Forex trading is one of the most exciting ways for anyone to speculate in the currency markets.

It is one of the many ways an investor can trade the financial markets. Other common ways to invest include stocks trading or investing in the share market.

But there is a difference between how the forex and the stock markets work. When you buy a stock, you are investing in the company, and it entitles you to one share of the company.

Unlike the stock markets that trade on an exchange, the forex markets are not centralized. This is known as trading over the counter (OTC).

When you trade currencies, you speculate whether one currency rises or falls in relation to the other currency.

Using trading strategies, you can make money when you buy or sell the respective currencies.

The foreign exchange markets are the most dynamic markets in the world. This is because unlike stocks, the forex market is one of the biggest and most active market in the world.

The forex or FX markets are open 24 hours a day.

Thus, traders from any part of the world can easily gain access to this market. In this forex trading course, we will start with the basics of the forex market.

What is forex trading?

Forex trading involves buying and selling of two currencies simultaneously.

As a trader, your goal is to speculate on the direction of prices. What is unique about the forex market is that the instruments are traded as pairs.

For example, when you buy EUR/USD, you are buying the Euro and selling the US dollar. You would buy the EUR/USD when you think that the euro exchange rate against the dollar will rise.

This means that the euro appreciates against the dollar. Conversely, the dollar depreciates against the euro.

The amount by which this value changes will determine whether you made a profit or a loss.

Difference between spot foreign exchange and forex trading

When you trade forex, you are only speculating on the currency market movements. You do not get delivery of the other currency.

This is the biggest difference between exchanging forex at an airport. Although the terminology may remain the same.

Take the example of an airport, converting your New Zealand dollars for Australian dollars. You are in effect selling the NZD and buying the AUD.

Thus, you part with your NZD's and you get AUD's in return.

When you are forex trading or currency trading, you don't get delivery of the other currency. But any profits or losses you make is then converted back to your base currency.

Forex trading is trading on currency CFDs. CFD is known as Contracts for Differences.

This a derivative financial instrument which allows you to speculate on the price. CFDs allow you to buy and sell currencies without owning the underlying asset.

Trading Terminology used in Forex

As a forex trader, you will come across quite a bit of trading jargon. As with any profession that has its own language, it is the same in forex markets too.

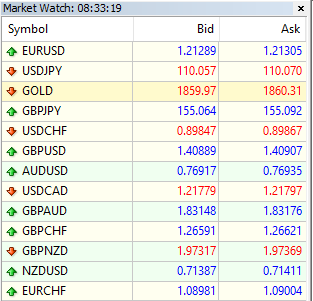

Forex Currency Pairs with Bid/Ask Prices

If you want to trade forex, it is important that you have a good understanding of these terms. There are many terms that used in currency trading. But it can get too overwhelming.

Below is a list of some common terms to help you get started:

Broker who offers forex CFDs: A broker who offers forex CFDs is an intermediary through which you can open a trading account. Brokers provide their services allowing you to speculate in the currency markets.

Investors or speculators open an account with a brokerage of their choice. You will need to open a trading account with your broker to buy or sell.

Brokers who offer forex CFDs make money by charging a mark up on the spread or charging you a commission on your trades.

This is for the services they provide, which is enabling you to access the prices. One of the services they provide is by bringing buyers and sellers into the market.

Majors: Majors or major currency pairs is a name given to forex currencies that are the most liquid. These currencies also come from the G7 countries.

They include the USD, EUR, JPY, GBP, CHF, AUD, CAD.

The major currency pairs are known for their liquidity. They also have tight spreads compared to other fx pairs.

Minors: Minors or minor currency pairs are exotic currencies. They are not as popular as the majors. For example, currency pairs like USDTRY, USDSEK, USDZAR, etc. fall into this category.

Crosses or Cross Rates: You can identify a cross currency pair because it does not have USD. An example of a cross currency pair is the EURGBP, AUDNZD for example. Any currency against the euro except USD also qualifies as a cross rate.

