% leeway to absorb any losses on the trade.

Since many retail forex traders do not have such amounts to a trade, margin trading or trading forex on leverage is a better solution.