Pip(s): A pip is the smallest change in a currency exchange rate. The exchange rate in forex trading is denoted in 4 decimals. The fourth decimal is a pip.

So if a euro dollar exchange rate changes from 1.2000 to 1.2005, that is a 5 pip change.

You may already know that 100 cents make up a dollar (or a euro or any other currency of your choice).

But when it comes to foreign exchange trading, we take it a bit further. So instead of 100 cents, we now have 1000 pips.

1000 pips = 100 cents = 1 full unit

Leverage: Leverage in forex trading is a number expressed as a ratio. It is a multiple by which you can trade. As a trader, it is important that you have a good understanding of leverage and margin.

A leverage of 1:100 means that for every $1 you put up, you can trade 100 times the amount. This is nothing but $100. If you buy EUR/USD as 1.2000 and price moves to 1.2001, then your profit would be $100.

At the same time, if price moves to 1.1999, then your loss would be -$100.

Leverage allows you to magnify the pip movements in the forex markets. Using leverage you can make a significant profit or a loss.

You can avoid leverage entirely. But this would mean that you would need to have a trading capital of at least $100,000.

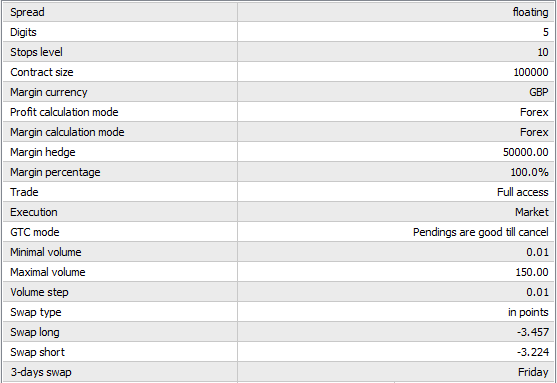

Margin: This is the amount you need to put up upfront when using leverage. A margin amount, as the name suggests is a percentage of the total amount required to enter a trade. Margin and leverage go hand in hand.

Trading Terminology: Rollover, Swap, Spread

Spread: A spread is the difference between the bid and ask price in a currency pair. A spread will never be zero.

It is the price at which you can buy or sell a currency pair for trading. A bid price is the price at which you will sell and the ask price is the price at which you will buy.

Rollover: Rollover is the fees charged on your overnight forex positions. It is an interest calculated on a daily basis and the total amount that you have open at the moment.

This rollover is then added or subtracted to your trading position. Forex traders also refer to rollover as overnight swap rates.

Commissions: Commissions are the fees that a broker charges. This is for every time you open and close a trade. Brokers calculate commissions on a standard lot or 100,000 units of the currency pair.

How to buy and sell forex

By now you should know that forex trading is trading the CFDs on currencies. This is also called retail forex trading.

The banks are the biggest participants in the forex market. This includes all the way from the central bank to your high street bank. These participants form the biggest chunk in the money markets.

As a forex trader, you do not take part in the markets actively. You only speculate on the direction or the value of one currency to another.

To buy or sell forex, a trader must have a trading account with a broker to begin with.

You will then have to deposit some money into your trading account. Then, you need to choose the leverage and you can start trading.

When you are trading the forex market, you will be placing orders with your forex brokerage.

These orders determine what should be done based on certain criteria. But before we go into these details, you should know about some key terms when trading.

Going long or short?

You may have come across this term if you have any trading experience. It refers to the trading positions you have in the market.

Going long means that you have a long position in the market. Going long means that you are bullish on the market, hence you buy.

Investors are long when they think that the market will be going up.

Going short means that you have a short position in the market. Investors are short in the market, when they believe that the value of the asset they are trading will fall.

Long and short are synonyms for bullish or bearish.

Introduction to trading orders

There are many ways you can buy and sell currencies through trading. Here are the most common types of orders that you will be using.

Types of Market Orders

Market order: This is the type of order that allows you buy or sell in the forex market. It can be whatever the current market rate is. If the EUR/USD is trading at 1.2000 and you place a market order, then your order executes at the market price.

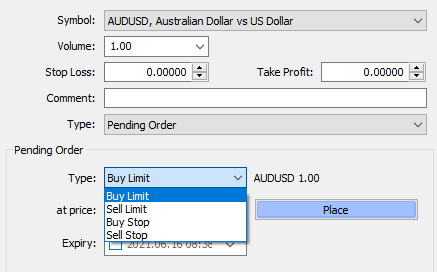

Pending order: A pending order is different from a market order. As the name suggests, the order remains pending until your price criteria is met. Investors use a pending order when they have a strategy in mind.

If an investor thinks that the value of one currency will rise or fall in relation to the other, to a certain price, they place a pending order at that price.

Pending Orders: When price hits your take profit, you will of course make money from your trade.Pending orders are also used as take profit and stop loss in your trades.

Take profit: Take profit means the price at which you will take your profit from your forex trading. It is the price at which a pending order is placed. When price reaches your take profit level, the pending order triggers. Your trade is automatically closed.

Stop loss: This is the opposite to the take profit. It is the price where you stop your losses on the forex trading. When price reaches the stop loss level, this pending order triggers and limits the loss on your trade.

Traders must use stop loss and take profit on their trades to manage their risk. It is also an essential market of trading strategies that you will use.

Limit and Stop orders: Limit and stop orders are primarily pending orders. As the name suggests, they can limit or stop your trade from further losses or profits.

Before you trade: Five quick facts about the forex market

Before we conclude this introduction, we leave you with five tips about the markets. These are important tips to you as a forex trader.

Although trading may seem simple, you will need to do good analysis of the markets. You should be able to listen/read the news that can impact the prices.

#1. The forex market is open 24 hours a day

This is the most unique aspect about trading forex. The markets never sleeps because money circulates around the world. And with so many currencies, traders have the option to pick what they want to trade.

The forex markets trade round the clock, 5 days a week. This means that the prices also move 5 days a week. The markets work in sessions.

There are three main sessions:

- New York or US session

- Asia or Tokyo Session

- Europe or London Session

#2. The biggest trading hubs around the world

London is the largest financial center when it comes to the world of money. It is the largest fx financial hub. This is followed by New York and Hong Kong. These three geographical locations dominate the world of currencies.

#3. Interest rates move the financial markets

If you have traded stocks, then you would know that a company's fundamentals are important. They play a role in determining the value of the share price.

With currencies it is different. Interest rates play an important role.

The interest rates are set by central banks based on micro and macro economic data. Currency traders follow the financial news to determine what the future interest rates will be.

A currency with higher interest rate is attractive than one with lower interest rate. This is the yield, that you will hear about in the markets.

#4. There is a significant risk in the currency markets

Every financial asset has its own risk involved. Forex is no different. But the important point to note is that this type of market can be very volatile.

Thus, you may have experience in trading other markets. But you should be aware of the risk when you trade currencies.

Many brokers allow you to open a mini or a demo account. You can use these accounts to get familiar with trading currencies. Because of the high risk, traders must have a clear strategy on how they want to trade.

This means that traders should be able to understand the financial news. A trader must also know the basics of fundamental and technical analysis to trade.

#5. Traders should focus on their emotions

Psychology plays a big role in determining your success or failure. For example, you can get callous when you have a string of winning trades.

Likewise, you can make wrong decisions after a few positions you traded ended up in a loss.

Greed and fear will be your two constant companions when trading

Having a control on your emotions, right from the start is important. You can find a course on trading psychology, which goes to show how important it is to have the right mindset.

You can also lose yourself in the news and other opinion pieces. These are from banks and other forex traders about the positions they have and so on.

This can influence you and can lead you to trade without a strategy in place.

In conclusion, we hope that this introduction to forex trading has been helpful. It gives you the solid foundation you need before we advance further.

In the next sections will cover the two main ways you can analyze the markets.